Interest income represents the earnings generated from lending assets or investing in interest-bearing accounts such as savings, bonds, or certificates of deposit. It serves as a crucial component for individuals and businesses seeking to grow their wealth through passive income streams. Explore the rest of the article to understand how interest income can enhance your financial strategy.

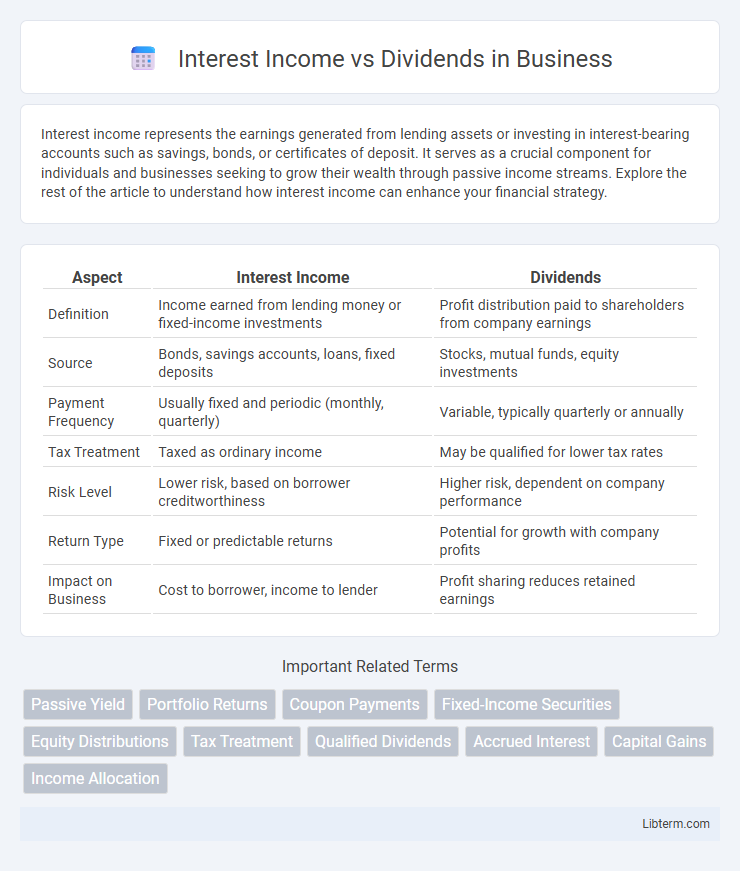

Table of Comparison

| Aspect | Interest Income | Dividends |

|---|---|---|

| Definition | Income earned from lending money or fixed-income investments | Profit distribution paid to shareholders from company earnings |

| Source | Bonds, savings accounts, loans, fixed deposits | Stocks, mutual funds, equity investments |

| Payment Frequency | Usually fixed and periodic (monthly, quarterly) | Variable, typically quarterly or annually |

| Tax Treatment | Taxed as ordinary income | May be qualified for lower tax rates |

| Risk Level | Lower risk, based on borrower creditworthiness | Higher risk, dependent on company performance |

| Return Type | Fixed or predictable returns | Potential for growth with company profits |

| Impact on Business | Cost to borrower, income to lender | Profit sharing reduces retained earnings |

Understanding Interest Income

Interest income represents earnings generated from lending money or investing in interest-bearing accounts, such as savings accounts, bonds, or certificates of deposit (CDs). It is typically fixed and predictable, based on the principal amount and interest rate over a specified period. Unlike dividends, which are payments made from company profits, interest income is contractual and does not depend on corporate performance.

Defining Dividends

Dividends represent a portion of a company's earnings distributed to shareholders, providing a direct income stream from ownership stakes. Unlike interest income earned from loans or bonds, dividends reflect a share in corporate profits and often signal a company's financial health. Regular dividend payments can indicate stable earnings and long-term value creation for investors.

Key Differences Between Interest Income and Dividends

Interest income is earnings generated from lending money or deposits, typically paid at a fixed rate, while dividends represent a share of profits distributed to shareholders by corporations. Interest is considered a contractual obligation and is taxed as ordinary income, whereas dividends can be qualified for lower tax rates depending on holding periods and the payer's status. Interest income provides predictable returns, whereas dividends fluctuate based on company performance and board decisions.

Sources of Interest Income

Interest income primarily originates from financial instruments such as savings accounts, certificates of deposit (CDs), bonds, and loans, where lenders earn returns on the principal amount. Unlike dividends, which are distributions of profit by corporations to shareholders, interest income is generated through fixed contractual agreements with institutions or individuals. Key sources include government securities, corporate bonds, bank deposits, and peer-to-peer lending platforms, offering predictable income streams based on interest rates and terms.

Sources of Dividend Income

Dividend income primarily originates from shares of stock in corporations distributed to shareholders as a portion of profits. Key sources include common and preferred stocks, mutual funds, and exchange-traded funds (ETFs) that hold dividend-paying equities. Understanding the origins of dividend income is essential for tax planning and investment strategy, as dividends often receive favorable tax treatment compared to interest income.

Taxation: Interest Income vs. Dividends

Interest income is typically taxed as ordinary income at federal and state levels, subject to the taxpayer's marginal tax rate, which can be as high as 37% in the U.S. Dividends are often taxed at lower qualified dividend rates, ranging from 0% to 20%, depending on income brackets and holding period requirements. Non-qualified dividends are taxed at ordinary income rates, making the distinction between interest income and dividends critical for tax planning and maximizing after-tax returns.

Risk Factors: Interest vs. Dividend Investments

Interest income generally comes from fixed-income securities such as bonds or savings accounts, featuring lower risk due to predictable payments and principal protection. Dividend investments, typically shares of dividend-paying stocks, carry higher risk stemming from market volatility, company performance, and potential dividend cuts. Interest income is often more stable but offers lower returns, while dividends can provide income growth but with greater exposure to economic and business risk factors.

Impact on Portfolio Diversification

Interest income, typically generated from bonds or savings accounts, provides steady, predictable cash flow that stabilizes portfolio returns and reduces overall volatility. Dividends, paid by stocks, offer the potential for both income and capital appreciation, enhancing diversification by combining income generation with exposure to equity growth. Incorporating both interest income and dividends into a portfolio balances risk and return, improving diversification through exposure to different asset classes and income types.

Choosing Between Interest and Dividend Investments

Interest income from bonds or savings accounts offers predictable returns with lower risk, appealing to conservative investors seeking steady cash flow. Dividend investments in stocks can provide higher potential income growth and tax advantages but come with market volatility and variable payouts. Evaluating risk tolerance, income stability needs, and tax implications is crucial when choosing between interest and dividend investments.

Frequently Asked Questions (FAQs)

Interest income is the earnings generated from lending money or holding interest-bearing assets like savings accounts, bonds, or certificates of deposit. Dividends are payments made to shareholders from a corporation's profits, typically distributed in cash or additional shares. Frequently asked questions often address tax treatment differences, where interest income is usually taxed as ordinary income, while qualified dividends may benefit from lower capital gains tax rates, and the impact on investment strategies.

Interest Income Infographic

libterm.com

libterm.com