A write-off is an accounting action that reduces the value of an asset or debt because it is no longer recoverable. Businesses use write-offs to reflect losses accurately and improve financial transparency, impacting taxable income and financial statements. Discover how understanding write-offs can benefit your financial management by reading the full article.

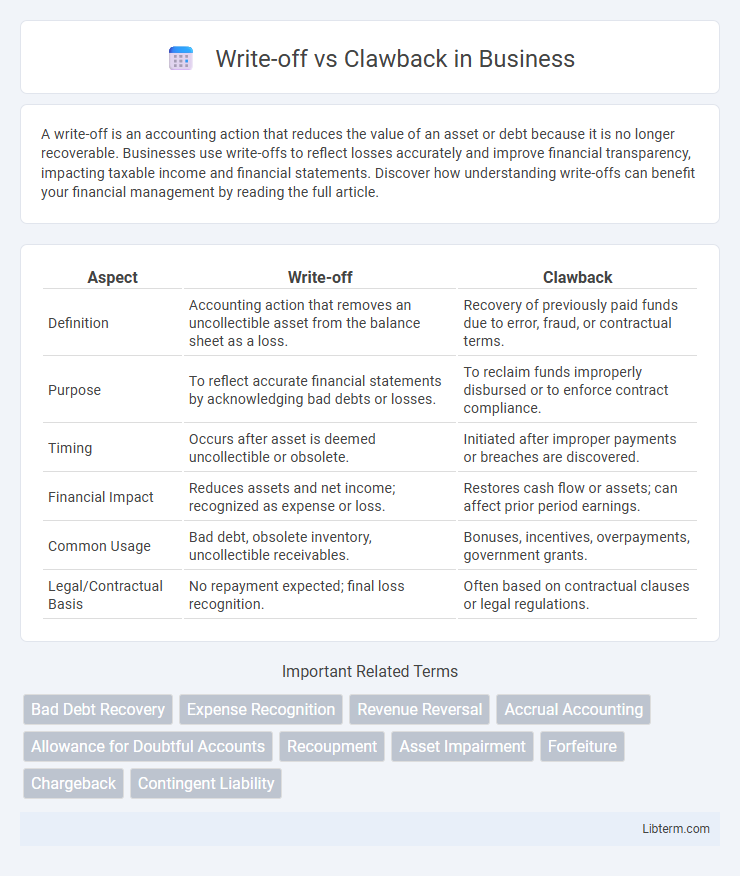

Table of Comparison

| Aspect | Write-off | Clawback |

|---|---|---|

| Definition | Accounting action that removes an uncollectible asset from the balance sheet as a loss. | Recovery of previously paid funds due to error, fraud, or contractual terms. |

| Purpose | To reflect accurate financial statements by acknowledging bad debts or losses. | To reclaim funds improperly disbursed or to enforce contract compliance. |

| Timing | Occurs after asset is deemed uncollectible or obsolete. | Initiated after improper payments or breaches are discovered. |

| Financial Impact | Reduces assets and net income; recognized as expense or loss. | Restores cash flow or assets; can affect prior period earnings. |

| Common Usage | Bad debt, obsolete inventory, uncollectible receivables. | Bonuses, incentives, overpayments, government grants. |

| Legal/Contractual Basis | No repayment expected; final loss recognition. | Often based on contractual clauses or legal regulations. |

Understanding Write-Offs: Definition and Purpose

A write-off is an accounting action used to recognize that an asset's value has significantly decreased, rendering it uncollectible or obsolete, often applied to bad debts or depreciated inventory. Its primary purpose is to adjust the financial statements to reflect a more accurate and realistic value of assets, ensuring compliance with accounting principles and providing stakeholders with a truthful representation of a company's financial health. By writing off losses, companies can reduce taxable income and improve future financial planning.

What is a Clawback? Key Concepts Explained

A clawback is a financial provision requiring the return of previously awarded funds or benefits due to non-compliance, error, or misconduct, commonly used in contracts, executive compensation, and government grants. Key concepts include identifying conditions triggering the clawback, such as breach of contract, fraud, or failure to meet performance targets, and enforcing repayment or restitution. Clawbacks help ensure accountability and protect organizations from financial losses by recapturing funds when obligations are not fulfilled.

Write-Off vs Clawback: Core Differences

Write-offs refer to accounting actions where uncollectible receivables are removed from the books as losses, impacting financial statements by reducing assets and income. Clawbacks involve the recovery of funds previously disbursed, often through legal or contractual means, affecting cash flow and liabilities rather than initial income recognition. The core difference lies in write-offs being a recognition of loss, while clawbacks represent retrieval of funds after payment, influencing distinct aspects of financial management and reporting.

Legal Framework: Regulations Governing Write-Offs and Clawbacks

Write-offs are governed by accounting standards such as GAAP and IFRS, which dictate when assets can be derecognized due to uncollectibility or impairment, while clawbacks are primarily regulated by contractual agreements and securities laws aiming to recover funds from misconduct or executive compensation. Regulatory bodies like the SEC enforce clawback provisions under rules such as the Dodd-Frank Act, ensuring the return of incentive-based compensation linked to financial restatements or fraud. Understanding these distinct legal frameworks is essential for compliance and risk management in corporate finance and governance.

Financial Impact: How Each Affects Company Statements

Write-offs directly reduce a company's assets and increase expenses, leading to lower net income and shareholder equity on financial statements. Clawbacks recover previously paid amounts, resulting in adjustments to prior revenue or expense entries, which can improve cash flow but may complicate income statement comparisons over time. Both mechanisms impact earnings quality and investor perceptions, influencing key financial ratios such as return on assets and earnings per share.

Common Scenarios for Write-Offs in Business

Common scenarios for write-offs in business include uncollectible accounts receivable, obsolete inventory, and damaged or lost assets. Companies often write off bad debts when customers fail to pay, reflecting a realistic valuation of receivables on financial statements. Inventory write-offs occur when goods become outdated or unsellable, and asset write-offs result from physical damage or impairment, ensuring accurate financial reporting.

When Are Clawbacks Enforced? Real-World Examples

Clawbacks are enforced when companies or regulatory bodies seek to recover bonuses, incentives, or payments due to misconduct, financial restatements, or violations of contract terms, typically within a defined time frame after the original transaction. Real-world examples include the 2008 financial crisis, where several banks clawed back executive bonuses following widespread losses and legal scrutiny, and the SEC's actions against companies like Wells Fargo for fraudulent sales practices. Unlike write-offs, which are accounting measures to remove uncollectible assets from books, clawbacks involve active recovery of previously disbursed funds based on contractual or legal grounds.

Tax Implications: Write-Off vs Clawback

Write-offs reduce taxable income by allowing businesses to deduct bad debts or uncollectible expenses, decreasing overall tax liability. Clawbacks, conversely, require repayment of previously claimed tax benefits or deductions, potentially increasing taxable income and tax owed in subsequent periods. Understanding the timing and conditions of each can optimize tax strategy and compliance.

Best Practices for Managing Write-Offs and Clawbacks

Effective management of write-offs and clawbacks involves implementing clear policies that define criteria for both processes, ensuring accurate documentation and timely communication with stakeholders to minimize financial discrepancies. Leveraging automated accounting software enhances tracking and reporting, reducing errors and enabling swift reconciliation of accounts affected by write-offs or clawbacks. Regular audits and staff training on compliance standards help identify potential issues early, safeguarding revenue integrity and maintaining regulatory adherence.

Choosing the Right Approach: Strategic Considerations

Choosing between write-off and clawback requires analyzing cash flow impact and long-term financial health. Write-offs provide immediate tax benefits and clean balance sheets, while clawbacks enable recovery of previously paid amounts, preserving revenue integrity. Strategic considerations include risk tolerance, regulatory environment, and the likelihood of successful recovery.

Write-off Infographic

libterm.com

libterm.com