Net income represents the profit a company retains after subtracting all expenses, taxes, and costs from total revenue, reflecting its financial health and operational efficiency. Understanding your net income helps you gauge the true profitability of your business and make informed financial decisions. Discover how mastering net income can improve your financial strategy by reading the rest of the article.

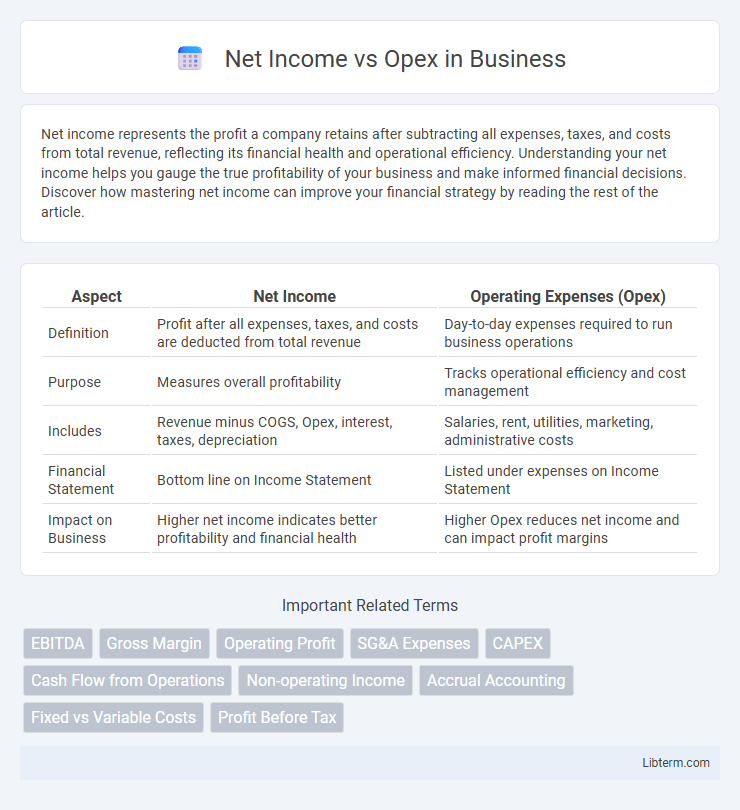

Table of Comparison

| Aspect | Net Income | Operating Expenses (Opex) |

|---|---|---|

| Definition | Profit after all expenses, taxes, and costs are deducted from total revenue | Day-to-day expenses required to run business operations |

| Purpose | Measures overall profitability | Tracks operational efficiency and cost management |

| Includes | Revenue minus COGS, Opex, interest, taxes, depreciation | Salaries, rent, utilities, marketing, administrative costs |

| Financial Statement | Bottom line on Income Statement | Listed under expenses on Income Statement |

| Impact on Business | Higher net income indicates better profitability and financial health | Higher Opex reduces net income and can impact profit margins |

Introduction to Net Income and Opex

Net Income represents a company's total earnings after subtracting all operating expenses, taxes, and costs from total revenue, serving as a key indicator of profitability. Operating Expenses (Opex) include costs incurred during normal business operations, such as salaries, rent, utilities, and maintenance, directly impacting the overall cost structure. Understanding the relationship between Net Income and Opex helps businesses optimize spending to maximize profitability and financial health.

Defining Net Income

Net income represents a company's total profit after all expenses, including operating expenses (Opex), taxes, and interest, have been deducted from total revenue. It is a key indicator of financial health, reflecting the company's profitability and efficiency in managing both operational and non-operational costs. Understanding net income helps stakeholders evaluate the overall success of business strategies beyond just controlling operating expenses.

Understanding Operating Expenses (Opex)

Operating Expenses (Opex) represent the day-to-day costs required to run a business, including wages, rent, utilities, and raw materials. These expenses directly impact net income by reducing the total revenue, as net income is calculated by subtracting Opex and other costs from sales revenue. Effective management of Opex is crucial for maximizing net income and maintaining profitability.

Key Differences Between Net Income and Opex

Net income represents the total profit a company earns after deducting all expenses, including operating expenses (Opex), taxes, interest, and depreciation, providing a comprehensive measure of financial performance. Operating expenses (Opex) are the costs incurred during normal business operations, such as salaries, rent, utilities, and maintenance, directly impacting a company's operational efficiency. The key difference lies in net income reflecting the bottom-line profitability, whereas Opex reflects ongoing costs essential for day-to-day business functions.

How Opex Impacts Net Income

Operating expenses (Opex) directly reduce net income by representing the ongoing costs of running a business, such as salaries, utilities, and rent. Higher Opex decreases profit margins, limiting the company's ability to reinvest or distribute earnings. Effective management of Opex is crucial for maximizing net income and ensuring long-term financial stability.

Calculating Net Income: Step-by-Step

Calculating net income begins with total revenue, from which operating expenses (Opex) such as salaries, rent, and utilities are subtracted to determine operating profit. Next, non-operating items including interest, taxes, and one-time expenses are deducted to arrive at the final net income figure. Accurate tracking of Opex is essential for precise net income calculation, enabling businesses to assess profitability and make informed financial decisions.

Examples of Common Operating Expenses

Common operating expenses (Opex) include rent, utilities, salaries, office supplies, and depreciation, all directly impacting a company's net income by reducing taxable profits. For instance, a business paying $10,000 monthly in rent and $5,000 in employee wages will record these as Opex, lowering the net income reported on financial statements. Effective management of operating expenses is crucial because while high Opex reduces net income, it can also indicate investments that drive long-term growth.

Strategies to Manage Opex for Higher Net Income

Effective strategies to manage operating expenses (Opex) significantly boost net income by reducing costs without compromising productivity. Implementing cost control measures such as automating routine processes, negotiating supplier contracts, and optimizing energy consumption directly lowers Opex. Regular financial audits and adopting data-driven budget forecasting enable businesses to identify inefficiencies and allocate resources strategically, enhancing profitability and net income growth.

Net Income vs Opex in Financial Analysis

Net Income measures a company's profitability after deducting all expenses, while Operating Expenses (Opex) represent the day-to-day costs necessary to run the business. Analyzing the ratio of Net Income to Opex provides insights into operational efficiency and cost management effectiveness. Financial analysts use this comparison to assess how well a company controls operating costs relative to its earnings, impacting overall profitability and long-term sustainability.

Conclusion: Importance of Distinguishing Net Income and Opex

Distinguishing Net Income from Operating Expenses (Opex) is crucial for accurate financial analysis and effective business decision-making. Net Income represents the company's profitability after deducting all expenses, including Opex, while Opex reflects the day-to-day costs required to run operations. Understanding their differences ensures precise budgeting, cost control, and performance evaluation, ultimately driving sustainable growth.

Net Income Infographic

libterm.com

libterm.com