Phantom stock is a type of employee incentive that grants the benefits of stock ownership without transferring actual shares, aligning employee interests with company performance. This plan ensures employees receive cash bonuses equivalent to the value of company stock at a future date, promoting long-term commitment and motivation. Discover how phantom stock can enhance your compensation strategy by exploring the full article.

Table of Comparison

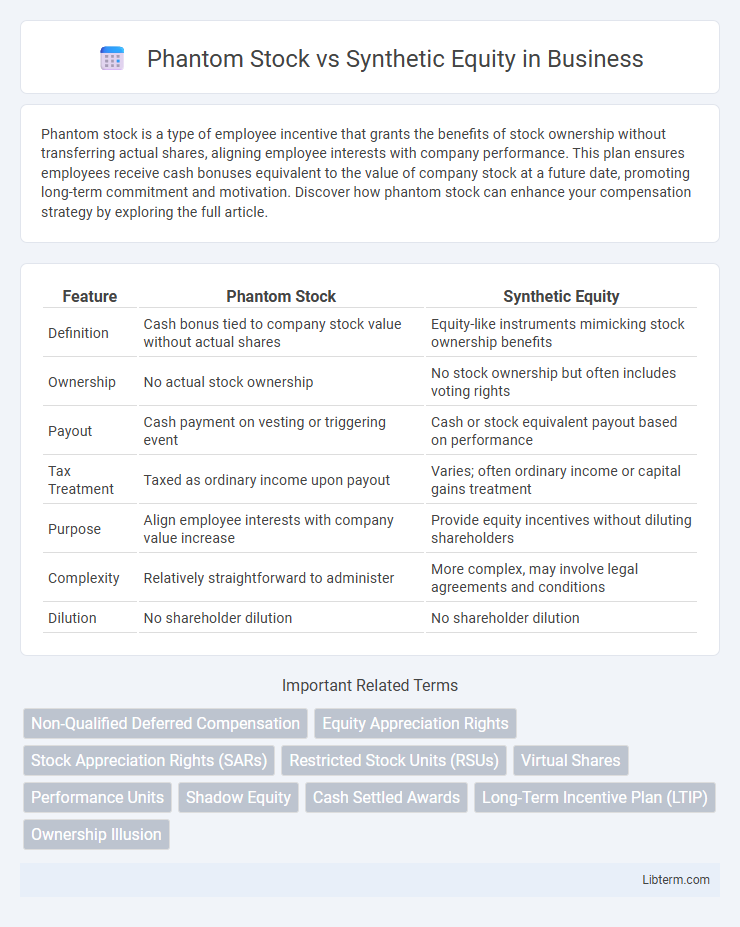

| Feature | Phantom Stock | Synthetic Equity |

|---|---|---|

| Definition | Cash bonus tied to company stock value without actual shares | Equity-like instruments mimicking stock ownership benefits |

| Ownership | No actual stock ownership | No stock ownership but often includes voting rights |

| Payout | Cash payment on vesting or triggering event | Cash or stock equivalent payout based on performance |

| Tax Treatment | Taxed as ordinary income upon payout | Varies; often ordinary income or capital gains treatment |

| Purpose | Align employee interests with company value increase | Provide equity incentives without diluting shareholders |

| Complexity | Relatively straightforward to administer | More complex, may involve legal agreements and conditions |

| Dilution | No shareholder dilution | No shareholder dilution |

Introduction to Phantom Stock and Synthetic Equity

Phantom stock and synthetic equity are types of employee incentive plans designed to mimic the benefits of actual stock ownership without issuing real shares. Phantom stock grants employees the right to receive cash or stock value based on company stock performance, aligning their interests with shareholders. Synthetic equity provides similar economic benefits, often including dividends and voting rights, to closely simulate real equity ownership while avoiding dilution of company stock.

Key Differences Between Phantom Stock and Synthetic Equity

Phantom stock provides employees with cash bonuses equivalent to the value of company shares without actual equity ownership, while synthetic equity grants rights that closely mimic stock ownership, including dividends and voting rights. Phantom stock plans are primarily designed for cash compensation tied to company performance, whereas synthetic equity offers a more extensive shareholder experience, often used to align employee interests with long-term company value. The key differences lie in ownership rights, tax treatment, and the nature of employee incentives, influencing how companies structure compensation to motivate and retain talent.

How Phantom Stock Works

Phantom stock grants employees units that mirror the value of actual company shares, providing cash bonuses equivalent to stock price increases without transferring ownership. These units typically vest over a predetermined period, aligning employee incentives with company performance and shareholder value. Upon vesting or triggering events, employees receive payouts based on the appreciation of the phantom shares, simulating equity ownership benefits without diluting equity.

How Synthetic Equity Is Structured

Synthetic equity is structured to mimic actual stock ownership through contractual agreements that grant employees rights to the financial benefits of equity without conferring legal ownership or voting rights. It commonly involves instruments such as stock appreciation rights (SARs), phantom stock units, or restricted stock units (RSUs), each providing employees with value tied to the company's stock performance or valuation milestones. This structure enables companies to motivate and retain talent by aligning employee incentives with shareholder value while avoiding dilution of equity and complex shareholder governance issues.

Advantages of Phantom Stock Plans

Phantom stock plans offer significant advantages by providing employees with the economic benefits of stock ownership without diluting actual equity, preserving company control and shareholder value. These plans create a strong retention tool and align employee interests with company performance through cash bonuses tied to stock value appreciation or dividends. Phantom stock is simpler to administer compared to synthetic equity, avoiding complex tax implications and regulatory compliance tied to actual equity grants.

Pros and Cons of Synthetic Equity

Synthetic equity offers employees similar benefits to actual stock, including potential financial gains tied to company valuation, without diluting shareholder equity. It provides flexibility in structuring compensation but may carry more complex tax implications and legal considerations compared to phantom stock. Companies benefit from increased employee motivation and retention, though administrative costs and regulatory compliance can pose challenges.

Tax Implications for Phantom Stock vs Synthetic Equity

Phantom stock typically subjects employees to ordinary income tax upon vesting or payout, with employers able to deduct the expense accordingly. Synthetic equity can offer more complex tax scenarios, potentially including capital gains treatment if structured properly, but may also trigger payroll taxes depending on the plan design. Understanding the specific tax treatment of each is crucial for companies to optimize compensation strategy and minimize tax liability.

Use Cases: When to Choose Each Option

Phantom stock suits companies aiming to reward employees with cash bonuses linked to company value without diluting equity, ideal for privately-held firms seeking straightforward retention tools. Synthetic equity works best for startups wanting to mimic actual stock ownership benefits, including voting rights or dividends, attracting top talent while controlling equity distribution. Use phantom stock for simpler, cash-based incentives and synthetic equity for nuanced, stock-like compensation aligning employee interests with long-term company growth.

Legal and Administrative Considerations

Phantom stock and synthetic equity both mimic stock ownership without transferring actual shares, but they differ significantly in legal and administrative implications. Phantom stock plans typically face fewer regulatory requirements since they are treated as liability awards, avoiding shareholder rights and complex securities laws, while synthetic equity may implicate equity classification and trigger more stringent compliance demands. Administratively, phantom stock is simpler to implement and manage, requiring clear valuation and payout terms, whereas synthetic equity plans often involve detailed agreements and may require intricate tracking of equity-like features for tax and governance purposes.

Conclusion: Choosing the Right Equity Compensation Tool

Choosing between Phantom Stock and Synthetic Equity depends on company goals, tax considerations, and employee incentives. Phantom Stock offers straightforward cash-based rewards linked to company valuation without equity dilution, while Synthetic Equity provides a more flexible approach replicating actual stock benefits, including potential voting rights and dividends. Aligning the choice with long-term business strategy and stakeholder expectations ensures optimal equity compensation outcomes.

Phantom Stock Infographic

libterm.com

libterm.com