A golden parachute is a lucrative severance package provided to top executives in the event of termination, often triggered by mergers or acquisitions. This financial arrangement includes substantial cash payments, stock options, or other benefits designed to protect the executive's financial interests. Discover how golden parachutes impact corporate governance and what they mean for your understanding of executive compensation by reading the full article.

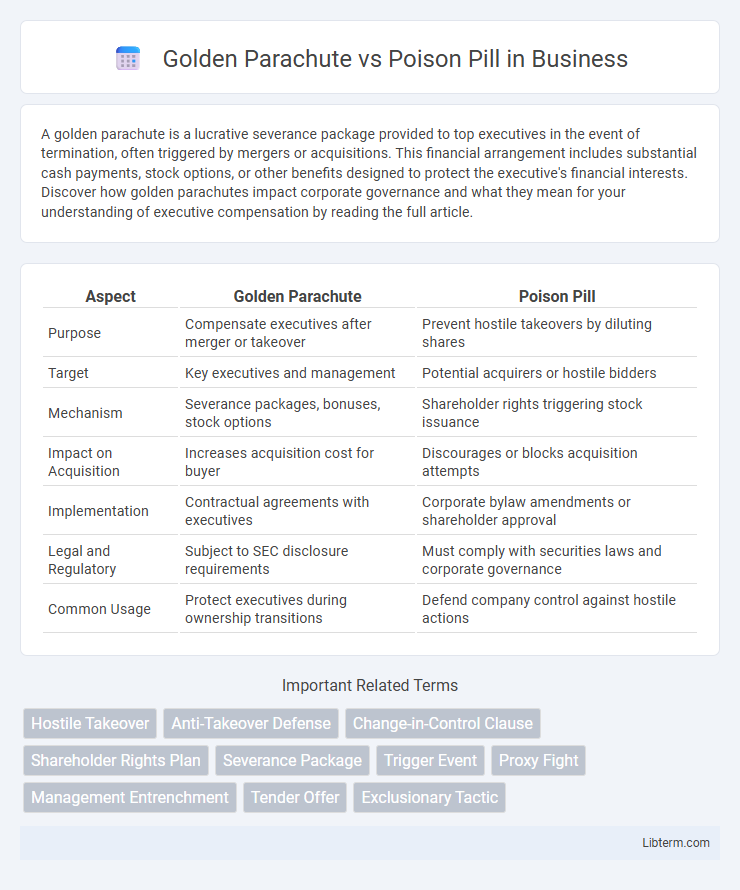

Table of Comparison

| Aspect | Golden Parachute | Poison Pill |

|---|---|---|

| Purpose | Compensate executives after merger or takeover | Prevent hostile takeovers by diluting shares |

| Target | Key executives and management | Potential acquirers or hostile bidders |

| Mechanism | Severance packages, bonuses, stock options | Shareholder rights triggering stock issuance |

| Impact on Acquisition | Increases acquisition cost for buyer | Discourages or blocks acquisition attempts |

| Implementation | Contractual agreements with executives | Corporate bylaw amendments or shareholder approval |

| Legal and Regulatory | Subject to SEC disclosure requirements | Must comply with securities laws and corporate governance |

| Common Usage | Protect executives during ownership transitions | Defend company control against hostile actions |

Introduction to Corporate Defense Mechanisms

Golden parachutes and poison pills are two essential corporate defense mechanisms designed to protect companies during hostile takeover attempts. A golden parachute provides lucrative benefits to top executives if they are terminated following a merger or acquisition, deterring potential buyers by increasing acquisition costs. The poison pill strategy involves issuing new shares or rights to existing shareholders, diluting the value of the stock and making hostile takeovers prohibitively expensive.

Defining Golden Parachute: What Is It?

A Golden Parachute is a contractual agreement that provides top executives with substantial financial benefits if they are terminated following a merger or acquisition. This compensation typically includes severance pay, bonuses, stock options, or other perks designed to protect executives from abrupt job loss. Unlike a Poison Pill, which is a defensive strategy to deter hostile takeovers, a Golden Parachute ensures executive security during corporate transitions.

Exploring the Poison Pill Strategy

The poison pill strategy is a defensive mechanism used by companies to deter hostile takeovers by making the target company less attractive or more costly to acquire. This tactic typically involves issuing new shares or rights to existing shareholders, diluting the ownership interest of a potential acquirer and complicating the acquisition process. Unlike golden parachutes, which provide financial benefits to executives upon termination after a takeover, poison pills directly impact the acquirer's ability to gain control.

Key Differences Between Golden Parachute and Poison Pill

Golden Parachutes provide lucrative financial benefits to top executives if they lose their job following a merger or acquisition, ensuring personal financial security. Poison Pills are shareholder rights plans designed to dilute ownership and thwart hostile takeovers, protecting the company's control and shareholder value. While Golden Parachutes focus on executive compensation, Poison Pills function as defensive mechanisms against unwanted acquisition attempts.

Strategic Objectives: Why Companies Use These Tactics

Golden parachutes serve to protect top executives by providing substantial financial benefits during mergers or takeovers, ensuring leadership stability and reducing resistance to acquisition offers. Poison pills deter hostile takeovers by diluting shares or triggering rights that make acquisitions prohibitively expensive, safeguarding shareholder value and company independence. Both tactics strategically aim to influence negotiation dynamics, preserve corporate control, and enhance shareholder returns amid potential acquisition threats.

Legal and Regulatory Considerations

Golden Parachutes are legally structured severance agreements that protect executives during mergers or acquisitions and must comply with SEC disclosure rules and Section 280G of the Internal Revenue Code to avoid tax penalties. Poison Pills, as shareholder rights plans, require board approval and adherence to state corporate laws, such as Delaware General Corporation Law, to prevent legal challenges from shareholders. Both strategies face scrutiny from regulators to ensure they do not unfairly disadvantage shareholders or violate fiduciary duties.

Shareholder Impact and Corporate Governance

Golden parachutes provide executives with substantial financial benefits during mergers or acquisitions, aligning their interests with deal completion but potentially leading to higher costs for shareholders and concerns over excessive executive compensation. Poison pills empower shareholders by diluting shares or restricting acquisition methods, acting as a defensive mechanism to prevent hostile takeovers and protect corporate control. Both strategies influence corporate governance by balancing management protection with shareholder rights, impacting decision-making dynamics during takeover scenarios.

Real-World Examples: Case Studies

The Golden Parachute awarded to Michael Ovitz during Disney's 2000 acquisition exemplifies a lucrative executive severance package designed to protect top executives amid takeover threats. In contrast, the Poison Pill strategy employed by Netflix in 2012 successfully deterred hostile bids by diluting shares, showcasing a shareholder rights plan aimed at making acquisitions prohibitively expensive. These case studies highlight how corporate defense mechanisms align with strategic goals to either compensate leadership or discourage unwanted mergers.

Advantages and Disadvantages of Each Approach

Golden parachutes provide substantial severance packages to executives during takeovers, ensuring retention and reducing resistance in acquisition scenarios but can be costly and perceived negatively by shareholders. Poison pills dilute shareholder value to thwart hostile takeovers, offering a strong defense mechanism but potentially discouraging beneficial offers and harming stock price. Both approaches balance control and corporate value protection, with golden parachutes incentivizing smooth transitions and poison pills prioritizing shareholder empowerment and takeover deterrence.

Conclusion: Choosing the Right Defense Mechanism

Golden Parachutes provide lucrative exit packages to executives during mergers, aligning their interests with shareholders by ensuring leadership stability. Poison Pills dilute share value or increase takeover costs, effectively deterring hostile bids and protecting shareholder value. Selecting the appropriate defense mechanism depends on a company's specific vulnerabilities, corporate culture, and long-term strategic goals to maximize shareholder protection and corporate control.

Golden Parachute Infographic

libterm.com

libterm.com