Semi-variable cost combines fixed and variable components, meaning part of the cost remains constant while the other fluctuates with production levels. Understanding how semi-variable costs behave can help you manage budgeting and forecasting more effectively. Explore the rest of this article to learn how to identify and control these costs in your business operations.

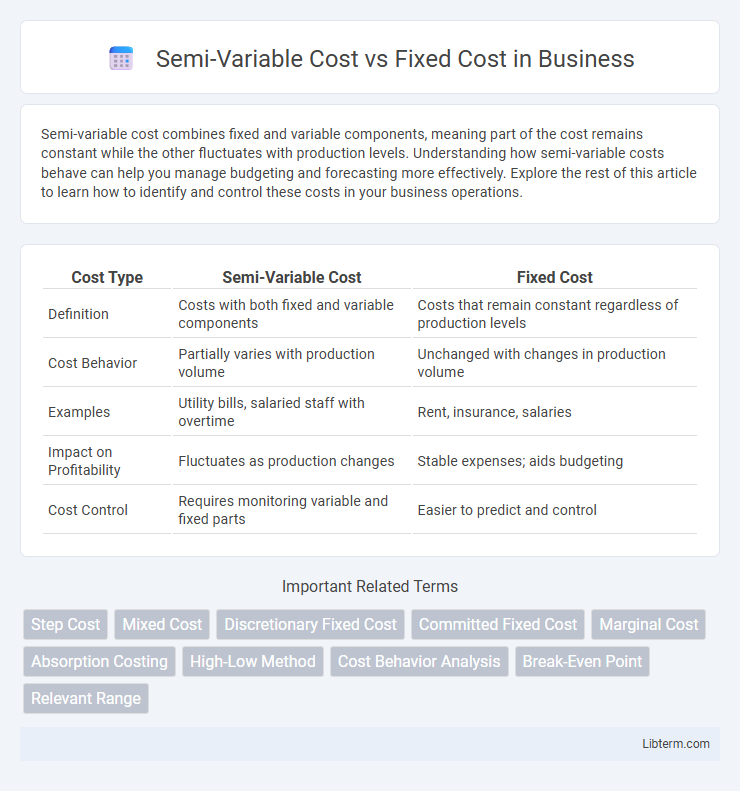

Table of Comparison

| Cost Type | Semi-Variable Cost | Fixed Cost |

|---|---|---|

| Definition | Costs with both fixed and variable components | Costs that remain constant regardless of production levels |

| Cost Behavior | Partially varies with production volume | Unchanged with changes in production volume |

| Examples | Utility bills, salaried staff with overtime | Rent, insurance, salaries |

| Impact on Profitability | Fluctuates as production changes | Stable expenses; aids budgeting |

| Cost Control | Requires monitoring variable and fixed parts | Easier to predict and control |

Understanding Cost Structures: An Overview

Semi-variable costs, also known as mixed costs, contain both fixed and variable components, changing with production volume but not proportionally. Fixed costs remain constant regardless of output levels, providing stability in budgeting and financial planning. Understanding these cost structures helps businesses optimize resource allocation and accurately forecast expenses.

What Are Fixed Costs?

Fixed costs are expenses that remain constant regardless of production levels or business activity, such as rent, salaries, and insurance premiums. These costs do not fluctuate with output volume and must be paid even if no goods or services are produced. Understanding fixed costs is essential for budgeting, forecasting, and break-even analysis in financial planning.

Defining Semi-Variable Costs

Semi-variable costs combine fixed and variable cost components, changing with production levels yet maintaining a base expense even at zero output. These costs, also known as mixed costs, include expenses like utility bills where a fixed minimum is paid regardless of usage, plus a variable portion that varies with consumption. Understanding semi-variable costs helps businesses forecast expenses more accurately and manage budgeting effectively by distinguishing between constant and fluctuating cost elements.

Key Differences Between Fixed and Semi-Variable Costs

Fixed costs remain constant regardless of production volume, such as rent or salaries, providing predictable expenses essential for budgeting. Semi-variable costs combine fixed and variable components, like utility bills that have a base charge plus usage-based fees, causing total costs to fluctuate with activity levels. Understanding these distinctions is crucial for accurate cost behavior analysis and effective financial planning.

Examples of Fixed and Semi-Variable Costs in Business

Fixed costs in business include rent, salaries of permanent employees, and insurance premiums, which remain constant regardless of production levels. Semi-variable costs, such as utility bills, sales commissions, and maintenance expenses, contain both a fixed base amount and a variable component that fluctuates with business activity. Identifying these costs helps businesses in budgeting, forecasting, and optimizing operational efficiency.

Impact on Budgeting and Financial Planning

Semi-variable costs, which combine fixed and variable components, require more nuanced budgeting approaches due to their fluctuating nature based on activity levels, making accurate financial forecasting challenging. Fixed costs remain constant regardless of production volume, providing stability and predictability in budget allocations and financial planning. Understanding the distinct behaviors of semi-variable and fixed costs enables more precise expense control and resource allocation, improving overall financial performance and strategic decision-making.

Relevance in Cost-Volume-Profit Analysis

Semi-variable costs contain both fixed and variable components, making them crucial for accurate Cost-Volume-Profit (CVP) analysis as they affect profit behavior at different production levels. Fixed costs remain constant regardless of output, providing a stable baseline for breakeven calculations and margin of safety assessments in CVP. Understanding the interplay between semi-variable and fixed costs enhances decision-making related to pricing, budgeting, and operational efficiency in financial planning.

Monitoring and Managing Semi-Variable Costs

Monitoring semi-variable costs requires tracking both fixed and variable components to accurately allocate expenses and forecast budgets. Effective management involves analyzing cost behavior patterns relative to production volume changes to optimize resource allocation and reduce waste. Implementing cost control software and periodic variance analysis can enhance decision-making and improve financial performance.

Strategic Decision-Making: Fixed vs Semi-Variable Costs

Fixed costs remain constant regardless of production levels, providing stability in budgeting but limiting flexibility in scaling operations. Semi-variable costs contain both fixed and variable components, allowing businesses to adjust expenses based on activity, which enhances responsiveness to market fluctuations. Strategic decision-making benefits from understanding these distinctions, as companies can better allocate resources, optimize cost management, and improve profitability by balancing fixed and semi-variable costs according to operational demands.

Summary: Choosing the Right Cost Approach for Your Business

Selecting the right cost approach involves understanding that semi-variable costs combine fixed and variable components, fluctuating with production levels, whereas fixed costs remain constant regardless of output. Businesses with fluctuating activity volumes benefit from semi-variable cost recognition to more accurately predict expenses and optimize budgeting. Fixed cost models suit stable operations with predictable expenses, ensuring consistent financial planning and control.

Semi-Variable Cost Infographic

libterm.com

libterm.com