Supply elasticity measures how much the quantity supplied of a good responds to changes in its price, reflecting the flexibility producers have in adjusting production levels. High supply elasticity indicates that producers can quickly scale output when prices fluctuate, while low elasticity suggests limited responsiveness. Explore the full article to understand how supply elasticity impacts market dynamics and your potential business decisions.

Table of Comparison

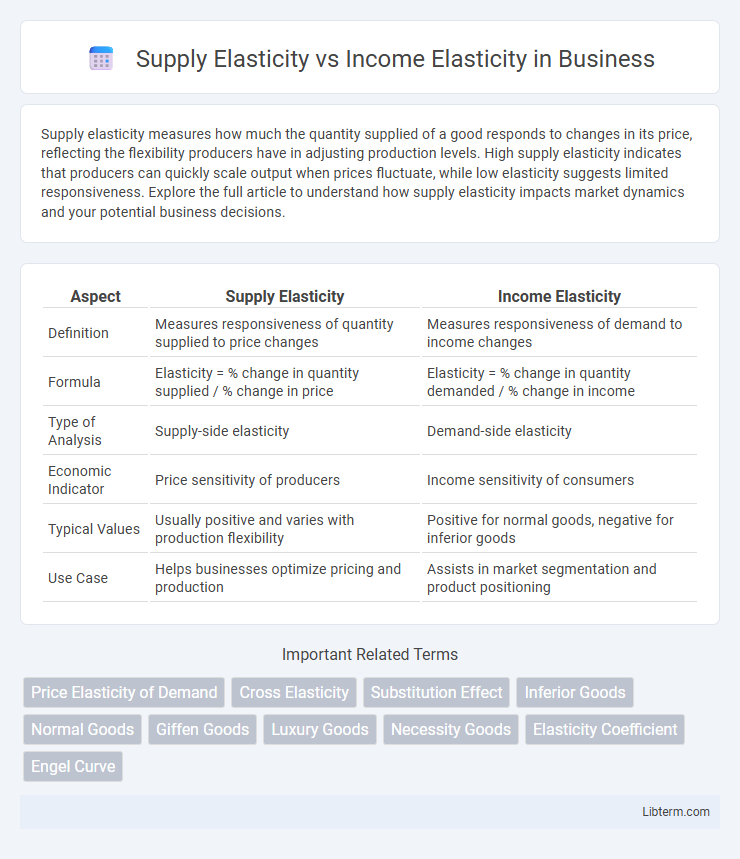

| Aspect | Supply Elasticity | Income Elasticity |

|---|---|---|

| Definition | Measures responsiveness of quantity supplied to price changes | Measures responsiveness of demand to income changes |

| Formula | Elasticity = % change in quantity supplied / % change in price | Elasticity = % change in quantity demanded / % change in income |

| Type of Analysis | Supply-side elasticity | Demand-side elasticity |

| Economic Indicator | Price sensitivity of producers | Income sensitivity of consumers |

| Typical Values | Usually positive and varies with production flexibility | Positive for normal goods, negative for inferior goods |

| Use Case | Helps businesses optimize pricing and production | Assists in market segmentation and product positioning |

Understanding Supply Elasticity: Definition and Importance

Supply elasticity measures the responsiveness of the quantity supplied of a good to a change in its price, indicating how producers adjust output when market prices fluctuate. High supply elasticity suggests producers can quickly increase production without a significant cost increase, which is crucial for market stability and price regulation. Understanding this concept helps businesses and policymakers forecast production changes and implement effective economic strategies.

Income Elasticity Explained: Meaning and Significance

Income elasticity of demand measures how the quantity demanded of a good responds to changes in consumer income, indicating whether a good is normal or inferior. A positive income elasticity signifies that demand increases as income rises, while a negative value reveals demand drops with higher incomes. This metric is crucial for businesses and policymakers to predict market trends and make informed production or policy decisions based on income fluctuations.

Key Differences Between Supply and Income Elasticity

Supply elasticity measures how the quantity supplied of a good responds to changes in its price, reflecting producers' sensitivity to price fluctuations. Income elasticity of demand evaluates how consumer demand varies with changes in income, indicating whether a good is normal or inferior. The key difference lies in supply elasticity's focus on producer response to price changes, whereas income elasticity centers on consumer behavior relative to income changes.

Factors Influencing Supply Elasticity

Supply elasticity is primarily influenced by factors such as production capacity, availability of raw materials, and time period for adjustment, determining how quantity supplied responds to price changes. Technological advancements and flexibility in the production process enhance supply elasticity by enabling quicker adjustments in output. In contrast, income elasticity measures consumer demand changes relative to income variations and is not directly affected by supply-side constraints.

Factors Affecting Income Elasticity

Income elasticity of demand measures how consumer demand changes with income variations, influenced by factors such as the nature of the good (necessity or luxury), consumer preferences, and income distribution within the market. Necessities tend to have low income elasticity, while luxury goods exhibit high positive income elasticity. Changes in consumer income levels and expectations about future earnings also significantly impact income elasticity, shaping overall market demand patterns.

Types of Supply Elasticity

Supply elasticity measures how the quantity supplied responds to price changes and includes types such as perfectly elastic, perfectly inelastic, relatively elastic, and relatively inelastic supply. Perfectly elastic supply implies suppliers respond infinitely to price changes, while perfectly inelastic supply indicates no change in quantity supplied despite price shifts. Relatively elastic supply exhibits greater responsiveness than inelastic supply, which shows limited quantity changes with price variations.

Types of Income Elasticity

Income elasticity of demand measures how consumer demand changes in response to income variations, categorized into three types: normal goods with positive income elasticity, inferior goods with negative income elasticity, and luxury goods with income elasticity greater than one. Supply elasticity, in contrast, assesses how quantity supplied responds to price changes, typically unrelated to income fluctuations. Understanding these distinctions helps businesses predict market behavior based on income trends and price adjustments.

Real-World Examples: Supply Elasticity vs Income Elasticity

Supply elasticity measures how the quantity supplied of a good responds to price changes, as seen in agricultural products like wheat, where a higher price encourages farmers to increase planting. Income elasticity reflects how consumer demand varies with income changes, illustrated by luxury cars, which see increased sales as income rises. Understanding these elasticities helps businesses and policymakers predict market behavior under different economic conditions.

Implications for Businesses and Policymakers

Supply elasticity measures how quantity supplied responds to price changes, influencing businesses' production planning and inventory management to optimize profits under varying market conditions. Income elasticity of demand indicates how consumer demand shifts with income fluctuations, guiding policymakers in anticipating consumption patterns during economic growth or downturns. Understanding both elasticities enables businesses to adjust strategies effectively and helps policymakers design targeted economic policies for stable market environments.

Comparing the Economic Impact of Supply and Income Elasticity

Supply elasticity measures how the quantity supplied of a good responds to price changes, directly influencing production adjustments and market equilibrium. Income elasticity reflects how consumer demand varies with changes in income levels, affecting overall market demand and economic cycles. Understanding the interplay between supply elasticity and income elasticity is crucial for predicting shifts in prices, output, and consumer behavior during economic fluctuations.

Supply Elasticity Infographic

libterm.com

libterm.com