Redemption value represents the amount an investor receives when a bond or other fixed-income security is redeemed before maturity, often at a premium or par value. Understanding redemption value is crucial for evaluating your potential returns and managing investment risk effectively. Explore the rest of this article to learn how redemption value impacts your financial decisions and investment strategies.

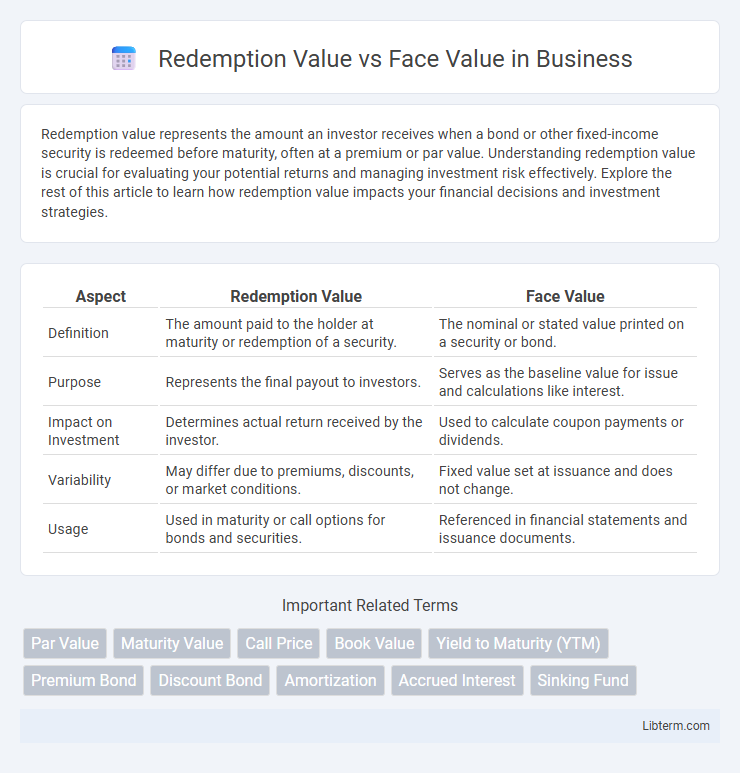

Table of Comparison

| Aspect | Redemption Value | Face Value |

|---|---|---|

| Definition | The amount paid to the holder at maturity or redemption of a security. | The nominal or stated value printed on a security or bond. |

| Purpose | Represents the final payout to investors. | Serves as the baseline value for issue and calculations like interest. |

| Impact on Investment | Determines actual return received by the investor. | Used to calculate coupon payments or dividends. |

| Variability | May differ due to premiums, discounts, or market conditions. | Fixed value set at issuance and does not change. |

| Usage | Used in maturity or call options for bonds and securities. | Referenced in financial statements and issuance documents. |

Understanding Redemption Value

Redemption value represents the amount an investor receives when a bond or preferred stock is redeemed before maturity, often differing from the face value due to premiums or discounts. It is crucial in assessing the true return on investment, especially when bonds are called early or securities have embedded call provisions. Understanding redemption value helps investors accurately evaluate potential gains or losses compared to the security's stated face value.

Defining Face Value

Face value is the nominal or stated value of a financial instrument indicated on the certificate or bond, representing the amount to be paid to the holder at maturity. Redemption value refers to the actual amount received upon redeeming the bond or security, which may include accrued interest or premiums above the face value. Understanding the distinction between face value and redemption value is crucial for investors assessing potential returns and evaluating market pricing.

Key Differences Between Redemption Value and Face Value

Redemption value refers to the amount an investor receives when a bond or debenture matures, which can include the original investment plus any premiums or accrued interest, whereas face value is the nominal or par value stated on the security at issuance. Redemption value may differ from face value if the bond is redeemed before maturity or carries a premium or discount, impacting the total return for the investor. Understanding these differences is crucial for evaluating bond investments and calculating potential yields accurately.

Importance in Investment Decisions

Redemption value represents the amount an investor receives at maturity, influencing the total return on bonds and fixed-income securities. Face value, or par value, is the principal amount printed on the security, serving as the basis for interest calculations and initial investment cost. Understanding the difference between redemption value and face value is crucial for investors to accurately assess yield, potential gains or losses, and make informed investment decisions.

Redemption Value in Bonds and Debentures

Redemption value in bonds and debentures refers to the amount the issuer agrees to pay the bondholder upon maturity, which may differ from the face value or par value initially stated. This value can include a premium above the face value to compensate investors for early redemption or specific terms outlined in the bond indenture. Understanding redemption value is crucial for calculating the actual returns and assessing the investment's yield compared to its nominal face value.

Face Value’s Role in Share Markets

Face value, also known as par value, represents the original cost of a share as stated on the stock certificate and serves as a baseline for share pricing in the stock market. It is crucial in calculating dividends, as many companies declare dividends as a percentage of the face value, impacting investor returns. Unlike redemption value, which pertains to bond maturity payouts, face value anchors the initial equity value and influences market perceptions of a company's stock stability and risk.

Impact on Returns and Yields

Redemption value directly influences the bondholder's actual returns since it determines the amount received at maturity, impacting the yield to maturity (YTM) calculations. When redemption value exceeds face value, investors realize a capital gain, enhancing total returns and driving yields above the coupon rate. Conversely, if the redemption value is less than the face value, yields fall below the nominal coupon rate, reducing investment attractiveness and overall return potential.

Factors Influencing Redemption Value

Redemption value varies significantly from face value based on factors such as interest rate fluctuations, time remaining until maturity, and the issuer's creditworthiness. Market conditions, including inflation rates and prevailing economic stability, directly influence the redemption value investors can expect. Callable features and early redemption options also affect the premium or discount investors may receive compared to face value.

Practical Examples and Case Studies

Redemption value represents the amount an investor receives at maturity, often differing from the face value due to accrued interest or premiums, as seen in zero-coupon bonds where redemption value exceeds the discounted purchase price. Case studies of callable bonds illustrate that redemption value may include a call premium paid before maturity, impacting investor returns compared to the nominal face value printed on the bond. Practical examples in corporate bonds highlight scenarios where redemption value fluctuates based on market conditions, call features, and bond indentures, emphasizing the importance of understanding these terms for accurate investment valuation.

Conclusion: Choosing Based on Financial Goals

Selecting between redemption value and face value depends on your financial objectives: prioritize redemption value if maximizing returns at the bond's maturity aligns with your goals, while face value is crucial when assessing the principal amount to be received. Understanding the impact of market fluctuations on redemption value helps in planning long-term investments, whereas face value provides clarity for fixed-income expectations. Aligning your choice with risk tolerance and cash flow needs ensures smarter bond investment decisions.

Redemption Value Infographic

libterm.com

libterm.com