Mineral interest represents the ownership rights to minerals beneath the earth's surface, allowing the holder to lease or sell these resources for profit. Understanding your mineral interest can unlock significant revenue opportunities through royalties and lease agreements. Explore the full article to learn how to maximize the value of your mineral interest.

Table of Comparison

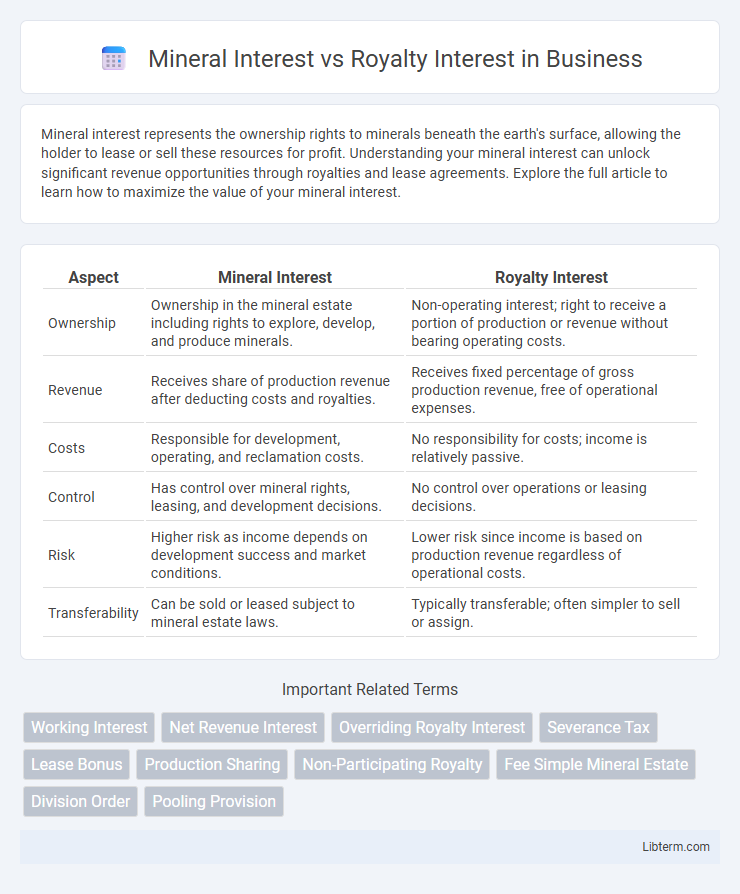

| Aspect | Mineral Interest | Royalty Interest |

|---|---|---|

| Ownership | Ownership in the mineral estate including rights to explore, develop, and produce minerals. | Non-operating interest; right to receive a portion of production or revenue without bearing operating costs. |

| Revenue | Receives share of production revenue after deducting costs and royalties. | Receives fixed percentage of gross production revenue, free of operational expenses. |

| Costs | Responsible for development, operating, and reclamation costs. | No responsibility for costs; income is relatively passive. |

| Control | Has control over mineral rights, leasing, and development decisions. | No control over operations or leasing decisions. |

| Risk | Higher risk as income depends on development success and market conditions. | Lower risk since income is based on production revenue regardless of operational costs. |

| Transferability | Can be sold or leased subject to mineral estate laws. | Typically transferable; often simpler to sell or assign. |

Understanding Mineral Interest

Mineral interest represents the ownership rights to the minerals beneath the surface of a property, allowing the holder to explore, lease, or sell those minerals. This interest includes both the right to receive royalty payments and the responsibility to pay for exploration and development costs. Understanding mineral interest is crucial for landowners and investors to effectively manage rights, revenues, and risks associated with subsurface mineral resources.

Defining Royalty Interest

Royalty interest represents a non-operating share of production revenue derived from mineral extraction without bearing the costs of exploration, drilling, or production. It entitles the holder to a percentage of the produced resources or revenue, commonly expressed as a fraction or decimal interest, such as a 1/8th or 12.5% royalty. Unlike mineral interest, royalty interest owners do not have ownership in the mineral estate itself but maintain financial rights tied to production outcomes.

Key Differences Between Mineral and Royalty Interests

Mineral interest grants ownership of the minerals beneath the land, providing rights to explore, develop, and produce minerals, while royalty interest entails a non-operating share of production revenue without ownership of the minerals or land. Mineral interest holders control leasing decisions and bear operational costs, whereas royalty interest owners receive a percentage of production income free of expenses. Key distinctions include control, cost responsibility, and the nature of income derived from oil, gas, or mineral extraction.

Rights Conveyed by Mineral Interests

Mineral interests convey ownership rights to explore, develop, and produce minerals beneath the surface, including the right to lease these minerals and receive profits from extraction. Unlike royalty interests, mineral interests carry operational control and responsibility for drilling and production activities. These rights often include the ability to negotiate leases, execute development plans, and manage mineral estate assets directly.

Rights Associated with Royalty Interests

Royalty interests grant the owner a share of production revenue without bearing drilling or operating costs, providing a passive income stream from oil, gas, or mineral extraction. Holders of royalty interests retain rights to receive payments based on production volumes or sales, but do not have rights to explore, develop, or operate the mineral property. These interests are distinct from mineral interests, which confer broader rights including leasing and development decisions.

Revenue Streams: Mineral vs Royalty Owners

Mineral interest owners generate revenue from production proceeds, including oil, gas, and minerals, allowing them to share in both the costs and profits of extraction. Royalty interest owners receive a fixed percentage of production revenue without bearing operational expenses, ensuring income without exposure to production costs. This difference creates distinct cash flow profiles, with mineral owners facing higher financial risk and potential reward, while royalty owners enjoy a steady income stream with limited risk.

Legal Considerations for Mineral and Royalty Interests

Legal considerations for mineral and royalty interests hinge on ownership rights and lease agreements. Mineral interest owners possess the right to explore, drill, and produce minerals beneath the land, while royalty interest owners receive a percentage of production revenue without operational control. Accurate legal descriptions, contract clarity, and adherence to state-specific oil and gas laws ensure proper allocation and enforcement of these interests.

Tax Implications for Mineral and Royalty Holders

Tax implications for mineral interest holders primarily involve the ability to deduct operating expenses and depletion allowances directly related to production activities, as they own a portion of the mineral estate. Royalty interest holders receive income that is typically considered passive and reported as royalty income, subject to ordinary income tax rates without the option to deduct operational costs. Understanding the distinction is crucial for accurate tax reporting and maximizing allowable deductions under IRS regulations for energy property income.

Transferring and Selling Interests: What to Know

Transferring and selling mineral interests require understanding that mineral interest owners hold rights to both the surface and subsurface minerals, allowing them to lease, sell, or grant rights, whereas royalty interest owners receive a portion of production revenue without ownership of the minerals themselves. Mineral interests can be sold outright or conveyed via deeds, often necessitating legal documentation and title review to confirm ownership and avoid disputes. When selling royalty interests, transactions typically involve assignment agreements that transfer future production revenue rights, ensuring compliance with lease terms and clear delineation of payment percentages for accurate revenue distribution.

Choosing Between Mineral and Royalty Interests

Choosing between mineral interest and royalty interest depends on the level of control and financial risk an investor is willing to assume. Mineral interests grant ownership of the minerals beneath the land, including rights to explore and develop, resulting in higher potential returns but also requiring active management and exposure to operational costs. Royalty interests provide passive income based on production without operational responsibilities, offering a lower-risk investment with a steady revenue stream from oil, gas, or mineral extraction.

Mineral Interest Infographic

libterm.com

libterm.com