Prepaid expenses represent payments made in advance for goods or services to be received in the future, impacting your company's cash flow and financial statements. Properly managing and accounting for these expenses ensures accurate recognition of costs over time, enhancing budget control and financial accuracy. Explore the rest of the article to understand how prepaid expenses influence your business and the best practices for handling them.

Table of Comparison

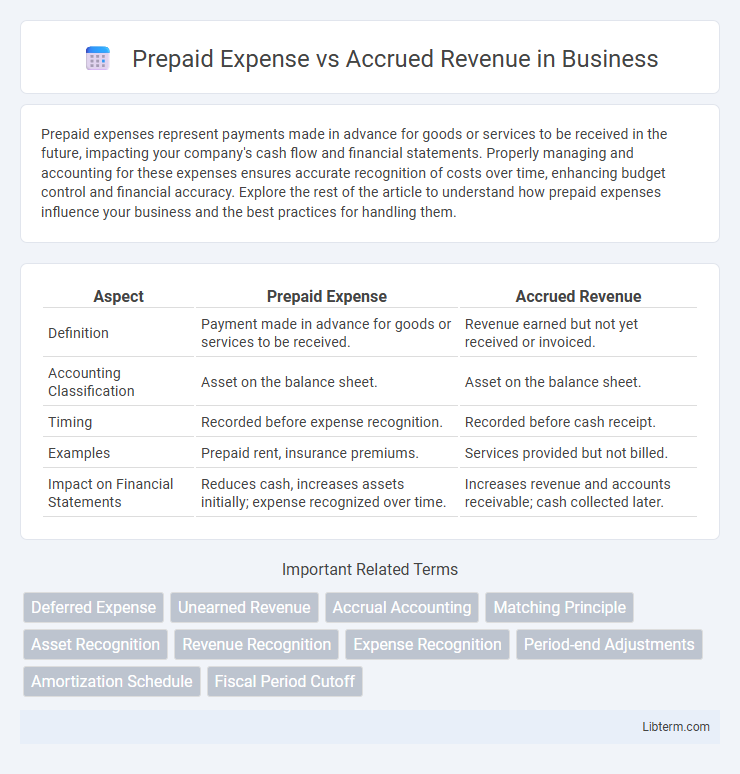

| Aspect | Prepaid Expense | Accrued Revenue |

|---|---|---|

| Definition | Payment made in advance for goods or services to be received. | Revenue earned but not yet received or invoiced. |

| Accounting Classification | Asset on the balance sheet. | Asset on the balance sheet. |

| Timing | Recorded before expense recognition. | Recorded before cash receipt. |

| Examples | Prepaid rent, insurance premiums. | Services provided but not billed. |

| Impact on Financial Statements | Reduces cash, increases assets initially; expense recognized over time. | Increases revenue and accounts receivable; cash collected later. |

Introduction to Prepaid Expense and Accrued Revenue

Prepaid expense represents payments made in advance for goods or services to be received in the future, such as insurance premiums or rent, which are recorded as assets until incurred. Accrued revenue refers to revenue earned for goods or services delivered but not yet received or recorded, typically recognized as receivables on the balance sheet. Understanding these concepts is essential for accurate financial reporting and matching revenues with related expenses in accounting periods.

Definition of Prepaid Expense

Prepaid expense refers to payments made for goods or services before they are received, representing an asset on the balance sheet until the benefit is realized. Common examples include prepaid insurance, rent, and subscriptions that are recorded as expenses only when consumed over time. Unlike accrued revenue, which is revenue earned but not yet received, prepaid expenses involve cash outflow occurring prior to expense recognition.

Definition of Accrued Revenue

Accrued revenue represents income earned by a business for goods or services delivered but not yet billed or received in cash, reflecting revenues recognized before payment is received. This contrasts with prepaid expenses, which are payments made in advance for goods or services to be received in the future, recorded as assets until the expense is incurred. Accrued revenue improves financial accuracy by matching income to the period in which it is earned, aligning with the accrual accounting principle.

Key Differences Between Prepaid Expense and Accrued Revenue

Prepaid expenses represent payments made in advance for goods or services to be received in the future, classified as assets on the balance sheet until recognized as expenses. Accrued revenue refers to earnings recognized before cash is received, recorded as assets because the service or product has been delivered but payment is pending. The key difference lies in timing and cash flow: prepaid expenses involve cash outflow preceding expense recognition, whereas accrued revenue involves revenue recognition prior to cash inflow.

Accounting Treatment of Prepaid Expense

Prepaid expenses are recorded as current assets on the balance sheet because they represent payments made in advance for goods or services to be received in the future. The accounting treatment involves initially debiting the prepaid expense account and crediting cash or accounts payable; as the service or benefit is consumed, the prepaid expense is gradually expensed by debiting the expense account and crediting the prepaid expense account. This systematic allocation follows the matching principle, ensuring expenses are recognized in the period they contribute to revenue generation.

Accounting Treatment of Accrued Revenue

Accrued revenue represents income earned but not yet received or recorded, requiring adjusting entries to recognize the revenue in the correct accounting period. The accounting treatment involves debiting accrued revenue (an asset account) and crediting revenue, ensuring accurate matching of income with related expenses. This adjustment aligns with the accrual basis of accounting, enhancing financial statement accuracy by reflecting earned revenues regardless of cash receipt.

Examples of Prepaid Expenses

Prepaid expenses include payments made in advance for goods or services such as insurance premiums, rent, and office supplies that provide future economic benefits. For example, a company paying six months' rent upfront records it as a prepaid expense, which is gradually expensed over the rental period. Utilities paid in advance and subscriptions are other common examples of prepaid expenses requiring systematic allocation across relevant accounting periods.

Examples of Accrued Revenues

Accrued revenues represent earnings that a company has delivered but not yet received payment for, such as interest income on loans granted or services provided on credit. For example, a law firm completing client work in March but invoicing in April records accrued revenue for the service period. Another common example is utilities consumed but billed in the next accounting cycle, where companies recognize revenue before cash receipt to align with the matching principle.

Financial Statement Impact

Prepaid expenses are recorded as current assets on the balance sheet and gradually expensed on the income statement as the benefit is realized, reducing net income over time. Accrued revenue is recognized as a current asset (accounts receivable) on the balance sheet and increases net income in the income statement, reflecting revenue earned but not yet received. Both concepts impact cash flow timing, but prepaid expenses defer expenses while accrued revenue accelerates revenue recognition.

Importance in Financial Reporting

Prepaid expenses represent payments made in advance for goods or services, ensuring that assets are accurately recorded and expenses recognized in the correct accounting period, which improves the reliability of financial statements. Accrued revenue reflects earned income not yet received, enabling companies to match revenues with expenses accurately and present a true financial position. Proper recognition of prepaid expenses and accrued revenue is crucial for compliance with accounting standards like GAAP or IFRS, enhancing transparency and decision-making for investors and stakeholders.

Prepaid Expense Infographic

libterm.com

libterm.com