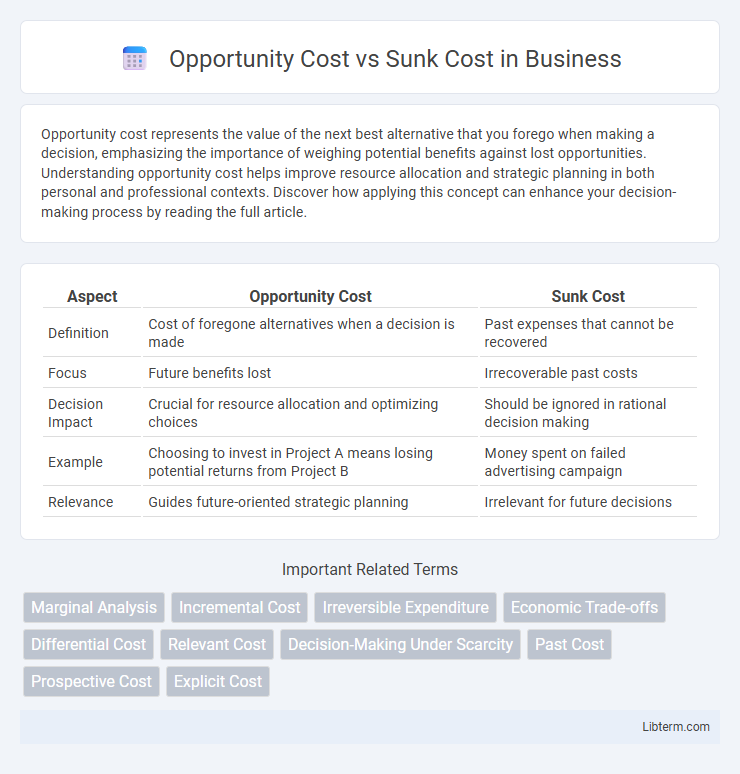

Opportunity cost represents the value of the next best alternative that you forego when making a decision, emphasizing the importance of weighing potential benefits against lost opportunities. Understanding opportunity cost helps improve resource allocation and strategic planning in both personal and professional contexts. Discover how applying this concept can enhance your decision-making process by reading the full article.

Table of Comparison

| Aspect | Opportunity Cost | Sunk Cost |

|---|---|---|

| Definition | Cost of foregone alternatives when a decision is made | Past expenses that cannot be recovered |

| Focus | Future benefits lost | Irrecoverable past costs |

| Decision Impact | Crucial for resource allocation and optimizing choices | Should be ignored in rational decision making |

| Example | Choosing to invest in Project A means losing potential returns from Project B | Money spent on failed advertising campaign |

| Relevance | Guides future-oriented strategic planning | Irrelevant for future decisions |

Introduction to Opportunity Cost and Sunk Cost

Opportunity cost represents the potential benefits an individual or business misses out on when choosing one alternative over another, reflecting the true cost of any decision. Sunk cost refers to expenses already incurred that cannot be recovered and should not influence ongoing decision-making. Understanding the distinction between opportunity cost and sunk cost is essential for effective resource allocation and rational economic choices.

Defining Opportunity Cost

Opportunity cost represents the value of the next best alternative foregone when making a decision, serving as a crucial concept in economics and business strategy. It quantifies what is sacrificed in terms of benefits or profits by choosing one option over another. Distinguishing opportunity cost from sunk cost, which refers to irrecoverable past expenditures, helps in evaluating future investments and resource allocation effectively.

Understanding Sunk Cost

Understanding sunk cost is essential for effective decision-making, as it represents expenses that have already been incurred and cannot be recovered. Unlike opportunity cost, which evaluates potential benefits from alternative choices, sunk costs should not influence current or future decisions since they remain constant regardless of the outcome. Recognizing sunk costs helps individuals and businesses avoid the fallacy of throwing good money after bad and focus on actions that maximize future value.

Key Differences Between Opportunity Cost and Sunk Cost

Opportunity cost represents the potential benefits lost when choosing one alternative over another, reflecting future-oriented decision-making, whereas sunk cost refers to past expenditures that cannot be recovered and should not impact current choices. Opportunity cost guides resource allocation by evaluating the value of the next best alternative, while sunk cost often leads to irrational decisions if past investments unduly influence ongoing commitment. Understanding these distinctions enhances economic efficiency and strategic planning by emphasizing forward-looking opportunity evaluation over unrecoverable past costs.

The Role of Opportunity Cost in Decision-Making

Opportunity cost plays a crucial role in decision-making by quantifying the value of the next best alternative forgone when choosing one option over another. Unlike sunk costs, which are past expenses that cannot be recovered, opportunity costs emphasize prospective benefits, guiding individuals and businesses towards more economically sound choices. Understanding opportunity cost enables optimized resource allocation and maximizes overall utility by focusing on future returns rather than irretrievable losses.

How Sunk Costs Influence Choices

Sunk costs, which are past expenditures that cannot be recovered, often distort decision-making by causing individuals or businesses to continue investments based on prior losses rather than current benefits. This cognitive bias leads to irrational commitment, where choices are influenced more by emotional attachment to sunk costs than by opportunity cost analysis. Recognizing the irrelevance of sunk costs helps optimize resource allocation and promotes better strategic decisions focused on future gains instead of past expenses.

Common Misconceptions About Sunk Cost Fallacy

Many people confuse sunk costs with opportunity costs, leading to the sunk cost fallacy, where past investments unduly influence current decisions despite irrecoverability. This fallacy causes individuals and businesses to continue investing in failing projects, ignoring better alternatives and potential future gains. Understanding that sunk costs should be disregarded when assessing options helps promote rational decision-making grounded in opportunity costs.

Real-World Examples: Opportunity Cost vs Sunk Cost

Choosing to invest in new technology instead of upgrading existing equipment exemplifies opportunity cost, as firms forgo potential gains from alternative investments. Sunk costs, like past research expenses on abandoned projects, should not influence current decisions since these costs cannot be recovered. Recognizing opportunity cost versus ignoring sunk costs helps businesses allocate resources efficiently and avoid irrational commitments.

Strategies to Minimize Sunk Cost Impact

Implement clear decision-making frameworks that emphasize future benefits over past investments to minimize the impact of sunk costs. Utilizing techniques such as regular project evaluations and setting predefined exit criteria helps avoid irrational commitments influenced by unrecoverable expenses. Applying opportunity cost analysis ensures resources are reallocated to more valuable alternatives, enhancing overall strategic efficiency.

Conclusion: Making Better Financial Decisions

Understanding the distinction between opportunity cost and sunk cost is crucial for making better financial decisions that maximize value and avoid irrational losses. Opportunity cost emphasizes the benefits foregone by choosing one option over another, guiding investors to consider alternative uses of resources. Ignoring sunk costs prevents commitment to past losses and helps focus on future gains, ensuring more rational and effective financial strategies.

Opportunity Cost Infographic

libterm.com

libterm.com