An accredited investor meets specific financial criteria set by regulatory authorities, allowing access to exclusive investment opportunities such as private equity, hedge funds, and venture capital. This status helps protect less experienced investors from high-risk investments while enabling those who qualify to diversify their portfolio with potentially higher returns. Discover how becoming an accredited investor can expand Your investment horizons by reading the rest of this article.

Table of Comparison

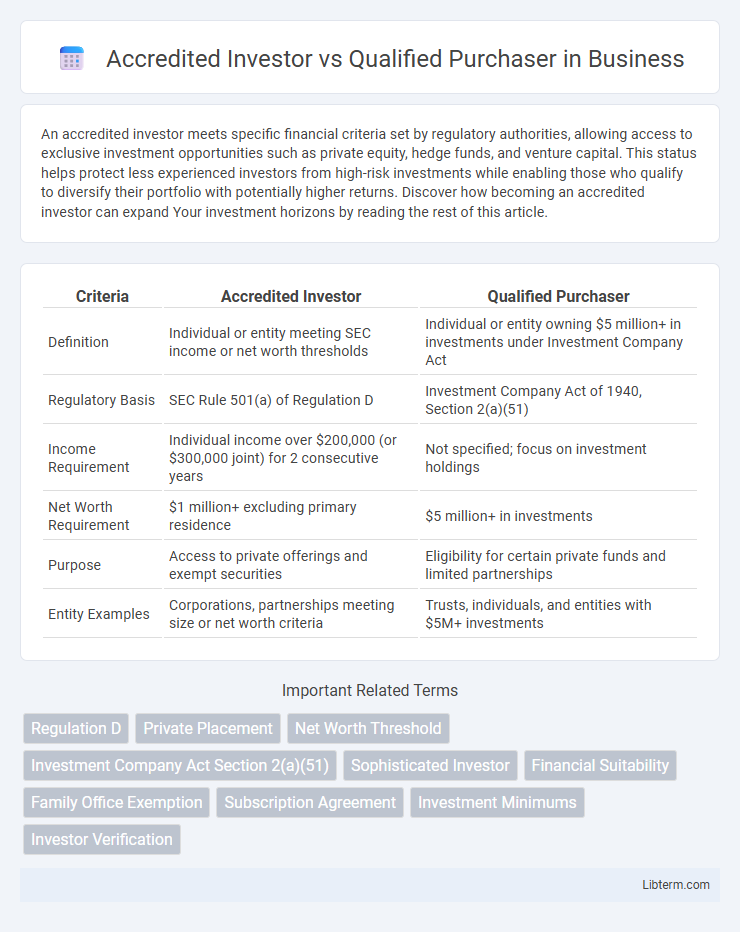

| Criteria | Accredited Investor | Qualified Purchaser |

|---|---|---|

| Definition | Individual or entity meeting SEC income or net worth thresholds | Individual or entity owning $5 million+ in investments under Investment Company Act |

| Regulatory Basis | SEC Rule 501(a) of Regulation D | Investment Company Act of 1940, Section 2(a)(51) |

| Income Requirement | Individual income over $200,000 (or $300,000 joint) for 2 consecutive years | Not specified; focus on investment holdings |

| Net Worth Requirement | $1 million+ excluding primary residence | $5 million+ in investments |

| Purpose | Access to private offerings and exempt securities | Eligibility for certain private funds and limited partnerships |

| Entity Examples | Corporations, partnerships meeting size or net worth criteria | Trusts, individuals, and entities with $5M+ investments |

Understanding Accredited Investors

An Accredited Investor is defined by the U.S. Securities and Exchange Commission (SEC) as an individual or entity meeting specific income, net worth, or professional certification criteria, such as having an annual income exceeding $200,000 or a net worth over $1 million excluding primary residence. This classification allows participation in private capital markets, hedge funds, and private equity investments typically unavailable to the general public due to their higher risk and complexity. Understanding the distinction between Accredited Investors and Qualified Purchasers, who must meet even higher asset thresholds, is essential for navigating investment opportunities and regulatory requirements effectively.

Defining Qualified Purchasers

Qualified purchasers are high-net-worth individuals or entities defined by the Investment Company Act of 1940, specifically those owning at least $5 million in investments or $25 million in family-owned investments. Unlike accredited investors, who meet criteria set by the SEC including income or net worth thresholds, qualified purchasers represent a smaller, more financially sophisticated group eligible for investment in certain private funds. This distinction allows qualified purchasers access to exclusive investment opportunities with potentially higher returns and greater risk.

Key Legal Criteria and Requirements

Accredited Investor status, defined by the SEC under Rule 501 of Regulation D, requires individuals to have an annual income exceeding $200,000 (or $300,000 jointly) or a net worth over $1 million, excluding primary residence. Qualified Purchaser status, outlined in Section 2(a)(51) of the Investment Company Act of 1940, demands owning at least $5 million in investments, targeting sophisticated investors with substantial financial assets. The distinction impacts eligibility for private investment offerings, with Qualified Purchasers permitted access to a broader range of exempt securities compared to Accredited Investors.

Financial Thresholds: Accredited vs Qualified

Accredited Investors must meet financial thresholds such as having a net worth exceeding $1 million, excluding primary residence, or an income of $200,000 annually for individuals. Qualified Purchasers face higher financial requirements, including owning at least $5 million in investments. These thresholds reflect the differing regulatory standards for participation in private investment opportunities.

Investment Opportunities Available

Accredited investors gain access to private placements, hedge funds, and venture capital funds that are exempt from SEC registration, offering a broader range of advanced investment opportunities than the general public. Qualified purchasers, holding significantly higher asset thresholds--typically $5 million or more in investments--qualify for exclusive, high-minimum investment vehicles like private equity funds and certain hedge funds with enhanced strategies and reduced regulatory restrictions. This distinction ensures qualified purchasers can engage in complex, large-scale investments with greater portfolio diversification and potential for higher returns compared to accredited investors.

Regulatory Protections and Implications

Accredited Investors qualify based on income or net worth thresholds set by the SEC, allowing access to private investment opportunities with fewer regulatory protections than public offerings. Qualified Purchasers meet higher asset thresholds, typically $5 million or more in investments, granting eligibility for more exclusive private funds with even fewer regulatory constraints. The distinction impacts disclosure requirements, investor protections, and eligibility for certain exemptions under securities laws, influencing risk exposure and due diligence obligations.

Process for Verification and Documentation

The verification process for Accredited Investors typically involves submitting financial documents such as tax returns, W-2s, bank statements, or third-party verification letters confirming income or net worth thresholds set by the SEC. Qualified Purchasers face a more stringent vetting process, requiring detailed documentation of investment portfolios exceeding $5 million, including brokerage statements and asset appraisals to prove eligibility under the Investment Company Act of 1940. Both categories mandate rigorous due diligence by issuers or fund managers to ensure compliance with regulatory definitions, preventing unqualified participation in high-risk private investment opportunities.

Benefits and Limitations of Each Status

Accredited Investors benefit from broader access to private investment opportunities, including hedge funds and private equity, with an income threshold of $200,000 per year or $1 million in net worth, but face limitations in investment amount and certain regulatory protections. Qualified Purchasers, typically individuals or family entities with at least $5 million in investments, enjoy even greater access to exclusive private placements and fewer regulatory restrictions, enabling more sophisticated investment strategies. However, the high wealth requirement limits Qualified Purchaser status to a smaller, elite group, restricting the inclusivity of these advanced investment benefits.

Impact on Private Investments

Accredited Investors, defined by the SEC as individuals or entities meeting income or net worth thresholds, gain access to private investment opportunities such as hedge funds, venture capital, and private equity that are not available to the general public. Qualified Purchasers meet a higher asset threshold, typically $5 million or more in investments, allowing participation in even more exclusive private funds with fewer regulatory restrictions. The distinction impacts private investments by dictating the level of investor sophistication required and the scope of investment options, with Qualified Purchasers able to engage in more complex and potentially higher-return private placements.

Choosing the Right Investor Classification

Choosing the right investor classification depends on regulatory criteria and investment goals, with Accredited Investors defined by income or net worth thresholds, typically $200,000 annual income or $1 million net worth excluding primary residence. Qualified Purchasers must meet higher asset requirements, often owning $5 million or more in investments, allowing access to more complex and less regulated investment opportunities. Proper classification ensures compliance with SEC rules and access to suitable private offerings.

Accredited Investor Infographic

libterm.com

libterm.com