Equity financing involves raising capital by selling shares of your company to investors, allowing you to obtain funds without incurring debt. This method not only provides financial resources but also brings in partners who share your company's growth potential and risks. Discover how equity financing can transform your business strategy by reading the rest of the article.

Table of Comparison

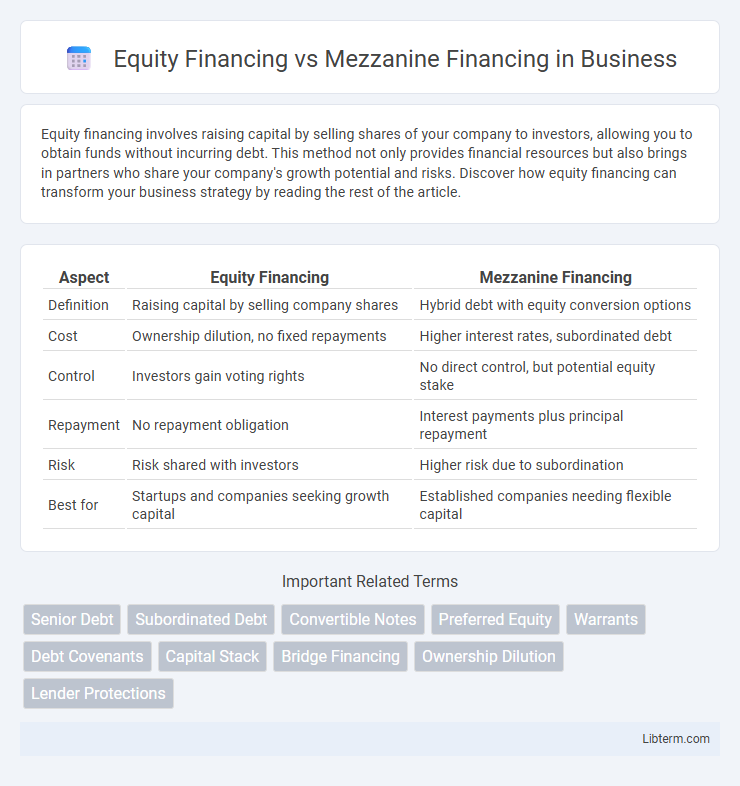

| Aspect | Equity Financing | Mezzanine Financing |

|---|---|---|

| Definition | Raising capital by selling company shares | Hybrid debt with equity conversion options |

| Cost | Ownership dilution, no fixed repayments | Higher interest rates, subordinated debt |

| Control | Investors gain voting rights | No direct control, but potential equity stake |

| Repayment | No repayment obligation | Interest payments plus principal repayment |

| Risk | Risk shared with investors | Higher risk due to subordination |

| Best for | Startups and companies seeking growth capital | Established companies needing flexible capital |

Introduction to Equity and Mezzanine Financing

Equity financing involves raising capital through the sale of company shares, providing investors ownership stakes and potential dividends, while also diluting existing ownership. Mezzanine financing is a hybrid of debt and equity, offering lenders higher returns through interest payments and equity conversion rights, often used for expansion or acquisitions. Both methods balance risk and reward differently, with equity financing emphasizing ownership participation and mezzanine financing combining debt security with equity upside.

Key Differences Between Equity and Mezzanine Financing

Equity financing involves raising capital by selling shares of ownership in a company, giving investors voting rights and a claim on future profits, while mezzanine financing is a hybrid form of capital that blends debt and equity features, typically providing lenders with fixed interest payments and warrants or options for equity participation. Equity financing dilutes ownership but does not require repayment, whereas mezzanine financing requires regular interest payments and eventual repayment, though it ranks below senior debt in the capital structure. Mezzanine financing is often used for growth capital or acquisitions and carries higher risk and cost compared to traditional debt but less dilution than pure equity financing.

How Equity Financing Works

Equity financing involves raising capital by selling shares of ownership in a company, allowing investors to gain partial ownership and potential dividends based on company performance. This method provides companies with access to funds without incurring debt, as investors assume the risk in exchange for equity stakes. Unlike mezzanine financing, equity financing does not require regular interest payments, making it a flexible option for businesses prioritizing growth and long-term value creation.

How Mezzanine Financing Works

Mezzanine financing operates as a hybrid of debt and equity financing, providing lenders with the right to convert debt into an equity interest in case of default. Typically used by companies seeking capital for expansion without diluting ownership immediately, mezzanine financing carries higher interest rates reflecting its subordinated position in the capital stack. This funding structure often includes warrants or options, aligning lender returns with company performance while bridging the gap between senior debt and equity financing.

Advantages of Equity Financing

Equity financing offers the advantage of not requiring fixed repayments, reducing the immediate financial burden on companies and preserving cash flow for operational growth. It attracts investors who provide not only capital but also strategic guidance and networking opportunities, enhancing business development. Additionally, equity financing improves the company's balance sheet by increasing shareholder equity, potentially increasing creditworthiness for future borrowing.

Advantages of Mezzanine Financing

Mezzanine financing offers flexible capital solutions combining debt and equity features, allowing companies to access substantial funds without diluting ownership as much as pure equity financing. It provides subordinated debt with equity kickers like warrants, enhancing investor returns while supporting business growth and expansion. This financing type bridges the gap between senior debt and equity, often requiring less collateral and offering tax-deductible interest payments, making it a cost-effective option for middle-market firms.

Risks and Challenges of Each Financing Option

Equity financing involves selling ownership stakes, which dilutes control and may reduce influence over business decisions, posing significant risks for founders and existing shareholders. Mezzanine financing, a hybrid of debt and equity, carries higher interest rates and repayment obligations, increasing financial strain and default risk if cash flow is insufficient. Both financing options challenge companies through potential loss of control, high costs, and impact on long-term financial stability.

Ideal Scenarios for Equity Financing

Equity financing is ideal for startups and high-growth companies seeking substantial capital without immediate repayment obligations, allowing them to leverage investor expertise and share business risks. It suits ventures with long-term growth potential and less predictable cash flows, where traditional debt financing may be unattainable or restrictive. Companies aiming to build strong strategic partnerships and avoid increasing debt leverage benefit significantly from equity financing.

Ideal Scenarios for Mezzanine Financing

Mezzanine financing is ideal for companies seeking growth capital without diluting ownership significantly, typically in later-stage businesses with stable cash flows and strong credit profiles. It suits scenarios where traditional debt financing limits have been reached, and the company requires flexible capital that combines debt and equity features. Businesses pursuing acquisitions, expansions, or recapitalizations often benefit from mezzanine financing due to its subordinate debt structure and potential equity kickers.

Choosing the Right Financing Option for Your Business

Choosing the right financing option for your business depends on factors such as control, cost, and risk tolerance. Equity financing involves selling ownership stakes, offering capital without repayment obligations but diluting control and earning potential, making it suitable for startups seeking growth. Mezzanine financing combines debt and equity features, providing flexible capital with subordinated debt and warrants, ideal for established businesses aiming to expand without giving up significant ownership.

Equity Financing Infographic

libterm.com

libterm.com