A finance lease allows you to use an asset while effectively taking on most of the risks and rewards of ownership without buying it outright. This type of lease is commonly used for equipment, vehicles, or property, enabling businesses to manage cash flow and preserve capital. Explore the details of how a finance lease can benefit your financial strategy in the rest of this article.

Table of Comparison

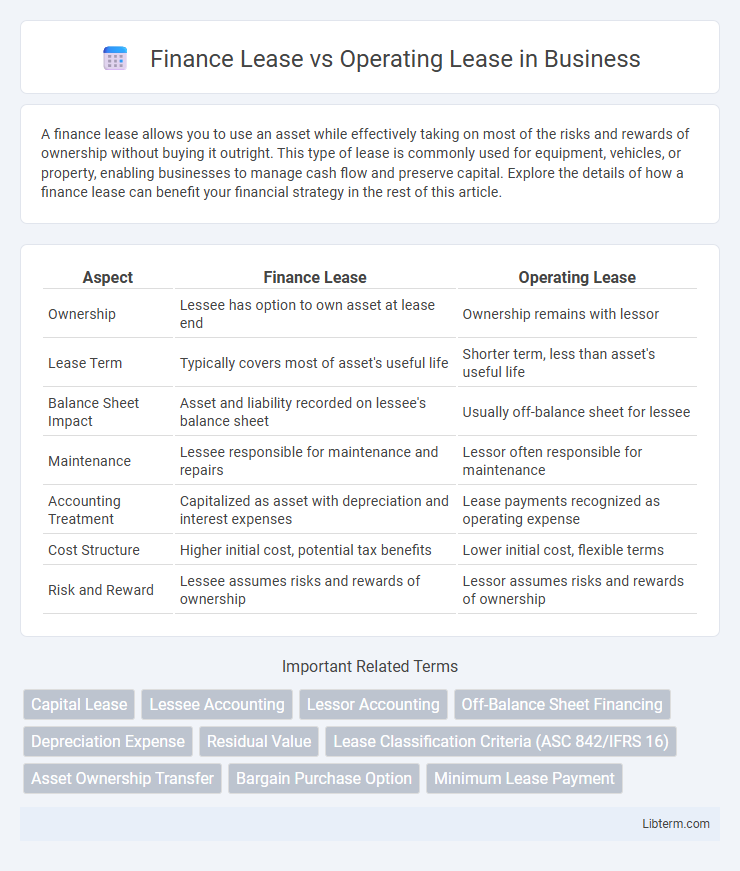

| Aspect | Finance Lease | Operating Lease |

|---|---|---|

| Ownership | Lessee has option to own asset at lease end | Ownership remains with lessor |

| Lease Term | Typically covers most of asset's useful life | Shorter term, less than asset's useful life |

| Balance Sheet Impact | Asset and liability recorded on lessee's balance sheet | Usually off-balance sheet for lessee |

| Maintenance | Lessee responsible for maintenance and repairs | Lessor often responsible for maintenance |

| Accounting Treatment | Capitalized as asset with depreciation and interest expenses | Lease payments recognized as operating expense |

| Cost Structure | Higher initial cost, potential tax benefits | Lower initial cost, flexible terms |

| Risk and Reward | Lessee assumes risks and rewards of ownership | Lessor assumes risks and rewards of ownership |

Introduction to Finance Lease and Operating Lease

Finance lease involves a long-term lease agreement where the lessee assumes most risks and rewards of ownership, recording both the leased asset and liability on the balance sheet. Operating lease is a short-term or cancellable lease where the lessor retains ownership risks, and payments are treated as operating expenses off the balance sheet. Key financial reporting differences affect asset capitalisation and impact company financial ratios and cash flow statements.

Key Definitions: Finance Lease vs. Operating Lease

A finance lease is a long-term agreement where the lessee assumes most risks and rewards of ownership, recorded as an asset and liability on the balance sheet. An operating lease is a short-term or cancelable agreement, treated as a rental expense without recognizing the asset or liability on financial statements. Understanding these distinctions is crucial for accurate lease accounting under IFRS 16 or ASC 842 standards.

Main Differences Between Finance Lease and Operating Lease

Finance leases transfer substantially all risks and rewards of ownership to the lessee, treating the asset as if owned on the balance sheet with depreciation and interest expenses recognized. Operating leases keep the asset off the lessee's balance sheet, with lease payments recorded as operating expenses, reflecting short-term or cancellable arrangements. Key differences include asset ownership transfer, balance sheet recognition, and accounting treatment of lease payments versus depreciation.

Asset Ownership in Finance and Operating Leases

In a finance lease, asset ownership effectively transfers to the lessee by the end of the lease term, with the lessee responsible for depreciation, maintenance, and risks associated with the asset. Conversely, in an operating lease, ownership remains with the lessor, who retains the asset on their balance sheet and assumes risks related to obsolescence and residual value. This distinction impacts financial reporting, with finance leases capitalized as assets and liabilities, whereas operating leases are treated as off-balance-sheet expenses.

Accounting Treatment of Each Lease Type

Finance leases require lessees to recognize both an asset and a liability on the balance sheet at the lease commencement date, reflecting the present value of lease payments, with subsequent depreciation of the asset and interest expense on the liability. Operating leases are treated as off-balance-sheet items under previous accounting standards, with lease payments expensed on a straight-line basis over the lease term; however, under IFRS 16 and ASC 842, operating leases must now be recognized on the balance sheet as a right-of-use asset and lease liability. The classification impacts financial ratios, with finance leases affecting assets, liabilities, and equity more significantly than operating leases.

Tax Implications of Finance and Operating Leases

Finance leases typically allow lessees to claim depreciation and interest expense deductions on the leased asset, leading to tax benefits similar to owning the asset. Operating leases usually result in lease payments being fully deductible as operating expenses, reducing taxable income without asset ownership or depreciation claims. Understanding IRS guidelines and accounting standards such as ASC 842 is crucial for optimizing tax strategies related to finance and operating leases.

Impact on Financial Statements

Finance leases transfer substantially all risks and rewards of ownership to the lessee, resulting in recognition of both an asset and a corresponding liability on the balance sheet, which increases total assets and liabilities. Operating leases are off-balance-sheet financing, with lease payments recorded as an expense on the income statement, leaving assets and liabilities unaffected under previous standards; however, under ASC 842 and IFRS 16, most operating leases now also require right-of-use assets and lease liabilities to be recognized. The impact on financial ratios varies, as finance leases increase leverage and asset turnover ratios, while operating leases previously improved these metrics by excluding leased assets and liabilities.

Advantages and Disadvantages of Finance Lease

Finance leases provide the lessee with ownership benefits, such as asset control and the ability to claim depreciation and interest expenses for tax advantages. These leases often require higher initial payments and long-term commitment, potentially impacting cash flow flexibility and increasing financial risk. Unlike operating leases, finance leases are recorded as liabilities on the balance sheet, which can affect debt ratios and borrowing capacity.

Pros and Cons of Operating Lease

Operating leases offer the advantage of lower upfront costs and off-balance-sheet treatment, which improves financial ratios and preserves borrowing capacity. This lease type provides flexibility with shorter terms and easier asset upgrades but may result in higher overall expenses due to continuous lease payments. A significant downside is the lack of asset ownership and no equity buildup, limiting long-term investment benefits and residual value gains.

How to Choose Between Finance Lease and Operating Lease

Choosing between a finance lease and an operating lease depends on factors such as asset ownership, lease term, and financial reporting preferences. Opt for a finance lease if you aim to capitalize the asset on your balance sheet, gain ownership rights, and have the intent to use the asset for most of its useful life. Select an operating lease for off-balance-sheet financing, shorter lease terms, and scenarios where asset maintenance and obsolescence risk are better managed by the lessor.

Finance Lease Infographic

libterm.com

libterm.com