Maximizing profit requires a strategic approach to both increasing revenue and managing costs effectively. Understanding market trends, consumer behavior, and operational efficiency can significantly boost your bottom line. Explore the rest of the article to discover actionable tips and insights on enhancing your profit margins.

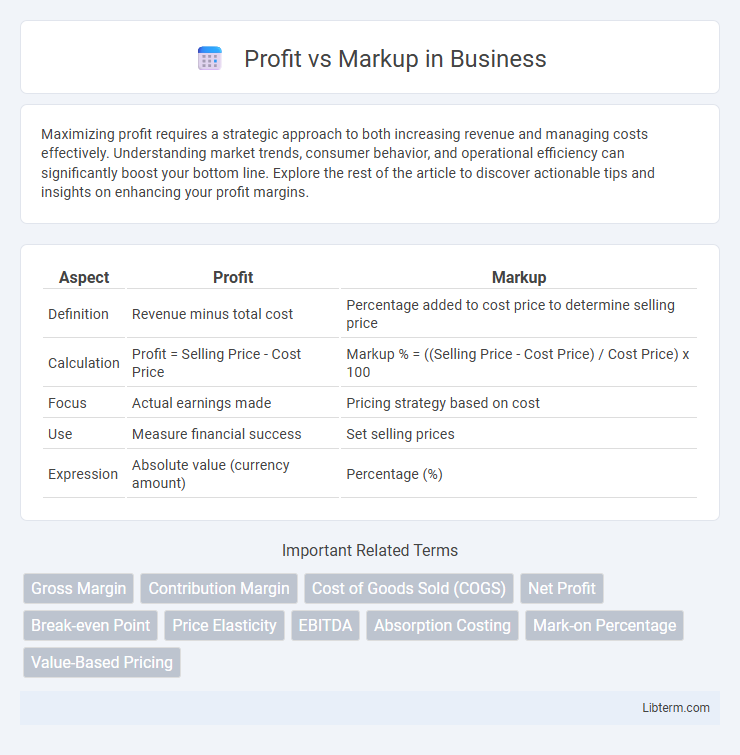

Table of Comparison

| Aspect | Profit | Markup |

|---|---|---|

| Definition | Revenue minus total cost | Percentage added to cost price to determine selling price |

| Calculation | Profit = Selling Price - Cost Price | Markup % = ((Selling Price - Cost Price) / Cost Price) x 100 |

| Focus | Actual earnings made | Pricing strategy based on cost |

| Use | Measure financial success | Set selling prices |

| Expression | Absolute value (currency amount) | Percentage (%) |

Understanding Profit and Markup: Key Definitions

Profit represents the financial gain derived when total revenue surpasses total costs, indicating the actual earnings of a business. Markup is the percentage added to the cost price of a product to determine its selling price, reflecting how much above cost a product is sold. Understanding the distinction between profit and markup is essential for accurate pricing strategies and financial analysis.

The Mathematical Formulas: Calculating Profit vs Markup

Profit is calculated by subtracting the cost price from the selling price, expressed as Profit = Selling Price - Cost Price. Markup represents the percentage increase on the cost price and is calculated using the formula Markup % = (Profit / Cost Price) x 100. Understanding these formulas helps businesses set prices that ensure profitability while maintaining competitive margins.

Core Differences Between Profit and Markup

Profit represents the actual financial gain after deducting all costs from total revenue, reflecting a business's net earnings. Markup is the percentage added to the cost price to determine the selling price, indicating how much a product's price exceeds its cost. Understanding the core difference helps businesses set pricing strategies that ensure profitability while covering expenses.

Practical Examples: Profit and Markup in Action

Profit represents the actual earnings after subtracting costs from the selling price, while markup indicates the percentage added to the cost price to determine the selling price. For instance, if a product costs $50 and sells for $70, the profit is $20, whereas the markup is 40% calculated by ($20 / $50 x 100). Understanding this distinction helps businesses price products accurately to achieve desired profit margins.

Why Confusing Profit with Markup Can Hurt Your Business

Confusing profit with markup can lead to inaccurate pricing strategies, causing businesses to underprice or overprice products and reduce overall profitability. Profit refers to the actual earnings after all costs, while markup is the percentage added to the cost price to determine the selling price. Misinterpreting these concepts often results in financial mismanagement, affecting cash flow and long-term sustainability.

Industry Standards: Profit Margins vs Typical Markups

Industry standards reveal that typical profit margins range between 5% to 20% depending on the sector, while markups often vary from 30% to 100% or more to cover costs and desired profits. Retail industries commonly apply markups of 50% to 100%, resulting in profit margins that tend to be lower due to operating expenses and competition. Understanding the distinction between markup, which is a percentage added to cost price, and profit margin, which is a percentage of the selling price, is crucial for accurate financial analysis and pricing strategy in business.

Impact of Profit and Markup on Pricing Strategies

Profit directly influences pricing strategies by determining the minimum price required to achieve desired financial goals, ensuring business sustainability and growth. Markup affects pricing by setting prices above cost to cover expenses and generate profit, guiding decisions on competitive positioning and market demand. Understanding the balance between profit margin and markup percentage enables businesses to optimize pricing strategies for maximum revenue and customer appeal.

Common Mistakes When Using Profit and Markup

Confusing profit with markup is a common mistake that leads to inaccurate pricing strategies, as profit is the difference between selling price and cost, while markup is the percentage added to the cost price. Many businesses incorrectly calculate profit margin by using markup percentages, causing either underpricing or overpricing of products. Misinterpreting these concepts can result in reduced profitability and cash flow issues, emphasizing the need for clear differentiation and precise calculation methods.

Tools and Tips for Accurately Calculating Profit and Markup

Accurately calculating profit and markup requires utilizing precise financial tools like spreadsheet software, profit margin calculators, and accounting applications that automate complex computations. Implementing tips such as consistently distinguishing between markup percentage (calculated on cost) and profit margin (calculated on sales revenue) ensures clarity and accuracy in pricing strategies. Regularly updating cost data and using templates designed for profit and markup calculations enhances decision-making and maximizes profitability.

Choosing the Right Approach: Profit or Markup for Your Business

Choosing the right approach between profit and markup depends on your business goals and pricing strategy. Profit focuses on the actual earnings after all costs, making it ideal for understanding net income and financial health. Markup emphasizes adding a percentage to the cost price, which simplifies pricing but requires accurate cost calculation to avoid underpricing or overpricing products.

Profit Infographic

libterm.com

libterm.com