Momentum investing focuses on capitalizing on existing market trends by buying assets showing strong price performance and selling those with weak performance. This strategy relies on the belief that stocks exhibiting upward or downward momentum will continue moving in the same direction for some time. Discover how momentum investing can enhance your portfolio by reading the rest of this article.

Table of Comparison

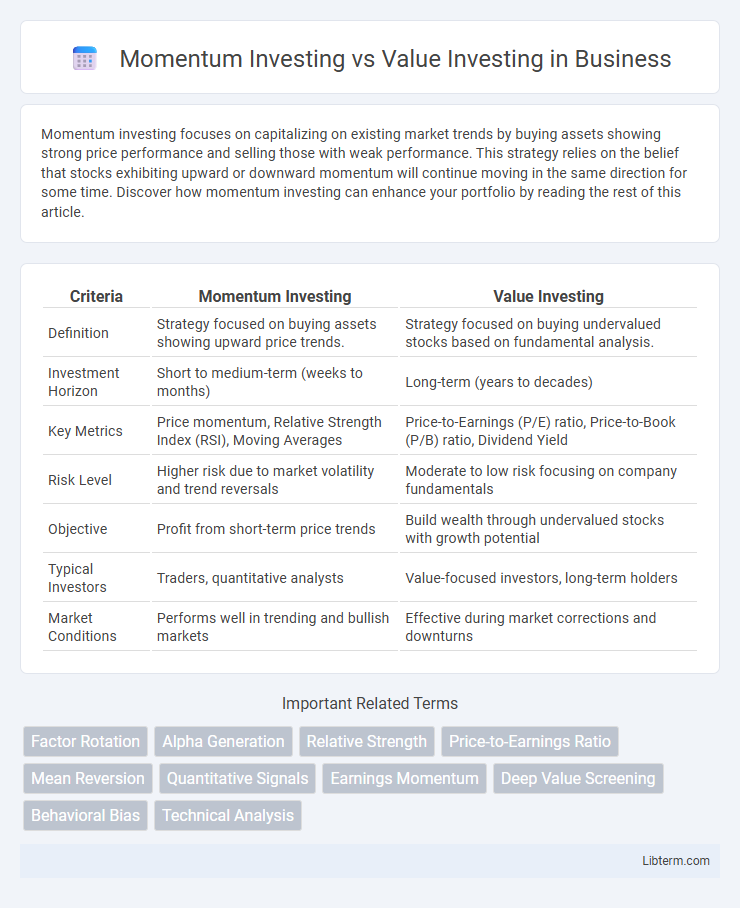

| Criteria | Momentum Investing | Value Investing |

|---|---|---|

| Definition | Strategy focused on buying assets showing upward price trends. | Strategy focused on buying undervalued stocks based on fundamental analysis. |

| Investment Horizon | Short to medium-term (weeks to months) | Long-term (years to decades) |

| Key Metrics | Price momentum, Relative Strength Index (RSI), Moving Averages | Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, Dividend Yield |

| Risk Level | Higher risk due to market volatility and trend reversals | Moderate to low risk focusing on company fundamentals |

| Objective | Profit from short-term price trends | Build wealth through undervalued stocks with growth potential |

| Typical Investors | Traders, quantitative analysts | Value-focused investors, long-term holders |

| Market Conditions | Performs well in trending and bullish markets | Effective during market corrections and downturns |

Understanding Momentum Investing

Momentum investing focuses on capitalizing on existing market trends by buying assets that have demonstrated strong past performance, often measured by recent price momentum over several months. This strategy assumes that stocks exhibiting upward price momentum will continue to rise due to investor herding and behavioral biases that drive prices beyond fundamentals. Key metrics used in momentum investing include relative strength index (RSI), moving average convergence divergence (MACD), and trend-following indicators to identify sustained price movements and optimize entry and exit points.

Defining Value Investing

Value investing centers on identifying undervalued stocks trading below their intrinsic value based on fundamental analysis, including metrics like price-to-earnings ratio and book value. Investors seek companies with strong financial health, stable earnings, and potential for long-term growth despite temporary market setbacks. This strategy contrasts with momentum investing, which emphasizes buying stocks exhibiting strong recent price trends regardless of intrinsic valuation.

Key Principles of Momentum Investing

Momentum investing relies on the principle that stocks exhibiting strong recent performance will continue to outperform due to persistent investor sentiment and market trends. Key strategies include buying securities with upward price momentum and selling those with downward momentum, often identified through technical indicators like moving averages and relative strength index (RSI). This approach contrasts with value investing, which emphasizes fundamental analysis to find undervalued stocks trading below their intrinsic value.

Core Strategies in Value Investing

Value investing centers on identifying undervalued stocks based on fundamental analysis, including metrics such as low price-to-earnings (P/E) ratios, high dividend yields, and strong balance sheets. Core strategies involve buying securities priced below their intrinsic value, emphasizing margin of safety to mitigate risk. Investors prioritize companies with stable earnings, solid cash flow, and durable competitive advantages to achieve long-term capital appreciation.

Historical Performance Comparison

Momentum investing has historically outperformed value investing during strong market trends, capitalizing on stocks with upward price trajectories. Value investing tends to deliver more consistent returns during economic recoveries by focusing on undervalued stocks with strong fundamentals. Over long-term periods, momentum strategies show higher volatility, whereas value investing often provides greater downside protection and steady compound growth.

Risk and Reward Profiles

Momentum investing targets stocks with recent price trends, offering high reward potential but exposing investors to elevated volatility and rapid reversals, increasing risk. Value investing seeks undervalued stocks based on fundamental analysis, typically providing more stable returns with lower downside risk but slower capital appreciation. The contrasting risk and reward profiles appeal to distinct investor preferences: momentum suits risk-tolerant traders seeking quick gains, while value aligns with conservative investors prioritizing capital preservation.

Suitable Market Conditions for Each Strategy

Momentum investing thrives in trending markets where price momentum is strong and persistent, enabling investors to capitalize on continuing asset price movements. Value investing performs best in volatile or recovering markets where undervalued stocks provide long-term growth potential as market inefficiencies correct over time. Identifying prevailing market conditions such as bull markets for momentum or bear markets for value can enhance strategy effectiveness and risk management.

Investor Psychology in Momentum vs Value Investing

Momentum investing capitalizes on investor herd behavior and the tendency to chase recent winners, driven by psychological biases like optimism and fear of missing out (FOMO). Value investing relies on contrarian psychology, exploiting market overreactions and undervaluation due to fear or pessimism, encouraging patience and discipline among investors. Understanding cognitive biases and emotional responses is crucial for success in both strategies, as momentum thrives on market sentiment while value investing benefits from rational assessment of fundamentals.

Common Pitfalls and Challenges

Momentum investing often struggles with sudden market reversals that can lead to significant losses due to its reliance on recent price trends. Value investing faces challenges in accurately assessing intrinsic value during prolonged market downturns or when companies exhibit "value traps" with deteriorating fundamentals. Both strategies require disciplined risk management and continual market analysis to navigate volatility and avoid emotional biases.

Choosing the Right Approach for Your Portfolio

Momentum investing capitalizes on stocks exhibiting strong recent performance, aiming to ride upward trends for short-term gains. Value investing focuses on identifying undervalued stocks trading below their intrinsic value, targeting long-term appreciation through fundamental analysis. Selecting the right approach depends on your risk tolerance, investment horizon, and market conditions, with momentum suited for more aggressive, time-sensitive strategies while value investing appeals to patient investors prioritizing stability and intrinsic worth.

Momentum Investing Infographic

libterm.com

libterm.com