Lateral integration enhances business growth by acquiring or merging with companies operating at the same level in the supply chain, increasing market share and reducing competition. This strategy streamlines operations, creating economies of scale and improving production efficiencies. Explore the article to discover how you can leverage lateral integration to strengthen your competitive edge.

Table of Comparison

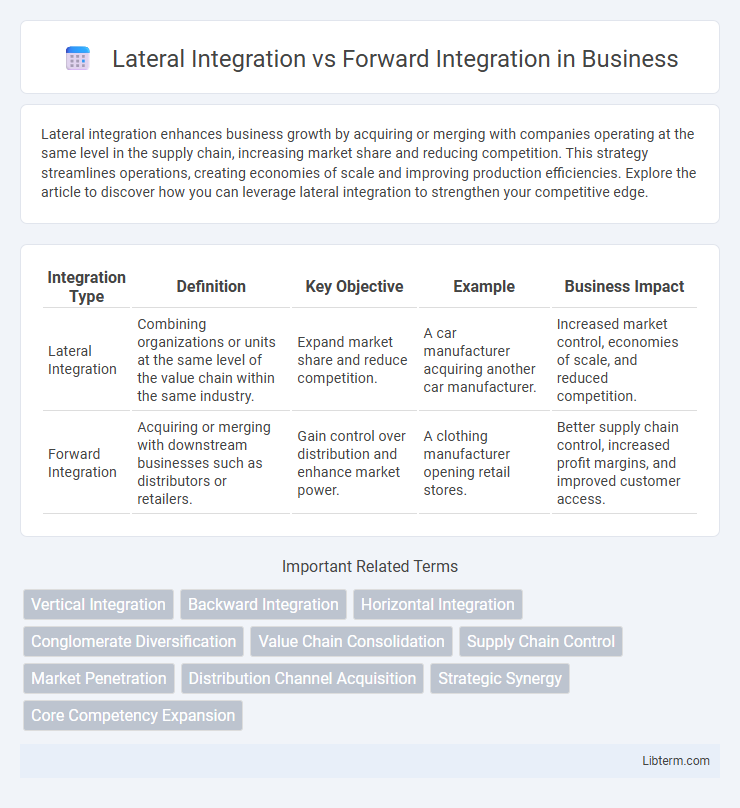

| Integration Type | Definition | Key Objective | Example | Business Impact |

|---|---|---|---|---|

| Lateral Integration | Combining organizations or units at the same level of the value chain within the same industry. | Expand market share and reduce competition. | A car manufacturer acquiring another car manufacturer. | Increased market control, economies of scale, and reduced competition. |

| Forward Integration | Acquiring or merging with downstream businesses such as distributors or retailers. | Gain control over distribution and enhance market power. | A clothing manufacturer opening retail stores. | Better supply chain control, increased profit margins, and improved customer access. |

Understanding Integration Strategies in Business

Lateral integration involves acquiring or merging with companies operating at the same level of the supply chain to increase market share and reduce competition. Forward integration refers to a company expanding its control over the distribution or retail aspects of its products, moving closer to the end customer. Both strategies aim to enhance competitive advantage, streamline operations, and improve profit margins by controlling more stages of the value chain.

What is Lateral Integration?

Lateral integration refers to the strategic process where a company acquires or merges with other firms at the same level of the supply chain within the same industry, enhancing its market share and reducing competition. This approach allows businesses to expand their product lines, increase economies of scale, and strengthen their competitive position. Lateral integration contrasts with forward integration, which involves moving closer to the end customer by acquiring or controlling distribution and retail operations.

What is Forward Integration?

Forward integration is a growth strategy where a company expands its operations by acquiring or merging with businesses closer to the final consumer, such as distributors or retailers. This approach helps firms control the distribution process, improve market access, and enhance profit margins by reducing dependency on intermediaries. Examples include a manufacturer opening its own retail stores or a supplier establishing direct sales channels.

Key Differences Between Lateral and Forward Integration

Lateral integration involves a company acquiring or merging with another company at the same stage of the supply chain, aiming to increase market share and reduce competition, while forward integration refers to a company expanding control over the next stage in the distribution process, such as moving closer to the end customer. Key differences include the target of expansion--lateral integration targets competitors or businesses within the same industry level, whereas forward integration targets distributors or retailers downstream. Lateral integration focuses on horizontal growth, whereas forward integration emphasizes vertical growth in the supply chain.

Benefits of Lateral Integration

Lateral integration allows companies to expand their product lines or services by acquiring or merging with firms in the same industry, enhancing market share and reducing competition. This strategy benefits businesses through economies of scale, increased bargaining power with suppliers, and diversification risk within the same market sector. It fosters innovation and resource sharing, driving efficiency and strengthening competitive positioning.

Advantages of Forward Integration

Forward integration offers significant advantages by enabling companies to control their distribution channels and customer experience more effectively. It reduces dependency on intermediaries, leading to higher profit margins and improved market responsiveness. This strategy also fosters stronger brand loyalty and better access to consumer insights, facilitating more targeted marketing and product development.

Risks and Challenges in Lateral Integration

Lateral integration entails expanding into different markets or industries, presenting risks such as unfamiliar market dynamics, cultural clashes, and operational inefficiencies due to lack of expertise. Challenges include managing diverse business units, potential dilution of brand identity, and increased complexity in coordination across unrelated sectors. Firms also face financial strain from acquiring or establishing new entities that may not achieve anticipated synergies or economies of scale.

Potential Drawbacks of Forward Integration

Forward integration can lead to high capital investment and increased operational complexity as companies take on new roles in the supply chain. This strategy may also result in reduced flexibility, limiting a firm's ability to adapt quickly to market changes or focus on core competencies. Furthermore, forward integration can create channel conflicts with existing distributors or retailers, potentially harming established business relationships.

Real-World Examples: Lateral vs Forward Integration

Lateral integration, exemplified by Disney's acquisition of Marvel Entertainment, expands a company's range of products within the same industry, enhancing market share and reducing competition. Forward integration, demonstrated by Tesla's operation of its own retail stores and service centers, allows direct control over the distribution channel, improving customer experience and increasing profit margins. Both strategies showcase distinct approaches to supply chain expansion, with lateral integration focusing on horizontal growth and forward integration emphasizing vertical control.

Choosing the Right Integration Strategy for Your Business

Selecting the right integration strategy depends on your business objectives and market position; lateral integration expands your company's product lines or services by acquiring or merging with competitors, enhancing market share and reducing competition. Forward integration involves taking control of distribution channels or retail outlets, allowing greater control over the supply chain and customer experience. Evaluating factors such as cost efficiency, market reach, and operational control is crucial in determining whether lateral or forward integration aligns best with your growth strategy.

Lateral Integration Infographic

libterm.com

libterm.com