Buyback programs allow companies to repurchase their own shares from the marketplace, often boosting stock value and signaling confidence in the business. Understanding the financial implications and strategic reasons behind buybacks can help you make informed investment decisions. Explore the rest of this article to learn how buybacks impact your portfolio and the broader market.

Table of Comparison

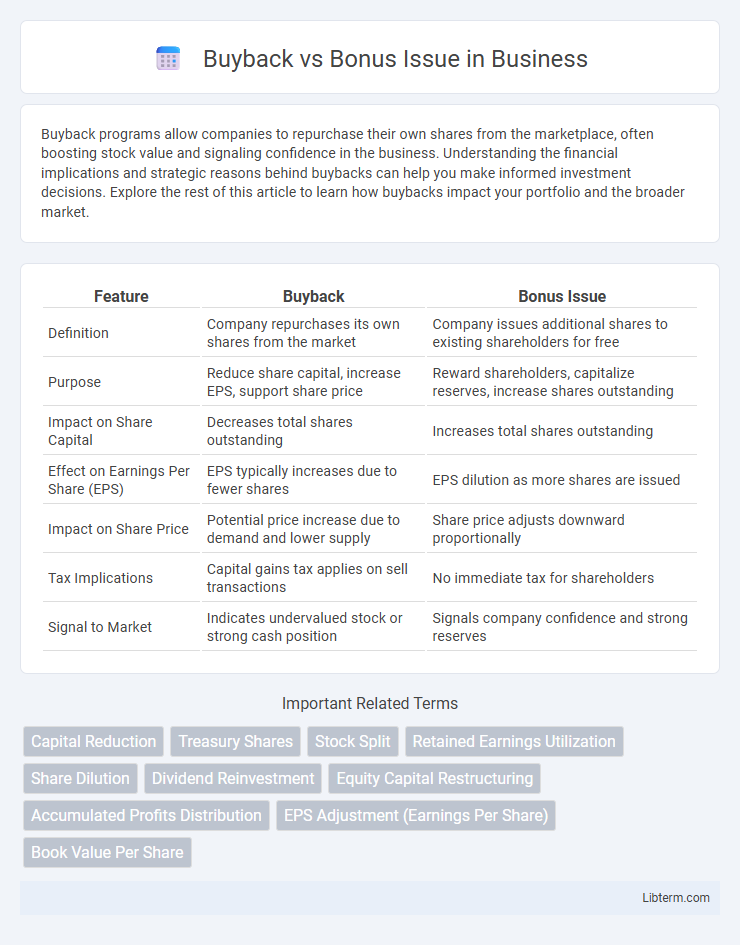

| Feature | Buyback | Bonus Issue |

|---|---|---|

| Definition | Company repurchases its own shares from the market | Company issues additional shares to existing shareholders for free |

| Purpose | Reduce share capital, increase EPS, support share price | Reward shareholders, capitalize reserves, increase shares outstanding |

| Impact on Share Capital | Decreases total shares outstanding | Increases total shares outstanding |

| Effect on Earnings Per Share (EPS) | EPS typically increases due to fewer shares | EPS dilution as more shares are issued |

| Impact on Share Price | Potential price increase due to demand and lower supply | Share price adjusts downward proportionally |

| Tax Implications | Capital gains tax applies on sell transactions | No immediate tax for shareholders |

| Signal to Market | Indicates undervalued stock or strong cash position | Signals company confidence and strong reserves |

Understanding Buyback and Bonus Issue

Buyback involves a company repurchasing its own shares from the market to reduce the number of outstanding shares, which can increase earnings per share and enhance shareholder value. A bonus issue, also called a stock dividend, is when a company distributes additional shares to existing shareholders without cost, increasing the total number of shares while diluting the share price proportionally. Both strategies are used to manage share capital and influence investor perception.

Key Differences Between Buyback and Bonus Issue

Buyback involves a company repurchasing its own shares from the market, reducing the total outstanding shares and often increasing earnings per share (EPS) and stock value. Bonus issue refers to the distribution of additional shares to existing shareholders without extra cost, diluting share value but increasing liquidity. Key differences include buybacks reducing share capital and improving share price, while bonus issues increase share capital without affecting a company's market capitalization directly.

Objectives of Buyback

Share buybacks aim to reduce the total number of outstanding shares, thereby increasing earnings per share (EPS) and enhancing shareholder value. Companies utilize buybacks to return excess cash to shareholders, signal confidence in the firm's future prospects, and improve return on equity (ROE). Buybacks also help counteract dilution caused by employee stock option plans and provide flexibility compared to dividends.

Purpose of Bonus Issue

The purpose of a bonus issue is to distribute additional shares to existing shareholders without any additional cost, thereby increasing the total number of shares outstanding and enhancing liquidity in the market. It aims to reward loyal investors by capitalizing reserves and retaining cash within the company for growth and operations. This mechanism also adjusts the share price to a more affordable level, potentially attracting broader investor interest.

Impact on Shareholder Value

Share buybacks increase shareholder value by reducing the number of outstanding shares, which typically boosts earnings per share (EPS) and potentially stock price. Bonus issues, while increasing the number of shares held by each shareholder, dilute the share price proportionally, leaving the overall shareholder value unchanged. Investors often view buybacks as a signal of management's confidence in the company's future earnings, whereas bonus issues are perceived as a method to reward shareholders without altering the company's market capitalization.

Effects on Share Capital and EPS

Buyback reduces the number of outstanding shares by repurchasing them from the market, leading to a decrease in share capital and an increase in Earnings Per Share (EPS) due to fewer shares. Bonus issue increases the number of shares by issuing additional shares to existing shareholders, resulting in a higher share capital while EPS remains unchanged as total earnings are spread over more shares. The contrasting effects highlight buyback's role in enhancing EPS through share reduction, whereas bonus issues expand equity without altering EPS.

Tax Implications for Investors

Buyback and bonus issues have distinct tax implications for investors based on jurisdictional tax laws. In a buyback, investors may face capital gains tax on the difference between the buyback price and their original purchase price, whereas bonus shares typically are not taxed at issuance but may impact capital gains calculation during eventual sale. Understanding local tax regulations on dividend distribution tax, capital gains tax rates, and holding periods is crucial for effective tax planning between buyback and bonus share transactions.

Advantages and Disadvantages of Buyback

Buybacks offer advantages such as increasing earnings per share by reducing the number of outstanding shares and providing flexibility in capital allocation without diluting ownership. Disadvantages include potential negative market perception if buybacks are seen as a lack of growth opportunities and the risk of misusing cash reserves that could be invested in business expansion. Buybacks may also lead to temporary stock price boosts without long-term value creation for shareholders.

Benefits and Limitations of Bonus Issue

Bonus issues increase the number of shares held by existing shareholders without additional cost, enhancing stock liquidity and signaling company confidence. However, bonus shares dilute earnings per share (EPS) and do not provide immediate cash benefits to investors. Companies must carefully assess their reserves and growth prospects before opting for a bonus issue to avoid negative market perceptions.

Choosing Between Buyback and Bonus Issue

Choosing between buyback and bonus issue depends on the company's financial strategy and shareholder objectives. Buybacks reduce outstanding shares, potentially increasing earnings per share (EPS) and stock price, benefiting shareholders through capital gains. Bonus issues distribute additional shares without cash outflow, enhancing liquidity and rewarding shareholders, but do not impact the company's market capitalization or EPS directly.

Buyback Infographic

libterm.com

libterm.com