Dollar-cost averaging lowers investment risk by spreading purchases over time, avoiding the pitfalls of market timing. This strategy ensures you buy more shares when prices are low and fewer when prices are high, potentially enhancing long-term returns. Discover how dollar-cost averaging can fit into your investment plan by reading the rest of the article.

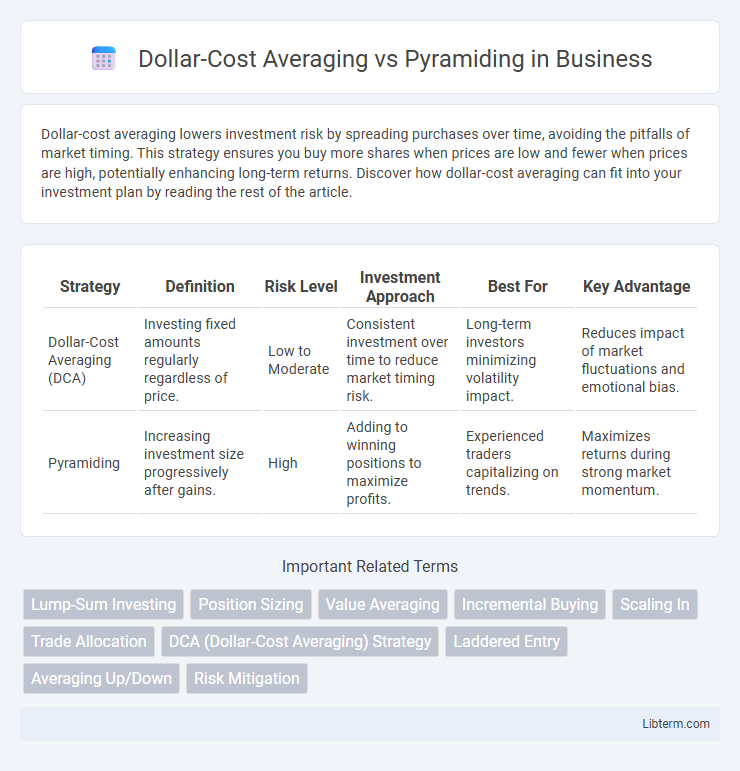

Table of Comparison

| Strategy | Definition | Risk Level | Investment Approach | Best For | Key Advantage |

|---|---|---|---|---|---|

| Dollar-Cost Averaging (DCA) | Investing fixed amounts regularly regardless of price. | Low to Moderate | Consistent investment over time to reduce market timing risk. | Long-term investors minimizing volatility impact. | Reduces impact of market fluctuations and emotional bias. |

| Pyramiding | Increasing investment size progressively after gains. | High | Adding to winning positions to maximize profits. | Experienced traders capitalizing on trends. | Maximizes returns during strong market momentum. |

Introduction to Dollar-Cost Averaging and Pyramiding

Dollar-cost averaging involves investing a fixed amount of money at regular intervals regardless of market conditions, reducing the impact of volatility and lowering the average cost per share over time. Pyramiding is an investment strategy that entails using unrealized profits from existing positions to increase exposure by adding more shares as the asset price moves favorably. Both methods aim to optimize investment returns but differ in risk management and capital allocation approaches.

Core Concepts: What is Dollar-Cost Averaging?

Dollar-Cost Averaging (DCA) is an investment strategy where a fixed dollar amount is invested consistently at regular intervals, regardless of market fluctuations. This approach reduces the impact of market volatility by purchasing more shares when prices are low and fewer shares when prices are high. DCA is designed to minimize the risk of making a large investment at an unfavorable time, promoting disciplined and steady portfolio growth.

Core Concepts: What is Pyramiding?

Pyramiding is an investment strategy that involves using unrealized profits from successful trades as margin to increase the position size, effectively compounding gains without additional capital. Unlike dollar-cost averaging, which spreads out investments evenly over time to reduce market volatility risk, pyramiding focuses on leveraging winning positions to amplify returns. This method requires careful risk management to avoid significant losses when the market reverses.

Key Differences Between DCA and Pyramiding

Dollar-Cost Averaging (DCA) involves investing a fixed amount of money at regular intervals regardless of market conditions, reducing the impact of volatility and lowering the average cost per share over time. Pyramiding focuses on increasing position size by using unrealized profits from successful trades to buy additional shares, amplifying gains but also risk. The key difference lies in DCA's steady, risk-averse approach versus pyramiding's aggressive, profit-driven strategy that seeks to maximize returns during trending markets.

Pros and Cons of Dollar-Cost Averaging

Dollar-Cost Averaging (DCA) reduces the impact of market volatility by investing fixed amounts at regular intervals, which helps minimize the risk of poor timing and emotional decision-making. However, DCA may result in lower overall returns during strong market uptrends due to delayed full investment, and it requires consistent capital allocation over time. This strategy is ideal for risk-averse investors seeking gradual portfolio growth but may underperform compared to aggressive tactics like Pyramiding in bullish markets.

Pros and Cons of Pyramiding

Pyramiding allows investors to maximize gains by adding to winning positions, leveraging profits to increase exposure and potential returns without additional capital outlay. However, it carries the risk of magnified losses if the market reverses, as increased positions amplify downside exposure. This strategy requires disciplined risk management and timing skills to avoid significant drawdowns during volatile market conditions.

Risk Management in DCA vs Pyramiding

Dollar-cost averaging (DCA) minimizes risk by investing fixed amounts periodically, reducing exposure to market volatility and avoiding timing mistakes. Pyramiding increases risk by adding positions only after gains, amplifying potential losses if the trend reverses. Effective risk management favors DCA for steady accumulation and controlled exposure, while pyramiding suits aggressive strategies reliant on strong trending markets.

Ideal Market Conditions for Each Strategy

Dollar-Cost Averaging excels in volatile or uncertain markets where prices fluctuate, allowing investors to mitigate risk by spreading out purchases over time and avoiding the pitfalls of market timing. Pyramiding thrives in strong, trending markets with clear upward momentum, enabling traders to increase their position size progressively as the asset price rises, maximizing gains. Choosing between these strategies depends on market conditions: Dollar-Cost Averaging suits sideways or choppy markets, while Pyramiding is ideal during sustained bullish trends.

Case Studies: Performance Comparison

Case studies comparing Dollar-Cost Averaging (DCA) and Pyramiding reveal distinct performance patterns under varying market conditions. DCA consistently minimizes risk and smooths entry points, showing superior outcomes during volatile or bearish markets by reducing exposure to market timing errors. Conversely, Pyramiding demonstrates higher returns in strong, trending bullish scenarios due to incremental scaling of winning positions, but it exposes investors to elevated risk and potential losses in market reversals.

Which Strategy Fits Your Investment Goals?

Dollar-cost averaging suits investors seeking steady growth and reduced risk by investing fixed amounts periodically, minimizing market timing impact. Pyramiding benefits those aiming for accelerated gains by increasing positions as asset prices rise, leveraging momentum but with higher risk. Choosing between these strategies depends on your risk tolerance, investment horizon, and goal for consistent returns or aggressive growth.

Dollar-Cost Averaging Infographic

libterm.com

libterm.com