A Climate Bond is a debt instrument specifically designed to fund projects that have positive environmental benefits, such as renewable energy, clean transportation, and sustainable agriculture. These bonds help shift capital toward combating climate change while offering investors opportunities aligned with their sustainability goals. Discover how Climate Bonds can impact your investment strategy and contribute to a greener future by reading the full article.

Table of Comparison

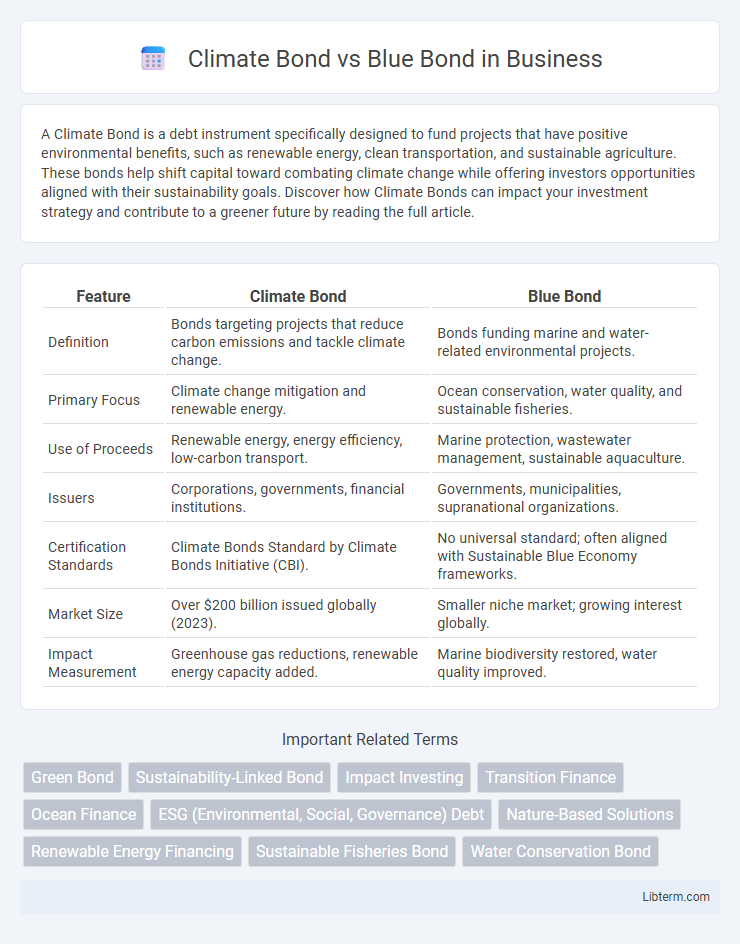

| Feature | Climate Bond | Blue Bond |

|---|---|---|

| Definition | Bonds targeting projects that reduce carbon emissions and tackle climate change. | Bonds funding marine and water-related environmental projects. |

| Primary Focus | Climate change mitigation and renewable energy. | Ocean conservation, water quality, and sustainable fisheries. |

| Use of Proceeds | Renewable energy, energy efficiency, low-carbon transport. | Marine protection, wastewater management, sustainable aquaculture. |

| Issuers | Corporations, governments, financial institutions. | Governments, municipalities, supranational organizations. |

| Certification Standards | Climate Bonds Standard by Climate Bonds Initiative (CBI). | No universal standard; often aligned with Sustainable Blue Economy frameworks. |

| Market Size | Over $200 billion issued globally (2023). | Smaller niche market; growing interest globally. |

| Impact Measurement | Greenhouse gas reductions, renewable energy capacity added. | Marine biodiversity restored, water quality improved. |

Understanding Climate Bonds: An Overview

Climate bonds are debt instruments specifically designed to fund projects that mitigate climate change by supporting renewable energy, energy efficiency, and other environmentally sustainable initiatives. Blue bonds, a subset of climate bonds, target the conservation and sustainable use of ocean and marine resources, focusing on issues like marine pollution and fisheries management. Understanding climate bonds involves recognizing their role in promoting green investments and driving the transition to a low-carbon economy through targeted financial mechanisms.

Blue Bonds Explained: Purpose and Scope

Blue bonds are debt instruments specifically designed to fund projects that promote ocean and waterway conservation, addressing challenges such as marine pollution, sustainable fisheries, and coastal ecosystem restoration. These bonds finance initiatives that support climate resilience and sustainable development in maritime sectors, targeting the preservation of marine biodiversity and improving water resource management. Unlike broader climate bonds, blue bonds have a focused scope on aquatic environmental sustainability, ensuring investments contribute directly to healthy and productive oceans.

Key Differences Between Climate Bonds and Blue Bonds

Climate bonds finance projects addressing climate change mitigation and adaptation across sectors such as renewable energy, energy efficiency, and sustainable agriculture, while blue bonds specifically fund ocean-related initiatives like marine conservation, sustainable fisheries, and coastal resilience. Climate bonds have broader environmental objectives encompassing air quality, deforestation, and carbon emissions reduction, whereas blue bonds target marine ecosystem health and ocean-related climate impacts. The primary difference lies in their thematic focus, with climate bonds supporting diverse climate-positive projects and blue bonds concentrating exclusively on ocean sustainability.

Environmental Impact: Climate vs Marine Focus

Climate Bonds primarily target global greenhouse gas reduction by financing renewable energy, clean transportation, and energy efficiency projects to mitigate climate change impacts. Blue Bonds concentrate on marine conservation, supporting sustainable fisheries, ocean habitat protection, and pollution reduction to preserve aquatic ecosystems. Both bond types drive environmental benefits but emphasize climate stabilization versus marine ecosystem resilience.

Funding Mechanisms and Structures

Climate bonds primarily finance projects aimed at reducing carbon emissions and enhancing energy efficiency by issuing fixed-income securities backed by environmental assets or revenue streams. Blue bonds specifically fund marine and ocean-related conservation initiatives, structuring repayment through government or private sector revenues associated with sustainable ocean economy activities. Both utilize transparent monitoring frameworks and third-party verification to ensure alignment with environmental objectives and investor accountability.

Global Market Trends for Climate and Blue Bonds

Climate bonds, which finance projects addressing climate change mitigation and adaptation, have experienced robust growth globally, reaching over $250 billion issued in recent years. Blue bonds, a subset of climate bonds dedicated to marine and ocean conservation projects, are emerging as a niche market with increasing issuance in regions like the Caribbean and Southeast Asia. Market trends indicate rising investor demand for sustainable finance vehicles, with global regulatory frameworks and green taxonomy development further accelerating both climate and blue bond markets.

Stakeholders and Eligible Projects

Climate Bonds primarily attract institutional investors, governments, and environmental organizations, focusing on projects that reduce greenhouse gas emissions, such as renewable energy, energy efficiency, and sustainable transport. Blue Bonds target stakeholders including governments, marine conservation groups, and coastal communities, funding eligible projects related to ocean health, like marine pollution control, sustainable fisheries, and coastal ecosystem restoration. Both bond types emphasize transparency and third-party verification to ensure funds support environmental sustainability goals.

Regulatory Frameworks and Certification Standards

Climate Bonds and Blue Bonds operate under distinct regulatory frameworks and certification standards tailored to their environmental objectives. Climate Bonds are governed by the Climate Bonds Initiative (CBI) taxonomy, which provides strict criteria to certify bonds supporting low-carbon projects across sectors like renewable energy and energy efficiency. Blue Bonds follow frameworks such as the International Capital Market Association's (ICMA) Green Bond Principles and the Blue Bond Principles, emphasizing projects that protect ocean and freshwater resources, with certification often requiring adherence to marine conservation standards and sustainable fisheries management.

Challenges and Opportunities in Bond Issuance

Climate bonds face challenges such as inconsistent global standards and certification complexities, which can hinder investor confidence and market growth. Blue bonds present opportunities by specifically targeting marine and water conservation projects, attracting investors interested in ocean sustainability and biodiversity preservation. Both bond types benefit from rising ESG investment demand but must navigate regulatory uncertainties and ensure transparent impact reporting to maximize issuance success.

Future Outlook: Innovations in Sustainable Finance

Climate bonds and blue bonds are pivotal in advancing sustainable finance, with innovations steadily shaping their future outlook. Emerging technologies like blockchain enhance transparency and traceability, while integration of AI-driven analytics improves risk assessment and impact measurement in both bond markets. Growing regulatory support and increased investor demand fuel the expansion of these green financing instruments, fostering innovation in project evaluation and reporting standards.

Climate Bond Infographic

libterm.com

libterm.com