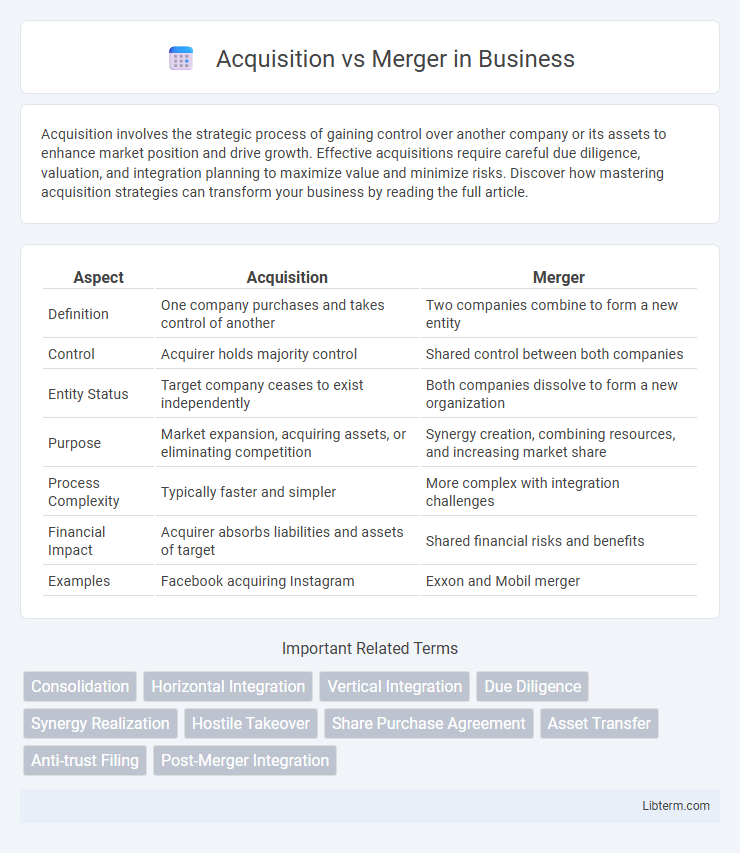

Acquisition involves the strategic process of gaining control over another company or its assets to enhance market position and drive growth. Effective acquisitions require careful due diligence, valuation, and integration planning to maximize value and minimize risks. Discover how mastering acquisition strategies can transform your business by reading the full article.

Table of Comparison

| Aspect | Acquisition | Merger |

|---|---|---|

| Definition | One company purchases and takes control of another | Two companies combine to form a new entity |

| Control | Acquirer holds majority control | Shared control between both companies |

| Entity Status | Target company ceases to exist independently | Both companies dissolve to form a new organization |

| Purpose | Market expansion, acquiring assets, or eliminating competition | Synergy creation, combining resources, and increasing market share |

| Process Complexity | Typically faster and simpler | More complex with integration challenges |

| Financial Impact | Acquirer absorbs liabilities and assets of target | Shared financial risks and benefits |

| Examples | Facebook acquiring Instagram | Exxon and Mobil merger |

Definition of Acquisition vs Merger

Acquisition occurs when one company takes over another, gaining control and ownership of its assets and operations. Merger involves two companies combining to form a new, single entity through mutual agreement, often to enhance competitive advantage. Both processes differ in execution, legal implications, and organizational structure outcomes.

Key Differences Between Acquisition and Merger

Acquisitions involve one company purchasing another, resulting in the acquiring company maintaining control, whereas mergers combine two companies to form a new entity with shared ownership. In acquisitions, the acquired company often loses its identity, while mergers typically preserve both companies' identities under a unified structure. Financial reporting differs as acquisitions treat the purchase as an asset acquisition, whereas mergers result in combined financial statements reflecting the integrated entity.

Common Types of Acquisitions

Common types of acquisitions include horizontal acquisitions, where a company acquires a competitor to increase market share and reduce competition. Vertical acquisitions involve purchasing suppliers or distributors to enhance supply chain efficiency and control. Conglomerate acquisitions occur between companies in unrelated industries, aimed at diversification and risk reduction.

Common Types of Mergers

Common types of mergers include horizontal mergers, which occur between companies in the same industry aiming to increase market share, and vertical mergers that combine firms operating at different stages of the supply chain to enhance efficiency. Conglomerate mergers involve companies from unrelated businesses seeking diversification, while market-extension mergers unite firms selling the same products in different markets to expand their geographic reach. Understanding these types helps businesses strategically plan growth and competitive positioning in various industries.

Strategic Motivations Behind Acquisitions

Acquisitions are primarily driven by strategic motivations such as market expansion, gaining access to new technologies, and achieving economies of scale, which can accelerate a company's growth and competitive positioning. Companies may pursue acquisitions to quickly enter new geographic regions or customer segments, reduce competition, or diversify product offerings. Unlike mergers, which often emphasize equal partnership and integration, acquisitions focus on leveraging synergies and enhancing shareholder value through control over the acquired entity.

Strategic Motivations Behind Mergers

Strategic motivations behind mergers primarily include achieving economies of scale, expanding market reach, and acquiring new technologies or capabilities to enhance competitive advantage. Companies often pursue mergers to diversify product lines, enter new geographic markets, and reduce operational costs through synergies. These strategic goals help firms strengthen their market position and drive long-term growth.

Legal and Regulatory Considerations

Acquisitions require thorough due diligence to navigate antitrust laws and obtain regulatory approvals, ensuring compliance with the Hart-Scott-Rodino Act and sector-specific regulations. Mergers often demand approval from multiple governmental bodies, including the Federal Trade Commission and Department of Justice, to prevent market monopolization and protect consumer interests. Legal documentation in both processes must address shareholder rights, intellectual property transfer, and potential liabilities to mitigate post-transaction disputes.

Impact on Stakeholders and Employees

Acquisitions often lead to significant organizational restructuring, causing uncertainty among employees due to potential layoffs or changes in roles, whereas mergers typically aim for integration and collaboration, promoting shared culture but may still result in workforce consolidation. Stakeholders in acquisitions may experience shifts in control and altered strategic directions, impacting investor confidence and customer relationships, while stakeholders in mergers benefit from combined resources and expanded market presence but face challenges in aligning interests. Both processes require careful communication strategies to manage expectations and maintain morale during transition periods.

Financial Implications and Valuation Methods

Acquisitions often involve a direct purchase of assets or shares, impacting financial statements through goodwill recognition and potential restructuring costs, whereas mergers combine entities, requiring complex valuation methods like discounted cash flow (DCF) or comparable company analysis to ensure equity exchange ratios are fair. The financial implications in acquisitions may include debt financing and immediate control shifts, while mergers emphasize proportional ownership and synergy realization reflected in the combined balance sheet. Valuation accuracy is critical in both scenarios, with methods such as precedent transactions and adjusted net asset value employed to capture the true economic value and anticipate post-transaction financial performance.

Case Studies: Successful Acquisitions and Mergers

Apple's acquisition of Beats Electronics in 2014 exemplifies a successful acquisition that enhanced Apple's product ecosystem and accelerated growth in the music streaming sector. The 2000 merger between Exxon and Mobil created ExxonMobil, a powerhouse in the oil and gas industry, demonstrating the value of strategic mergers in increasing market share and operational efficiency. Amazon's acquisition of Whole Foods in 2017 successfully expanded its physical retail presence and integrated supply chains, illustrating the impact of acquisitions on diversifying business models.

Acquisition Infographic

libterm.com

libterm.com