An incubator provides a controlled environment with optimal temperature, humidity, and oxygen levels to support the growth and development of premature infants or fragile biological samples. This essential device plays a crucial role in neonatal care by reducing the risk of infection and ensuring proper thermal regulation for vulnerable newborns. Explore this article to understand how an incubator works and its vital benefits for your tiny patients or research needs.

Table of Comparison

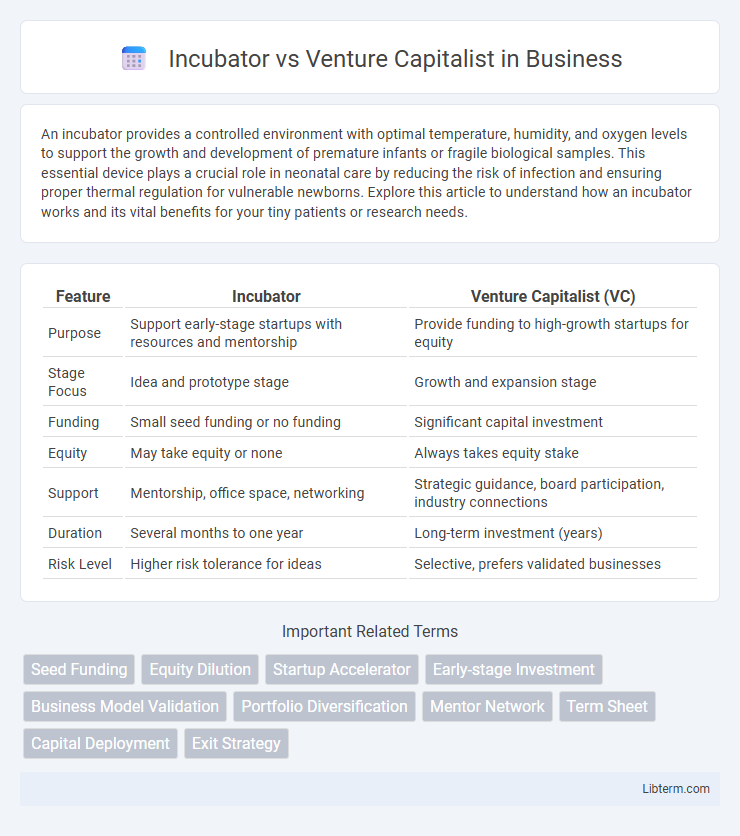

| Feature | Incubator | Venture Capitalist (VC) |

|---|---|---|

| Purpose | Support early-stage startups with resources and mentorship | Provide funding to high-growth startups for equity |

| Stage Focus | Idea and prototype stage | Growth and expansion stage |

| Funding | Small seed funding or no funding | Significant capital investment |

| Equity | May take equity or none | Always takes equity stake |

| Support | Mentorship, office space, networking | Strategic guidance, board participation, industry connections |

| Duration | Several months to one year | Long-term investment (years) |

| Risk Level | Higher risk tolerance for ideas | Selective, prefers validated businesses |

Understanding Incubators and Venture Capitalists

Incubators provide early-stage startups with resources such as mentoring, office space, and networking opportunities to help develop business ideas and gain initial traction. Venture capitalists (VCs) invest capital into high-growth startups in exchange for equity, aiming for substantial returns through scalability and market expansion. Understanding the distinct roles highlights how incubators focus on nurturing foundational growth, while VCs prioritize financial investment and rapid scaling.

Key Differences Between Incubators and Venture Capitalists

Incubators provide early-stage startups with office space, mentorship, and resources to develop their ideas, focusing on nurturing business foundations over months or years. Venture Capitalists invest substantial capital into startups with proven potential in exchange for equity, aiming for rapid growth and significant financial returns within a few years. The key differences lie in their roles--incubators emphasize support and development, while venture capitalists prioritize funding and scaling high-growth companies.

How Incubators Support Early-Stage Startups

Incubators provide early-stage startups with essential resources such as office space, mentoring, and access to a collaborative community, facilitating critical business development. They often offer structured programs that focus on refining business models, product development, and market validation, enabling startups to build a solid foundation. Unlike venture capitalists, incubators prioritize nurturing startups during the fragile initial phases without immediate equity expectations.

The Role of Venture Capitalists in Startup Growth

Venture capitalists provide critical funding and strategic guidance that fuel startup growth, enabling rapid scaling through access to extensive networks and industry expertise. They invest in high-potential startups, often taking equity stakes that align their interests with long-term success. Their involvement accelerates market entry, supports product development, and drives business expansion in competitive markets.

Funding Models: Incubators vs Venture Capitalists

Incubators provide early-stage startups with funding primarily through grants, equity investments, or membership fees, often coupled with resources like office space and mentorship to foster growth. Venture capitalists offer larger capital infusions in exchange for significant equity stakes, focusing on companies with high-growth potential and scalability. While incubators emphasize nurturing and development over longer periods, venture capitalists prioritize rapid returns and aggressive business expansion.

Equity Stakes: What Startups Should Expect

Startups engaging with incubators typically receive smaller equity stakes, ranging from 2% to 10%, in exchange for mentorship, workspace, and initial funding. Venture capitalists usually demand larger equity stakes, often between 15% to 30%, reflecting their higher financial investment and increased risk exposure. Founders should anticipate more hands-on involvement and strategic guidance from VCs in exchange for significant equity dilution compared to the more supportive, resource-driven equity arrangements with incubators.

Mentorship and Networking Opportunities

Incubators provide intensive mentorship and foster strong networking opportunities by connecting startups with industry experts, investors, and potential partners during the early stages of development. Venture capitalists offer strategic guidance and access to a broader network primarily focused on scaling and accelerating business growth post-product validation. Both models enhance startup success, but incubators emphasize foundational mentorship while venture capitalists leverage expansive networks for rapid expansion.

Choosing the Right Path: Incubator or VC?

Choosing between an incubator and a venture capitalist depends on your startup's stage, needs, and growth potential. Incubators offer early-stage startups resources like mentorship, workspace, and networking to develop ideas, while venture capitalists provide significant funding in exchange for equity, targeting startups with scalable business models ready for rapid growth. Evaluating your startup's readiness for investment, required support, and long-term goals helps determine the optimal path for capital and development.

Success Stories: Incubator-Backed vs VC-Funded Startups

Incubator-backed startups often demonstrate higher early-stage survival rates thanks to hands-on mentorship, shared resources, and structured development programs, exemplified by companies like Reddit and Dropbox. VC-funded startups typically achieve rapid scaling and significant market impact, with success stories such as Uber and Airbnb highlighting the advantages of substantial capital injection and strategic networking. Comparative analyses reveal incubators excel in nurturing ideation and prototyping phases, while venture capitalists drive aggressive growth and market penetration.

Future Trends in Startup Funding and Support

Incubators are increasingly integrating advanced technologies such as AI-driven mentorship and virtual collaboration platforms to enhance startup development, while venture capitalists are leveraging data analytics to identify high-potential investments earlier in the funding cycle. Emerging trends indicate a hybrid model combining incubator resources with venture capitalist funding to provide startups with continuous support from ideation through scaling. The future of startup funding will likely prioritize sustainable investment and impact-driven innovation, with increased collaboration between incubators and VCs to accelerate market readiness and global expansion.

Incubator Infographic

libterm.com

libterm.com