Net profit represents the actual earnings remaining after all expenses, taxes, and costs have been deducted from total revenue, providing a clear picture of a company's financial health. Understanding net profit is essential for assessing business performance and making informed decisions about growth and investments. Discover how mastering net profit can improve your financial strategy by reading the rest of the article.

Table of Comparison

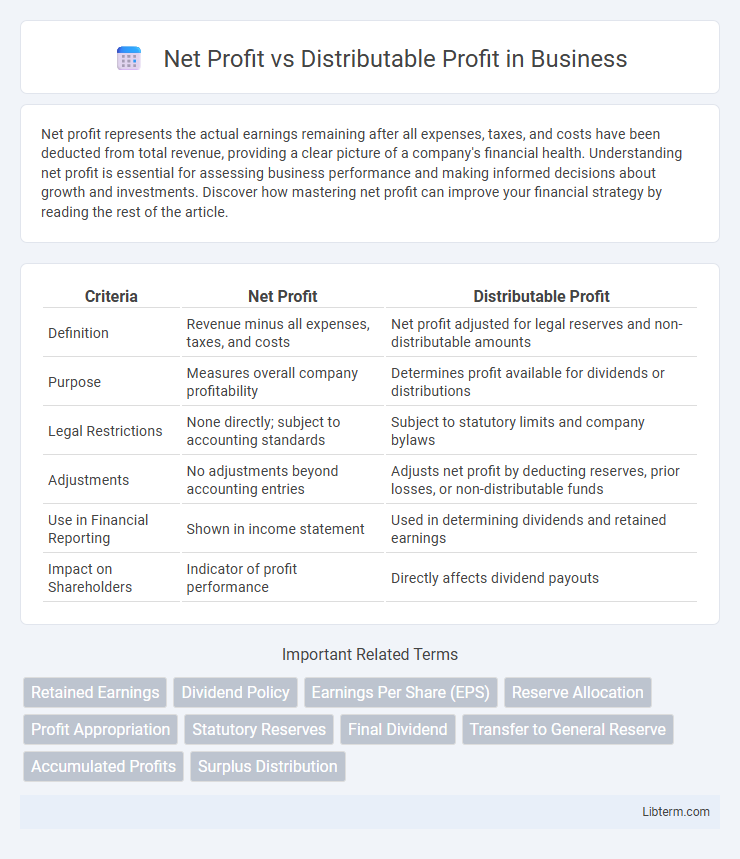

| Criteria | Net Profit | Distributable Profit |

|---|---|---|

| Definition | Revenue minus all expenses, taxes, and costs | Net profit adjusted for legal reserves and non-distributable amounts |

| Purpose | Measures overall company profitability | Determines profit available for dividends or distributions |

| Legal Restrictions | None directly; subject to accounting standards | Subject to statutory limits and company bylaws |

| Adjustments | No adjustments beyond accounting entries | Adjusts net profit by deducting reserves, prior losses, or non-distributable funds |

| Use in Financial Reporting | Shown in income statement | Used in determining dividends and retained earnings |

| Impact on Shareholders | Indicator of profit performance | Directly affects dividend payouts |

Introduction to Net Profit and Distributable Profit

Net profit represents the total earnings of a company after deducting all operating expenses, taxes, and interest from revenue, reflecting the business's overall financial performance. Distributable profit is the portion of net profit legally available for distribution to shareholders as dividends, accounting for retained earnings and statutory reserves. Understanding the difference between net profit and distributable profit is essential for accurate financial reporting and effective dividend policy management.

Definition of Net Profit

Net profit represents the total earnings of a company after deducting all operating expenses, taxes, interest, and other costs from total revenue. It reflects the company's financial performance over a specific period and is often referred to as the "bottom line" on the income statement. Net profit is a key indicator of profitability but does not directly determine the amount available for distribution to shareholders, as certain adjustments may be needed to calculate distributable profit.

Definition of Distributable Profit

Distributable profit refers to the portion of net profit that a company is legally allowed to distribute to its shareholders as dividends after meeting all operational expenses, tax obligations, and reserve requirements. Unlike net profit, which represents the total earnings of the company, distributable profit excludes unrealized gains and retained earnings locked for future investments or statutory purposes. This ensures that only sustainable and realized profits are paid out, maintaining financial stability and regulatory compliance.

Key Differences Between Net Profit and Distributable Profit

Net profit represents the total earnings of a company after deducting all expenses, taxes, and costs, reflecting overall financial performance. Distributable profit is the portion of net profit legally available for distribution to shareholders as dividends, considering reserves and statutory restrictions. The key difference lies in net profit being a broad measure of profitability, while distributable profit accounts for legal and accounting adjustments to determine the actual dividend payout capacity.

Calculation Methods for Net Profit

Net Profit is calculated by subtracting total expenses, including operating costs, taxes, and interest, from total revenue, reflecting the company's overall profitability. This figure differs from Distributable Profit, which adjusts Net Profit by adding back non-cash expenses like depreciation and subtracting unrealized gains or losses to determine the actual amount available for dividends. Understanding the calculation methods for Net Profit is crucial for accurate financial analysis and subsequent profit distribution decisions.

Calculation Methods for Distributable Profit

Distributable profit is calculated by adjusting net profit for non-cash items, unrealized gains, and legal or statutory reserves that cannot be distributed. Net profit is derived from total revenue minus total expenses, while distributable profit reflects the actual earnings available for distribution to shareholders. This calculation ensures compliance with accounting principles and corporate regulations governing profit allocation.

Importance of Net Profit in Financial Analysis

Net profit represents the total earnings of a company after all expenses, taxes, and costs have been deducted, serving as a key indicator of overall financial health and operational efficiency. It is crucial in financial analysis because it reveals the company's ability to generate profit from its core activities, influencing investment decisions and valuation models. Unlike distributable profit, which determines the dividend payout potential, net profit provides a comprehensive measure of profitability essential for strategic planning and long-term growth assessment.

Role of Distributable Profit in Dividend Decisions

Distributable profit represents the portion of net profit available for dividend distribution after accounting for statutory reserves and reinvestments, making it a crucial determinant in dividend decisions. Companies rely on distributable profit to ensure compliance with legal requirements and maintain financial stability while rewarding shareholders. Understanding the distinction between net profit and distributable profit enables more accurate dividend policy formulation and sustainable payout strategies.

Common Misconceptions and Mistakes

Net profit represents the company's total earnings after all expenses, taxes, and interest, while distributable profit refers specifically to the portion of net profit available for dividend payments to shareholders. A common misconception is treating net profit as fully distributable without considering legal reserves, retained earnings, and non-cash adjustments that reduce the actual distributable amount. Mistakes often arise from ignoring statutory restrictions and re-investment policies that limit profit distribution, leading to potential financial and regulatory issues.

Practical Examples and Case Studies

Net profit reflects a company's total earnings after all expenses, taxes, and costs, while distributable profit is the portion of net profit legally available for dividend payments to shareholders. For example, a firm with a net profit of $1 million might have $700,000 as distributable profit due to regulatory restrictions on reserves and retained earnings, demonstrated in case studies from financial reporting of companies under IFRS. Practical examples highlight that companies must adjust net profit by deducting non-distributable reserves and statutory obligations before declaring dividends.

Net Profit Infographic

libterm.com

libterm.com