A purchase order is a formal document issued by a buyer to a seller, specifying the products or services, quantities, and agreed prices. It serves as a legally binding contract that ensures clarity and accountability in business transactions. Explore the rest of the article to understand how purchase orders can streamline your procurement process.

Table of Comparison

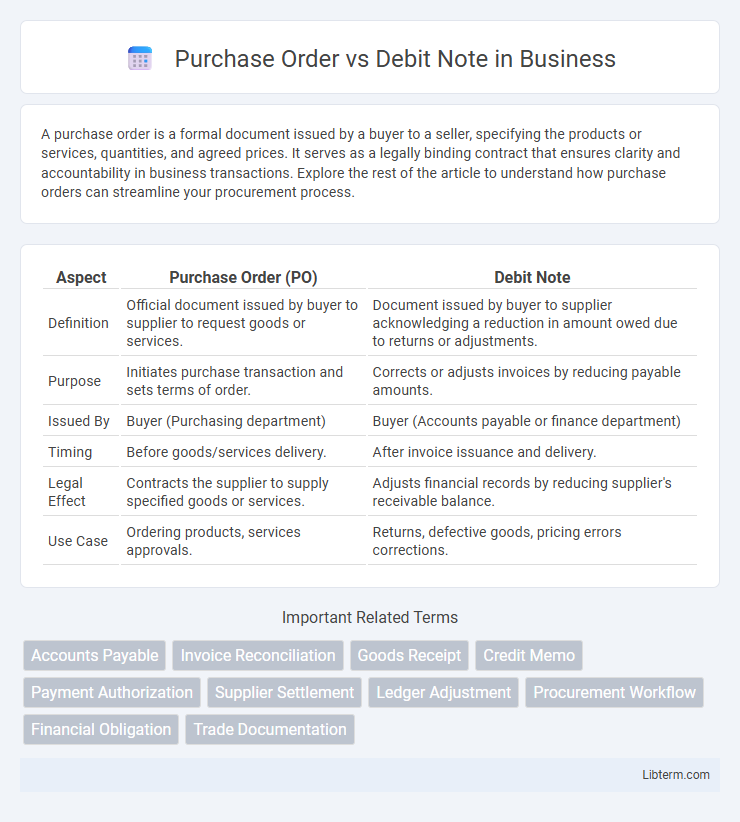

| Aspect | Purchase Order (PO) | Debit Note |

|---|---|---|

| Definition | Official document issued by buyer to supplier to request goods or services. | Document issued by buyer to supplier acknowledging a reduction in amount owed due to returns or adjustments. |

| Purpose | Initiates purchase transaction and sets terms of order. | Corrects or adjusts invoices by reducing payable amounts. |

| Issued By | Buyer (Purchasing department) | Buyer (Accounts payable or finance department) |

| Timing | Before goods/services delivery. | After invoice issuance and delivery. |

| Legal Effect | Contracts the supplier to supply specified goods or services. | Adjusts financial records by reducing supplier's receivable balance. |

| Use Case | Ordering products, services approvals. | Returns, defective goods, pricing errors corrections. |

Introduction to Purchase Orders and Debit Notes

Purchase orders are formal documents issued by a buyer to authorize a purchase transaction with a supplier, specifying quantities, descriptions, and agreed prices for products or services. Debit notes are financial documents sent by a buyer to a seller to request a credit adjustment, typically reflecting returns, overcharges, or discrepancies in the original invoice. Understanding the distinction between purchase orders and debit notes is essential for accurate procurement and accounting processes in business operations.

Definition of Purchase Order

A Purchase Order (PO) is a formal document issued by a buyer to a supplier, specifying the types, quantities, and agreed prices for products or services requested. It serves as an official offer to buy and becomes a legally binding contract once accepted by the supplier. In contrast, a Debit Note is issued by the buyer to the supplier to request a credit for returned goods or billing errors, adjusting the original invoice amount.

Definition of Debit Note

A Debit Note is a document issued by a buyer to a seller indicating a return of goods or a request for a credit adjustment due to discrepancies such as damaged products or incorrect invoicing. Unlike a Purchase Order, which is a formal request to procure goods or services, a Debit Note serves as evidence for the buyer's claim against the seller for monetary corrections. This document plays a crucial role in maintaining accurate accounts payable and is essential for resolving disputes in business transactions.

Key Differences Between Purchase Order and Debit Note

Purchase orders are formal documents issued by a buyer to authorize a purchase, specifying product details, quantities, and agreed prices, serving as a contractual agreement before delivery. Debit notes are issued by buyers or sellers to request a correction in billing, such as returning goods or adjusting invoiced amounts due to discrepancies or errors. While purchase orders initiate a transaction, debit notes act as post-transaction adjustments to reconcile financial records between trading parties.

Purpose and Usage of Purchase Orders

Purchase orders serve as formal documents issued by buyers to sellers, specifying the products, quantities, and agreed prices for goods or services. Their primary purpose is to authorize and streamline procurement processes, ensuring clarity and legal obligation before any transaction takes place. Purchase orders also function as crucial records for tracking orders, managing budgets, and facilitating invoice reconciliation in business operations.

Purpose and Usage of Debit Notes

A debit note serves as a formal request issued by a buyer to a seller to adjust an invoice due to discrepancies like damaged goods, pricing errors, or returned items, ensuring accurate financial records and payment adjustments. Unlike purchase orders, which initiate the buying process by authorizing the purchase of goods or services, debit notes specifically address post-transaction issues requiring correction or compensation. Companies rely on debit notes to maintain transparent accounting practices and facilitate communication regarding invoicing disputes or credit adjustments.

Importance in the Procurement Process

A Purchase Order (PO) serves as a formal authorization and contract between a buyer and supplier, outlining the goods or services requested, quantities, and agreed prices, which ensures clarity and legal protection in the procurement process. A Debit Note is crucial for correcting discrepancies such as overcharges or damaged goods by notifying the supplier of an amount owed back to the buyer, maintaining accurate financial records. Proper use of Purchase Orders and Debit Notes enhances accountability, streamlines supplier communication, and supports effective audit trails in procurement management.

Common Scenarios for Each Document

Purchase orders are commonly used in procurement scenarios where buyers request specific goods or services from suppliers, establishing terms such as quantity, price, and delivery date before the transaction. Debit notes arise frequently when buyers identify discrepancies like overcharges, damaged goods, or returned items, serving as formal requests for a price adjustment or refund from the seller. Both documents facilitate clear communication and accurate financial record-keeping within business transactions.

Benefits of Proper Documentation

Proper documentation of purchase orders ensures accurate tracking of goods and services, facilitating smooth procurement processes and preventing discrepancies. Debit notes provide a formal record to adjust or correct invoices, promoting transparency and accountability in financial transactions. Together, these documents enhance audit readiness, reduce disputes, and improve overall financial management efficiency.

Best Practices for Managing Purchase Orders and Debit Notes

Establish a clear approval workflow for purchase orders to ensure budget compliance and vendor accountability, reducing errors and unauthorized expenses. Implement automated matching systems to verify debit notes against corresponding purchase orders and invoices, streamlining discrepancy resolution and maintaining accurate financial records. Maintain detailed audit trails and regularly review outstanding debit notes to optimize cash flow management and strengthen vendor relationships.

Purchase Order Infographic

libterm.com

libterm.com