Basel II is a comprehensive set of banking regulations developed by the Basel Committee on Banking Supervision to enhance risk management and improve financial stability. It focuses on three pillars: minimum capital requirements, supervisory review, and market discipline, helping banks better assess credit, market, and operational risks. Explore the rest of this article to understand how Basel II impacts your banking experience and financial security.

Table of Comparison

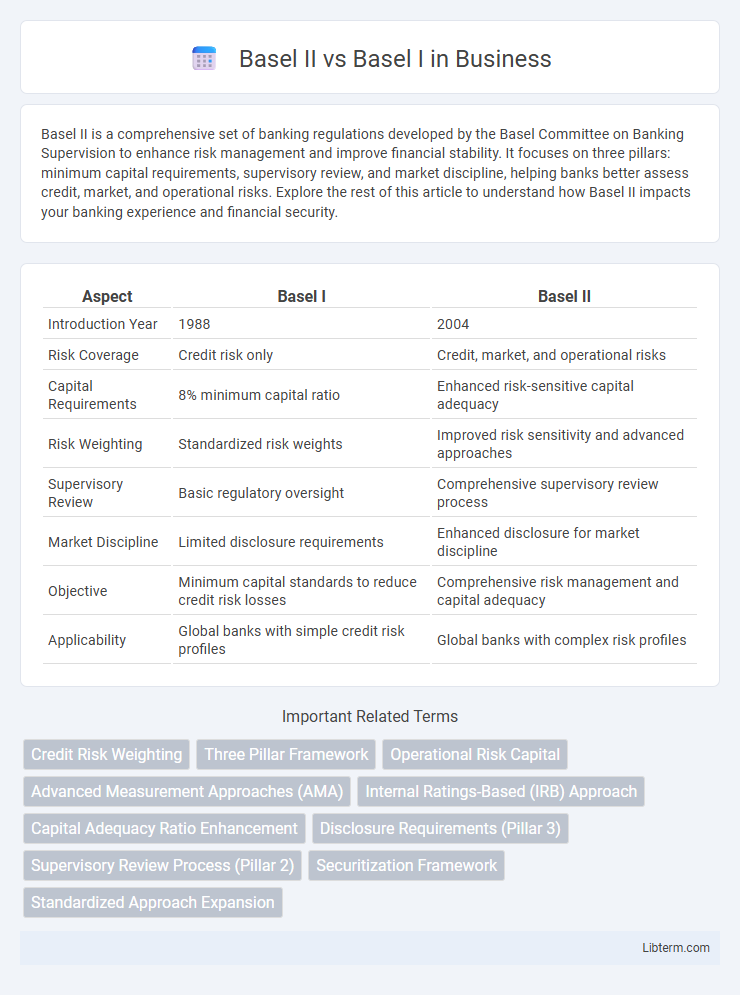

| Aspect | Basel I | Basel II |

|---|---|---|

| Introduction Year | 1988 | 2004 |

| Risk Coverage | Credit risk only | Credit, market, and operational risks |

| Capital Requirements | 8% minimum capital ratio | Enhanced risk-sensitive capital adequacy |

| Risk Weighting | Standardized risk weights | Improved risk sensitivity and advanced approaches |

| Supervisory Review | Basic regulatory oversight | Comprehensive supervisory review process |

| Market Discipline | Limited disclosure requirements | Enhanced disclosure for market discipline |

| Objective | Minimum capital standards to reduce credit risk losses | Comprehensive risk management and capital adequacy |

| Applicability | Global banks with simple credit risk profiles | Global banks with complex risk profiles |

Introduction to Basel Accords

The Basel Accords are international banking regulations developed by the Basel Committee on Banking Supervision to enhance risk management and capital adequacy in banks. Basel I, introduced in 1988, primarily focused on credit risk and established minimum capital requirements based on risk-weighted assets. Basel II, introduced in 2004, expanded the framework by incorporating operational and market risks, offering a more comprehensive and risk-sensitive approach to capital adequacy and promoting improved risk assessment methodologies.

Overview of Basel I Framework

Basel I Framework, introduced in 1988 by the Basel Committee on Banking Supervision, established a standardized approach for measuring credit risk through risk-weighted assets, setting a minimum capital adequacy ratio of 8%. The framework categorized bank's assets into five risk buckets, assigning fixed risk weights to differentiate credit exposure and ensure sufficient capital buffers. Basel I primarily focused on credit risk without addressing market or operational risks, providing the foundation for the more comprehensive Basel II reforms.

Key Objectives of Basel II

Basel II aims to enhance the risk sensitivity of banking regulations by introducing three pillars: minimum capital requirements, supervisory review, and market discipline, improving upon Basel I's simplistic capital adequacy framework. It emphasizes improved risk assessment through advanced internal ratings-based approaches and operational risk measurement, fostering more effective management of credit, market, and operational risks. Basel II also seeks to increase transparency and accountability, encouraging stronger risk governance and more accurate capital allocation in the banking sector.

Differences in Risk Assessment

Basel II introduces a more sophisticated risk assessment framework compared to Basel I by incorporating three pillars: minimum capital requirements, supervisory review, and market discipline. Basel II emphasizes risk sensitivity by using internal risk models for credit, operational, and market risks, whereas Basel I primarily uses fixed risk weights that do not capture the variability in borrower creditworthiness. This enhanced approach under Basel II allows banks to hold capital more aligned with the actual risks on their balance sheets, improving financial stability and risk management.

Capital Adequacy Requirements Compared

Basel II introduces a more risk-sensitive capital adequacy framework compared to Basel I by incorporating three pillars: minimum capital requirements, supervisory review, and market discipline. The capital adequacy requirements under Basel II use advanced risk assessment methods, including internal ratings-based approaches, to determine credit, operational, and market risk capital, whereas Basel I relies on standardized risk weights. Basel II's refined risk calibration enhances the ability of banks to hold capital proportionate to the underlying risks, improving financial stability and regulatory effectiveness.

Supervisory Review Process Enhancements

Basel II introduced significant enhancements to the Supervisory Review Process by emphasizing a more comprehensive assessment of banks' internal risk management and capital adequacy beyond the minimum regulatory requirements set by Basel I. It mandated banks to employ advanced risk measurement techniques and encouraged supervisors to evaluate banks' overall risk profiles, including credit, market, and operational risks. This approach fostered a more forward-looking and dynamic supervision framework, improving risk sensitivity and promoting stronger capital buffers tailored to individual bank risk levels.

Market Discipline: Disclosure and Transparency

Basel II significantly enhances market discipline through stricter disclosure and transparency requirements compared to Basel I, mandating banks to provide detailed information on risk exposure, capital adequacy, and risk management practices. This increased transparency enables market participants to better assess banks' risk profiles and promotes more informed decision-making. By improving the quality and granularity of disclosed data, Basel II fosters greater accountability and confidence in the financial system.

Impact on Banks and Financial Institutions

Basel II introduced more sophisticated risk-sensitive frameworks compared to Basel I, leading banks to enhance their risk management practices and capital adequacy assessments significantly. Financial institutions faced higher compliance costs due to the implementation of advanced internal rating systems and stress testing requirements, but gained improved risk differentiation and regulatory oversight. The shift enabled banks to allocate capital more efficiently, promoting financial stability and reducing the likelihood of systemic crises.

Global Adoption and Implementation Challenges

Basel II introduced a more sophisticated risk-sensitive framework compared to Basel I, leading to varied global adoption rates due to differing regulatory environments and banking system maturity. Emerging markets faced significant implementation challenges, including the need for advanced risk assessment models and enhanced data collection infrastructure. Developed countries adopted Basel II more rapidly, benefiting from established financial systems and regulatory expertise, though they also encountered complexities in aligning legacy systems with new capital adequacy requirements.

Conclusion: Basel II Advancements Over Basel I

Basel II introduces more sophisticated risk-sensitive capital requirements compared to Basel I's simple, uniform approach, enhancing financial stability and reducing regulatory arbitrage. It incorporates three pillars: minimum capital requirements, supervisory review, and market discipline, providing a comprehensive framework for risk management. The advancements in Basel II allow banks to align capital more closely with actual credit, market, and operational risks, promoting a more resilient banking system.

Basel II Infographic

libterm.com

libterm.com