A One Person Company (OPC) offers the advantage of limited liability with the simplicity of sole proprietorship, making it ideal for individual entrepreneurs. This business structure separates your personal assets from the company's liabilities, ensuring enhanced financial protection. Explore the rest of the article to understand how forming an OPC can benefit your entrepreneurial journey.

Table of Comparison

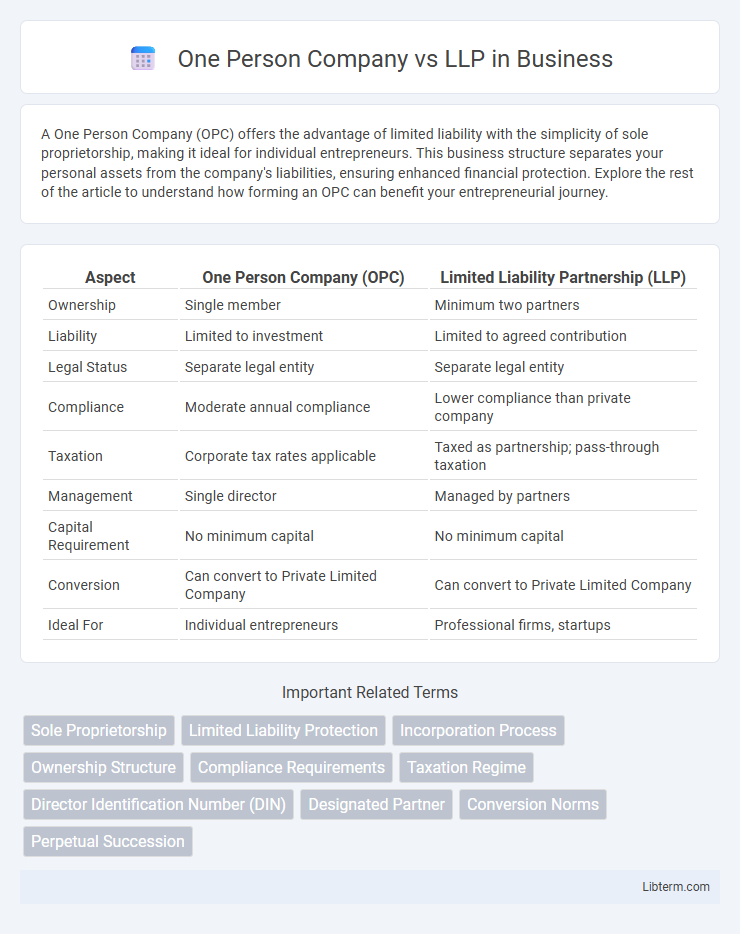

| Aspect | One Person Company (OPC) | Limited Liability Partnership (LLP) |

|---|---|---|

| Ownership | Single member | Minimum two partners |

| Liability | Limited to investment | Limited to agreed contribution |

| Legal Status | Separate legal entity | Separate legal entity |

| Compliance | Moderate annual compliance | Lower compliance than private company |

| Taxation | Corporate tax rates applicable | Taxed as partnership; pass-through taxation |

| Management | Single director | Managed by partners |

| Capital Requirement | No minimum capital | No minimum capital |

| Conversion | Can convert to Private Limited Company | Can convert to Private Limited Company |

| Ideal For | Individual entrepreneurs | Professional firms, startups |

Introduction to One Person Company (OPC) and LLP

One Person Company (OPC) is a type of business entity in India designed for individual entrepreneurs seeking limited liability protection with a sole shareholder structure. Limited Liability Partnership (LLP) combines the flexibility of a partnership with the limited liability feature of a company, requiring at least two partners to manage the business. Both OPC and LLP offer distinct benefits in terms of liability protection and compliance requirements, catering to different business sizes and needs.

Legal Structure: OPC vs LLP

A One Person Company (OPC) allows a single individual to own and manage a corporate entity with limited liability, combining the benefits of sole proprietorship and corporate structure under the Companies Act, 2013. In contrast, a Limited Liability Partnership (LLP) requires a minimum of two partners and offers limited liability protection under the LLP Act, 2008, enabling flexibility in management and partnership rights. OPCs maintain a closely held ownership model with mandatory nomination of a nominee, whereas LLPs emphasize partnership and profit-sharing frameworks with less stringent compliance.

Eligibility and Formation Criteria

One Person Company (OPC) requires a single individual who must be a resident of India, and formation mandates a minimum capital as defined under the Companies Act, 2013. Limited Liability Partnership (LLP) demands at least two partners with no restriction on residency, and its formation is regulated under the Limited Liability Partnership Act, 2008 without specifying minimum capital. Eligibility for OPC restricts the individual from being a member in another OPC or an existing company, whereas LLP allows partners to simultaneously hold other business interests.

Minimum Member and Director Requirements

A One Person Company (OPC) requires a minimum of one member and one director, with the sole member also assumed to be the director. In contrast, a Limited Liability Partnership (LLP) mandates at least two partners, with no minimum director requirement since LLPs do not have directors but designated partners. OPCs are suitable for individual entrepreneurs, while LLPs facilitate business partnerships with limited liability protection for multiple members.

Capital and Compliance Obligations

One Person Company (OPC) requires a minimum authorized capital of Rs1 lakh and faces simpler compliance obligations, including annual filings and maintaining basic records. Limited Liability Partnership (LLP) has no minimum capital requirement but mandates filing of annual returns and statement of accounts, along with stricter compliance under the LLP Act, 2008. OPCs are suitable for single entrepreneurs with low compliance burden and capital needs, whereas LLPs offer flexible capital infusion and higher regulatory compliance for multiple partners.

Taxation Differences: OPC vs LLP

One Person Company (OPC) is taxed as a private limited company with a flat corporate tax rate of 22% (plus applicable surcharge and cess), whereas Limited Liability Partnership (LLP) is taxed at 30% without dividend distribution tax. OPCs are subject to Minimum Alternate Tax (MAT) under Section 115JB if their tax liability is below 18.5% of book profits, while LLPs are not liable for MAT. Dividend income from OPCs is taxable in the hands of shareholders, whereas LLP profits are passed through and taxed only at the partner's level, avoiding double taxation.

Conversion: OPC to LLP and Vice Versa

Conversion between One Person Company (OPC) and Limited Liability Partnership (LLP) involves specific regulatory procedures under the Companies Act, 2013 and LLP Act, 2008, respectively. An OPC can convert into an LLP only if it qualifies as a small company, requiring approval from the Ministry of Corporate Affairs (MCA) and compliance with prescribed conditions, while conversion from LLP to OPC is generally not permitted. The conversion process includes filing e-forms such as INC-5 and LLP-5, along with submission of necessary financial statements and compliance reports to ensure legal validity and continuity of business operations.

Advantages of OPC Over LLP

An One Person Company (OPC) offers the advantage of complete ownership and control to a single individual, ensuring streamlined decision-making without the need for partners. OPC requires fewer compliance formalities compared to a Limited Liability Partnership (LLP), reducing administrative burdens and operational costs. It provides limited liability protection similar to an LLP, safeguarding the personal assets of the sole shareholder from business liabilities.

Advantages of LLP Over OPC

Limited Liability Partnership (LLP) offers greater flexibility in management compared to One Person Company (OPC), allowing multiple partners to contribute expertise and share responsibilities. LLP provides enhanced credibility and easier access to funding from investors and financial institutions due to its partnership structure. Furthermore, LLP facilitates perpetual succession and does not face restrictions on partner count, unlike OPC which is limited to a single owner.

Which Structure is Right for Your Business?

Choosing between a One Person Company (OPC) and a Limited Liability Partnership (LLP) depends on factors like business size, risk, and compliance needs. OPC offers sole ownership with limited liability and simpler compliance, suitable for solo entrepreneurs focusing on full control. LLP provides flexibility with multiple partners, limited liability protection, and more rigorous compliance, ideal for collaborative ventures seeking shared responsibility and higher credibility.

One Person Company Infographic

libterm.com

libterm.com