Starting prices vary based on product features, model specifications, and market demand, offering options to fit different budgets and preferences. Understanding these pricing tiers helps you make informed decisions and maximize value from your purchase. Explore the rest of the article to discover detailed insights and tips on finding the best starting price for your needs.

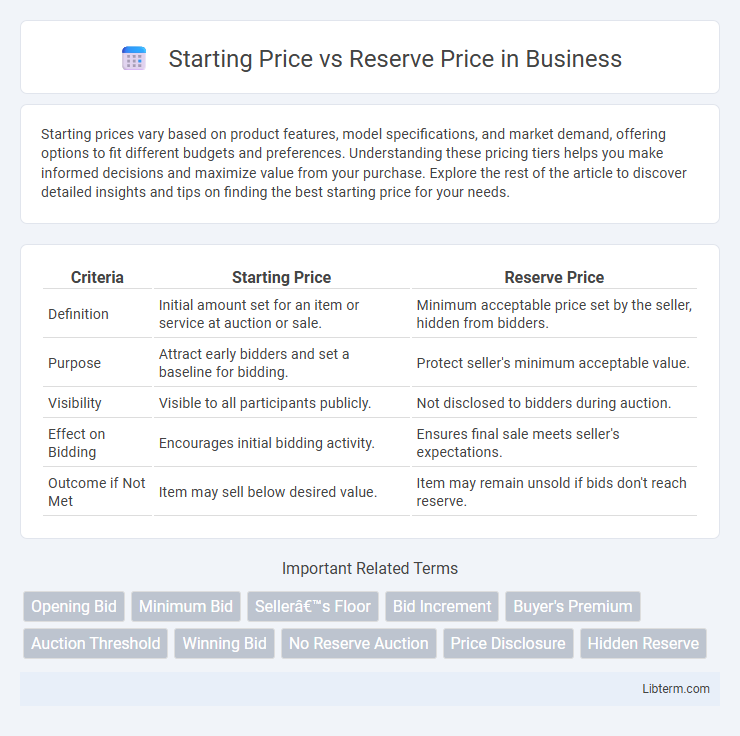

Table of Comparison

| Criteria | Starting Price | Reserve Price |

|---|---|---|

| Definition | Initial amount set for an item or service at auction or sale. | Minimum acceptable price set by the seller, hidden from bidders. |

| Purpose | Attract early bidders and set a baseline for bidding. | Protect seller's minimum acceptable value. |

| Visibility | Visible to all participants publicly. | Not disclosed to bidders during auction. |

| Effect on Bidding | Encourages initial bidding activity. | Ensures final sale meets seller's expectations. |

| Outcome if Not Met | Item may sell below desired value. | Item may remain unsold if bids don't reach reserve. |

Understanding Starting Price and Reserve Price

The starting price is the initial amount set by the seller at the beginning of an auction, serving as the minimum bid to attract potential buyers. The reserve price is a confidential minimum threshold that must be met for the item to be sold, protecting sellers from underselling. Understanding the distinction between starting price and reserve price ensures bidders recognize when an auction might conclude without a sale if the reserve remains unmet.

Key Differences Between Starting Price and Reserve Price

The starting price is the initial amount set by the seller to attract bidders, while the reserve price represents the minimum acceptable sale price hidden from bidders. Unlike the starting price, which is publicly visible at the auction's outset, the reserve price prevents the item from being sold below the seller's threshold and only becomes relevant if bidding fails to meet it. Understanding the distinction helps bidders gauge the auction dynamics and sellers protect their minimum expected value.

The Role of Starting Price in Auctions

The starting price in auctions acts as the minimum bid required to initiate bidding, setting the auction's floor value and influencing bidder interest. A strategically low starting price can stimulate competition and increase bidding activity, while a high starting price may deter potential bidders and slow auction momentum. Understanding the starting price's impact is crucial for sellers aiming to balance attracting participants and achieving optimal final sale prices.

Why Sellers Set a Reserve Price

Sellers set a reserve price to ensure their item does not sell below a minimum acceptable value, protecting their investment and market expectations. This hidden threshold motivates competitive bidding while safeguarding seller interests against undervaluation. Reserve prices help balance buyer enthusiasm with seller confidence in achieving fair market value.

Impact on Bidding Behavior

Starting price sets the initial minimum bid, influencing early bidder participation and creating a psychological anchor that can stimulate competitive bidding or discourage engagement if set too high. Reserve price acts as a hidden minimum that safeguards the seller's value but may suppress aggressive bidding if bidders perceive the price as unattainable. Understanding how these pricing strategies affect bidder motivation is essential for optimizing auction dynamics and maximizing final sale prices.

Strategies for Setting the Starting Price

Setting the starting price strategically influences bidder engagement and auction outcomes by establishing initial value expectations. Optimal strategies include researching comparable sales data to position the starting price competitively just below the perceived market value, enticing more participants while maintaining seller confidence. Balancing between a low starting price to stimulate bidding activity and a price that reflects the reserve ensures maximum interest and protects against undervaluation.

How Reserve Price Protects Sellers

The reserve price acts as a hidden minimum threshold in an auction, ensuring sellers do not part with items below a preset value. Unlike the starting price, which merely initiates bidding, the reserve price safeguards the seller's financial interests by preventing low bids from winning. This mechanism enhances seller confidence by maintaining control over the final sale price and minimizing potential losses.

Common Mistakes When Setting Prices

Common mistakes when setting starting price versus reserve price include setting the starting price too close to the reserve price, which reduces bidder motivation and limits auction excitement. Another frequent error is underestimating the reserve price, leading to failed sales and revenue loss. Sellers often neglect market research, resulting in unrealistic price settings that fail to attract competitive bids.

Effects on Auction Outcomes and Final Sale Price

Starting price influences bidder participation by setting initial expectations and can either stimulate competition or deter early bids. Reserve price acts as a hidden minimum acceptable amount, protecting the seller from undervaluation and potentially causing a no-sale if bids do not meet it. The interplay between starting and reserve prices affects auction dynamics by balancing bidder engagement with seller protection, ultimately impacting the final sale price and auction success rate.

Best Practices for Choosing Starting and Reserve Prices

Choosing starting and reserve prices requires balancing competitive appeal with seller protection to maximize auction success. Researching market trends and comparable sales helps set a realistic starting price that attracts bidders without undervaluing the item. Setting a reserve price slightly below the expected sale value safeguards against low bids while maintaining buyer interest and trust.

Starting Price Infographic

libterm.com

libterm.com