Effective financial planning helps you manage your income, expenses, and investments to achieve long-term financial goals and ensure stability. Understanding budgeting, saving, and risk management is essential for building a secure financial future. Explore the rest of this article to discover practical strategies for mastering your financial planning.

Table of Comparison

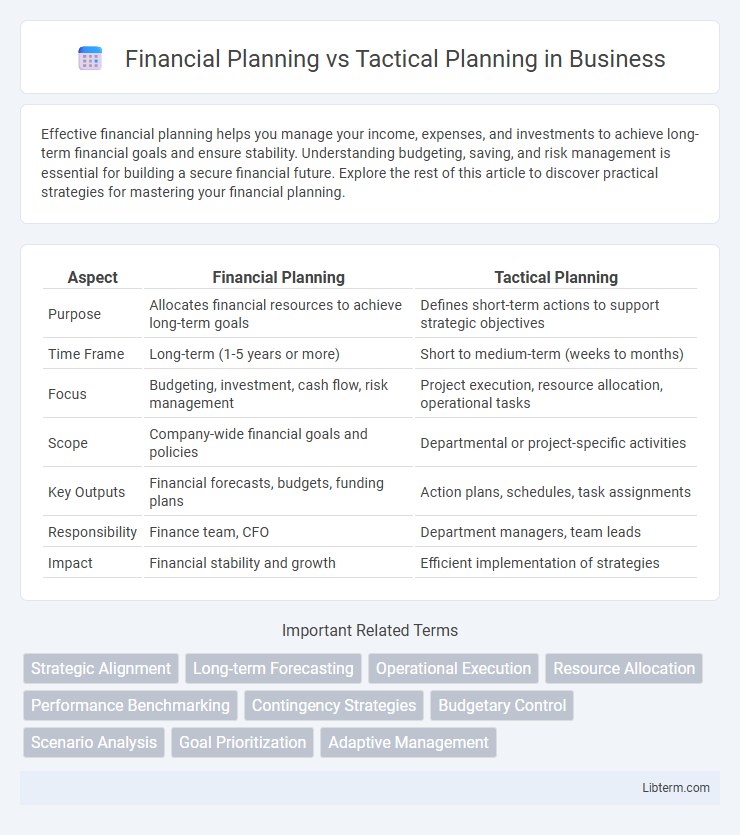

| Aspect | Financial Planning | Tactical Planning |

|---|---|---|

| Purpose | Allocates financial resources to achieve long-term goals | Defines short-term actions to support strategic objectives |

| Time Frame | Long-term (1-5 years or more) | Short to medium-term (weeks to months) |

| Focus | Budgeting, investment, cash flow, risk management | Project execution, resource allocation, operational tasks |

| Scope | Company-wide financial goals and policies | Departmental or project-specific activities |

| Key Outputs | Financial forecasts, budgets, funding plans | Action plans, schedules, task assignments |

| Responsibility | Finance team, CFO | Department managers, team leads |

| Impact | Financial stability and growth | Efficient implementation of strategies |

Understanding Financial Planning: Definition and Scope

Financial planning involves developing comprehensive strategies to manage an individual's or organization's long-term financial goals, including budgeting, investing, retirement planning, tax strategies, and risk management. It focuses on analyzing current financial situations, forecasting future needs, and creating systematic approaches to optimize wealth accumulation and preservation over time. Unlike tactical planning, which emphasizes short-term actions and operational execution, financial planning encompasses a broad scope of financial decision-making aimed at sustainable growth and financial security.

What is Tactical Planning? Key Concepts

Tactical planning involves developing specific short-term actions designed to achieve the objectives set by strategic financial planning, typically spanning weeks to months. Key concepts include resource allocation, task prioritization, and setting measurable milestones that guide day-to-day operational decisions. It translates broader financial goals into actionable steps, ensuring alignment with overall business strategy while adapting to immediate market conditions.

Core Differences Between Financial and Tactical Planning

Financial planning centers on setting long-term goals for managing an organization's budget, investments, and capital allocation to ensure sustainable growth and profitability. Tactical planning involves short-term, detailed actions and resource allocations aimed at achieving specific objectives that support the strategic goals outlined in the financial plan. The core difference lies in financial planning's emphasis on forecasting and managing monetary resources over an extended period, while tactical planning focuses on immediate, operational steps to implement parts of the overall strategy.

Objectives of Financial Planning

Financial planning centers on setting long-term financial objectives such as wealth accumulation, risk management, and retirement funding, ensuring resources align with future goals. It involves forecasting income, expenses, investments, and cash flow to create a comprehensive strategy for financial health. Tactical planning, by contrast, focuses on short-term actions and resource allocation aimed at achieving specific operational targets within the broader financial plan.

Tactical Planning: Focus on Short-Term Actions

Tactical planning emphasizes short-term actions that align with an organization's immediate objectives, typically covering a timeframe of weeks to months. It involves detailed resource allocation, task prioritization, and quick adaptation to changing market conditions to achieve specific operational goals. Effective tactical planning bridges the gap between long-term financial strategies and daily execution, ensuring agile responses to emerging challenges.

Integrating Financial and Tactical Planning for Business Success

Integrating financial planning with tactical planning ensures businesses allocate resources efficiently while executing short-term actions aligned with long-term goals. Financial planning provides budget forecasts and risk assessments that support tactical initiatives such as marketing campaigns or operational improvements. Combining these approaches enhances decision-making accuracy, driving sustainable growth and competitive advantage.

Tools and Techniques Used in Financial Planning

Financial planning utilizes tools such as budgeting software, cash flow analysis, and financial forecasting models to create long-term strategies for asset management and risk mitigation. Techniques include scenario analysis, Monte Carlo simulations, and ratio analysis to evaluate financial health and optimize investment portfolios. These tools and methods enable comprehensive planning aligned with individual or organizational financial goals and market conditions.

Essential Steps in Tactical Planning

Tactical planning involves defining specific short-term actions that align with the broader financial plan, emphasizing detailed steps such as setting measurable objectives, allocating resources effectively, and establishing timelines for execution. It requires continuous monitoring and adjustment to respond to market fluctuations and operational challenges, ensuring that each task contributes to achieving strategic financial goals. Key steps also include identifying responsible teams and implementing performance metrics to track progress and optimize outcomes.

Common Challenges in Financial and Tactical Planning

Financial planning and tactical planning both encounter challenges such as aligning short-term actions with long-term financial goals and managing resource constraints effectively. Inaccurate forecasting, data misinterpretation, and rapidly changing market conditions often hinder the development of reliable plans. Balancing flexibility with accountability remains a critical issue, especially when unexpected financial risks or operational disruptions arise.

Choosing the Right Planning Approach for Your Organization

Choosing the right planning approach for your organization depends on whether you prioritize long-term financial goals or short-term operational objectives. Financial planning focuses on budgeting, forecasting, and allocating resources to ensure sustainability and growth over time, while tactical planning emphasizes immediate actions and specific initiatives to meet short-term targets. Aligning your strategy with your organization's mission and market conditions ensures effective decision-making and resource utilization.

Financial Planning Infographic

libterm.com

libterm.com