Phantom stock is a form of employee compensation that grants the benefits of stock ownership without actual equity transfer, often used to align employee interests with company performance. This method offers financial incentives based on the company's stock value, typically paid out in cash, enhancing retention and motivation. Explore the rest of the article to understand how phantom stock can impact your compensation strategy and corporate growth.

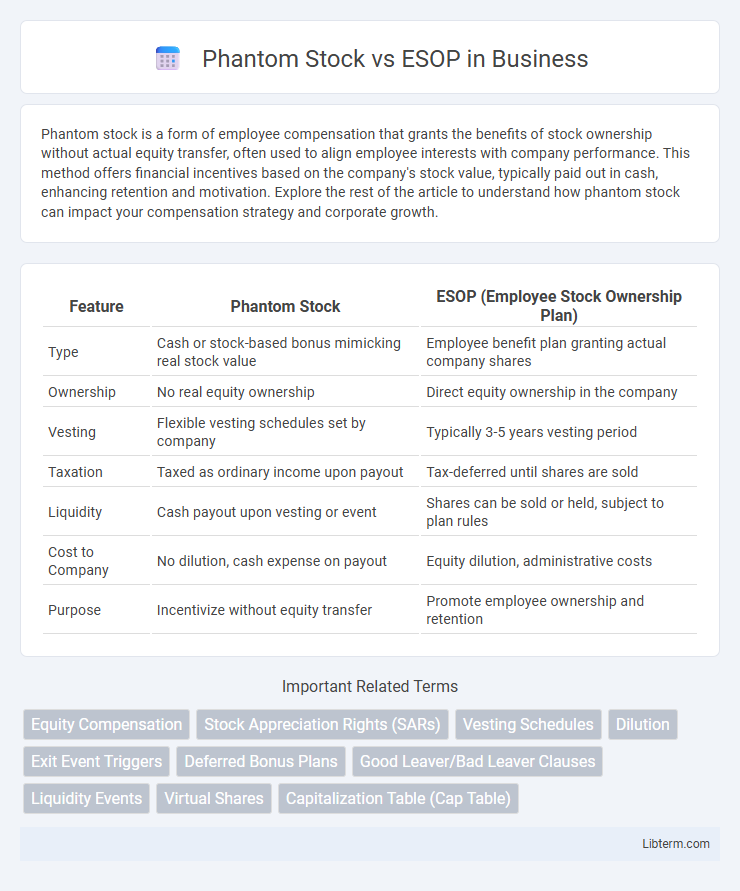

Table of Comparison

| Feature | Phantom Stock | ESOP (Employee Stock Ownership Plan) |

|---|---|---|

| Type | Cash or stock-based bonus mimicking real stock value | Employee benefit plan granting actual company shares |

| Ownership | No real equity ownership | Direct equity ownership in the company |

| Vesting | Flexible vesting schedules set by company | Typically 3-5 years vesting period |

| Taxation | Taxed as ordinary income upon payout | Tax-deferred until shares are sold |

| Liquidity | Cash payout upon vesting or event | Shares can be sold or held, subject to plan rules |

| Cost to Company | No dilution, cash expense on payout | Equity dilution, administrative costs |

| Purpose | Incentivize without equity transfer | Promote employee ownership and retention |

Introduction to Phantom Stock and ESOP

Phantom Stock and Employee Stock Ownership Plans (ESOPs) are strategic tools for employee compensation and retention, each with distinct structures. Phantom Stock grants employees simulated shares that mimic actual stock value without transferring ownership, providing cash bonuses based on stock appreciation. ESOPs, by contrast, confer real equity, giving employees actual shares that build ownership and align their long-term interests with company growth.

Key Differences Between Phantom Stock and ESOP

Phantom Stock provides employees with cash bonuses equivalent to stock value appreciation without granting actual equity, while ESOP (Employee Stock Ownership Plan) offers employees real company shares, fostering direct ownership. Phantom Stock plans avoid dilution of existing shareholders and typically have simpler administrative requirements, whereas ESOPs involve complex regulatory compliance and can impact company capital structure. Vesting schedules and payout conditions differ, with Phantom Stock often tied to performance metrics or liquidity events, whereas ESOP shares usually accumulate and transfer upon retirement or termination.

How Phantom Stock Works

Phantom stock grants employees the right to receive cash or stock value equivalent to company shares without actual ownership, aligning incentives with company performance. The phantom shares vest over a specified period, and upon vesting or a triggering event, employees receive a cash payment or equivalent stock value based on the company's stock price at that time. This structure avoids dilution of equity and simplifies administration compared to traditional ESOPs, while still providing a performance-based reward mechanism.

How ESOP Works

Employee Stock Ownership Plan (ESOP) operates by allocating actual shares of company stock to employees, which are held in an ESOP trust until the employee retires or leaves the company. Contributions made by the company to the ESOP trust are often tax-deductible, enhancing corporate financial efficiency. Employees benefit from stock value appreciation, aligning their interests with company performance and incentivizing long-term commitment.

Eligibility and Participation Criteria

Phantom Stock plans typically allow selective eligibility, often restricted to key executives or high-performing employees, whereas ESOPs generally include a broader range of employees to promote widespread ownership. Phantom Stock does not require actual stock ownership, making participation criteria more flexible and customizable based on company discretion. ESOP participation mandates compliance with Employee Retirement Income Security Act (ERISA) rules, ensuring all eligible employees receive equitable benefits and voting rights tied to actual shares.

Tax Implications for Employees

Phantom stock plans create taxable income for employees when cash payouts are received, typically subject to ordinary income tax and payroll taxes at the time of vesting or payment. ESOP distributions may qualify for favorable tax treatment, including deferral options under Internal Revenue Code Section 1042 if shares are sold to an ESOP, and employees typically pay capital gains tax upon selling ESOP shares after retirement or termination. The timing and type of taxation differ significantly, with phantom stock triggering immediate ordinary income tax, while ESOPs often provide tax-deferred growth and capital gains advantages.

Tax Implications for Employers

Phantom stock plans create deferred compensation obligations for employers, which are generally deductible when paid, aligning tax timing with actual cash outflows. ESOP contributions are tax-deductible when made, often allowing employers to reduce taxable income immediately while fostering employee ownership. However, ESOPs require more administrative complexity and may trigger valuation expenses, whereas phantom stock offers simpler accounting but deferred tax benefits tied to payout events.

Pros and Cons of Phantom Stock

Phantom stock offers companies a cost-effective way to reward employees by providing stock appreciation benefits without diluting equity or requiring actual stock issuance. It avoids complexities related to stock ownership, such as voting rights and shareholder obligations, making it appealing for private companies. However, phantom stock plans create a liability on the company's balance sheet and can lead to significant cash payouts, posing financial risks during liquidity events or market downturns.

Pros and Cons of ESOP

Employee Stock Ownership Plans (ESOPs) provide employees with actual company shares, fostering a strong sense of ownership and aligning their interests with long-term corporate growth. The primary advantage of ESOPs is the potential for significant financial gain, as employees benefit directly from stock appreciation and dividends, but this also comes with the risk of market volatility affecting their investment. On the downside, ESOPs can lead to concentration of employee wealth in company stock, increasing financial exposure if the company underperforms or faces bankruptcy.

Choosing the Right Plan: Phantom Stock vs ESOP

Choosing between Phantom Stock and ESOP involves evaluating company goals, cash flow, and employee motivation strategies. Phantom Stock offers cash-based rewards tied to company valuation without equity dilution, ideal for closely held businesses aiming to retain control. ESOPs provide actual ownership shares, aligning employee interests with long-term company growth but require compliant administration and impact equity structure.

Phantom Stock Infographic

libterm.com

libterm.com