Credit Default Swaps (CDS) are financial derivatives that function as insurance contracts against the risk of a borrower defaulting on debt payments. These instruments enable investors to manage credit risk by transferring potential losses to protection sellers in exchange for periodic premiums. Discover how Credit Default Swaps impact markets and your investment strategies by reading the full article.

Table of Comparison

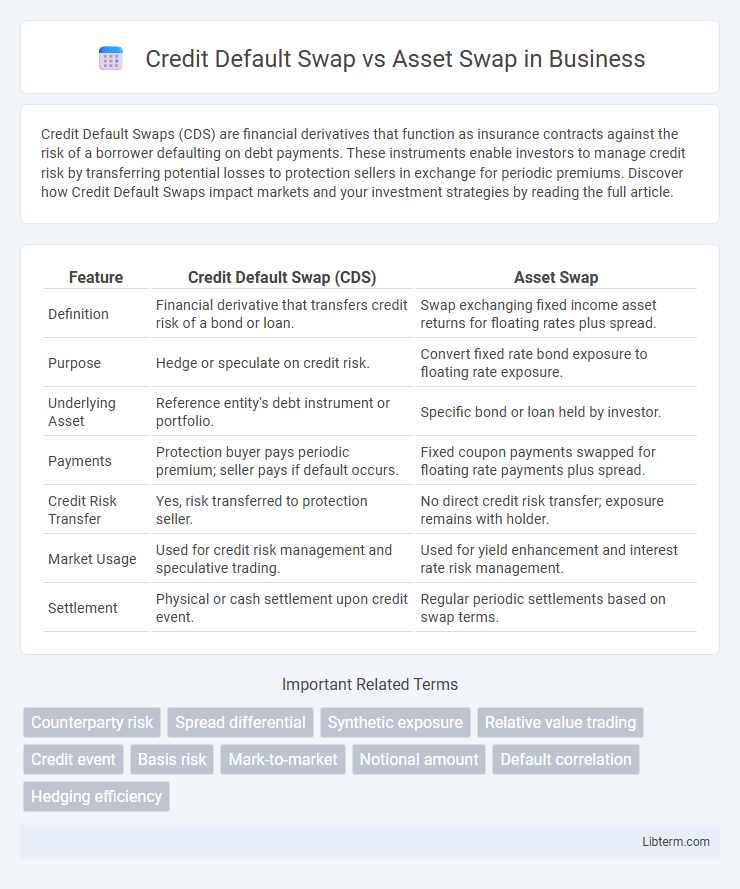

| Feature | Credit Default Swap (CDS) | Asset Swap |

|---|---|---|

| Definition | Financial derivative that transfers credit risk of a bond or loan. | Swap exchanging fixed income asset returns for floating rates plus spread. |

| Purpose | Hedge or speculate on credit risk. | Convert fixed rate bond exposure to floating rate exposure. |

| Underlying Asset | Reference entity's debt instrument or portfolio. | Specific bond or loan held by investor. |

| Payments | Protection buyer pays periodic premium; seller pays if default occurs. | Fixed coupon payments swapped for floating rate payments plus spread. |

| Credit Risk Transfer | Yes, risk transferred to protection seller. | No direct credit risk transfer; exposure remains with holder. |

| Market Usage | Used for credit risk management and speculative trading. | Used for yield enhancement and interest rate risk management. |

| Settlement | Physical or cash settlement upon credit event. | Regular periodic settlements based on swap terms. |

Introduction to Credit Default Swaps and Asset Swaps

Credit Default Swaps (CDS) are financial derivatives that provide protection against the default risk of a borrower by allowing one party to transfer the credit exposure of fixed income products to another party. Asset Swaps combine a fixed-rate bond with an interest rate swap, converting the bond's cash flows into floating-rate payments to hedge interest rate risk or enhance returns. Both instruments play crucial roles in credit risk management and fixed income portfolio strategies by offering tailored risk mitigation and yield enhancement options.

Definition and Basic Concepts

A Credit Default Swap (CDS) is a financial derivative that provides credit protection by transferring the risk of default from one party to another in exchange for periodic payments. An Asset Swap involves exchanging the cash flows of a fixed-rate bond for floating-rate payments, essentially converting the bond's interest rate exposure. Both instruments serve as tools for managing credit and interest rate risks but differ fundamentally in structure: CDS isolates credit risk, while Asset Swaps modify income streams and interest rate sensitivities.

Key Differences at a Glance

Credit Default Swaps (CDS) provide protection against the risk of a borrower defaulting, functioning as insurance contracts between counterparties, whereas Asset Swaps involve exchanging fixed-income cash flows for floating-rate payments to hedge interest rate risk or enhance returns. CDS primarily transfer credit risk without altering the asset's underlying cash flows, while Asset Swaps modify the exposure to interest rates by swapping fixed coupon payments for floating ones, maintaining the underlying bond ownership. Key distinctions include CDS's role in credit risk management and default protection versus Asset Swaps' focus on interest rate risk adjustment and yield optimization.

Purpose and Use Cases

Credit Default Swaps (CDS) serve as financial derivatives designed to transfer the credit risk of fixed income products between parties, primarily used by investors for hedging or speculating on credit events like defaults or rating downgrades. Asset Swaps combine a fixed-rate bond and an interest rate swap to convert fixed coupon payments into floating rates, commonly employed by investors to manage interest rate exposure and enhance yield relative to benchmark rates. CDS are pivotal in credit risk management, while Asset Swaps optimize interest rate structures and cash flow profiles in bond portfolios.

How Credit Default Swaps Work

Credit Default Swaps (CDS) function as financial derivatives that transfer the credit risk of a borrower from the protection buyer to the protection seller in exchange for periodic premium payments. When a credit event, such as default or bankruptcy, occurs, the protection seller compensates the buyer for the loss, providing insurance against credit risk. In contrast, an Asset Swap combines a fixed-income security with an interest rate swap to convert the asset's cash flows, but does not directly transfer credit risk like a CDS.

How Asset Swaps Work

Asset swaps work by combining a fixed-rate bond with an interest rate swap, allowing investors to convert fixed coupon payments into floating rate cash flows, thus managing interest rate risk. This structure enables the holder to exchange the bond's fixed income stream for a variable payment linked to a benchmark rate like LIBOR or SOFR, improving portfolio flexibility. By contrast, credit default swaps provide insurance against the default of a bond issuer, focusing specifically on credit risk rather than interest rate exposure.

Risk Exposure Comparison

Credit Default Swaps (CDS) primarily transfer default risk by providing protection against issuer credit events, whereas Asset Swaps expose investors to interest rate risk combined with credit risk embedded in the reference asset. In CDS, risk exposure is limited to counterparty default and credit event occurrence, while Asset Swaps entail fluctuations in underlying bond yields and credit spreads affecting the swap's value. Consequently, CDS serve as a targeted credit risk hedge, whereas Asset Swaps involve a mixed risk profile involving both credit and interest rate volatility.

Market Participants and Applications

Credit Default Swaps (CDS) are predominantly utilized by institutional investors, hedge funds, and banks to manage or hedge credit risk exposure by transferring the risk of default on debt instruments. Asset Swaps attract fixed-income investors and portfolio managers seeking to convert fixed-rate bond returns into floating rates, enhancing yield or managing interest rate risk. Both instruments serve strategic roles in risk management and speculative strategies, with CDS emphasizing credit protection and Asset Swaps focusing on interest rate optimization.

Pros and Cons of Each Instrument

Credit Default Swaps (CDS) provide effective credit risk protection by allowing investors to hedge against default, but they carry counterparty risk and can be costly due to premium payments. Asset Swaps convert bonds into synthetic floating-rate instruments, enhancing liquidity and yield management, yet they expose holders to interest rate risk and may involve complex structuring. CDS offer targeted credit exposure management, whereas Asset Swaps are preferable for interest rate risk flexibility and cash flow customization.

Choosing Between Credit Default Swap and Asset Swap

Choosing between a Credit Default Swap (CDS) and an Asset Swap depends on the investor's risk profile and exposure needs. CDS contracts provide protection against credit events such as default, making them optimal for hedging credit risk, while Asset Swaps offer a way to convert fixed-rate bond payments into floating rates, enhancing liquidity and flexibility in portfolio management. Investors seeking pure credit risk transfer favor CDS, whereas those aiming for interest rate risk management and yield enhancement typically opt for Asset Swaps.

Credit Default Swap Infographic

libterm.com

libterm.com