Understanding the true cost involves analyzing both upfront expenses and long-term financial impact, which can vary widely depending on factors such as quality, features, and maintenance. Making informed decisions requires comparing different options carefully to ensure optimal value for your investment. Explore the rest of this article to discover how to effectively manage and reduce costs in your specific context.

Table of Comparison

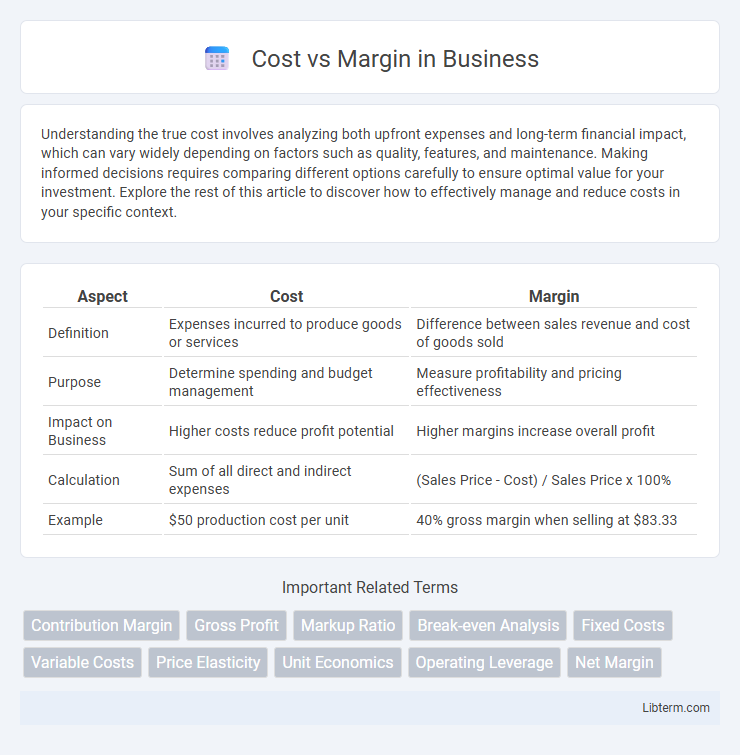

| Aspect | Cost | Margin |

|---|---|---|

| Definition | Expenses incurred to produce goods or services | Difference between sales revenue and cost of goods sold |

| Purpose | Determine spending and budget management | Measure profitability and pricing effectiveness |

| Impact on Business | Higher costs reduce profit potential | Higher margins increase overall profit |

| Calculation | Sum of all direct and indirect expenses | (Sales Price - Cost) / Sales Price x 100% |

| Example | $50 production cost per unit | 40% gross margin when selling at $83.33 |

Understanding Cost and Margin: Key Definitions

Understanding cost involves recognizing all expenses incurred in producing a product or service, including fixed and variable costs. Margin refers to the difference between sales revenue and the cost of goods sold, expressed as a percentage, indicating profitability. Grasping the relationship between cost and margin is essential for pricing strategies and financial decision-making in business operations.

The Importance of Cost Analysis in Business

Cost analysis plays a crucial role in determining profit margins by identifying all expenses associated with production and operations. Accurate cost evaluation enables businesses to set competitive prices while maintaining healthy profit margins. Understanding cost structures helps in strategic decision-making to optimize resource allocation and improve overall financial performance.

Margin: Types and Their Business Impact

Margin types, including gross margin, operating margin, and net profit margin, each provide critical insights into a company's profitability and operational efficiency. Gross margin highlights the percentage of revenue remaining after deducting direct costs, essential for pricing strategies and product line assessments. Operating margin and net profit margin reflect overall business health by accounting for operational expenses and all costs respectively, guiding strategic decisions and resource allocation.

How to Calculate Cost and Margin Effectively

Calculating cost effectively involves accurately summing all direct expenses such as raw materials, labor, and manufacturing overhead to determine the total cost of production. Margin calculation requires subtracting the total cost from the selling price and then dividing this difference by the selling price to express profit as a percentage. Utilizing precise cost accounting methods and regular margin analysis enables businesses to optimize pricing strategies and ensure profitability.

Cost vs Margin: What’s the Core Difference?

Cost represents the total expenditure required to produce or acquire a product, including materials, labor, and overhead, while margin refers to the difference between the selling price and the cost, indicating the profitability of a sale. Understanding the core difference between cost and margin is crucial for pricing strategies, as cost sets the baseline expense and margin measures financial gain. Effective management of costs directly impacts the achievable margin, influencing overall business profitability and competitive positioning.

Factors Influencing Cost and Margin Dynamics

Cost and margin dynamics are primarily influenced by raw material prices, labor expenses, and operational efficiency, which directly affect production costs. Market demand fluctuations and competitive pricing pressure play critical roles in determining profit margins by impacting selling prices and volume. Furthermore, technological advancements and supply chain optimization can reduce costs and enhance margin stability in dynamic economic environments.

Common Mistakes in Cost and Margin Calculation

Common mistakes in cost and margin calculation include inaccurately allocating fixed and variable costs, leading to distorted profit margins. Overlooking indirect costs such as overhead expenses often results in underestimating true production costs, which impacts pricing strategy and profitability. Failing to update cost components regularly can cause outdated margin analysis, impairing decision-making and financial forecasting.

Strategies to Optimize Margin Without Raising Costs

Implementing targeted pricing strategies such as value-based pricing enhances profit margins without increasing costs by aligning prices with customer perceived value. Streamlining operations through process automation and waste reduction improves efficiency, reducing overhead expenses, which directly boosts margin. Leveraging data analytics for demand forecasting and inventory management minimizes stockouts and overstocks, optimizing resource allocation while maintaining cost control.

Tools and Software for Monitoring Cost vs Margin

Tools and software for monitoring cost vs margin enable businesses to track expenses and revenue in real-time, ensuring accurate profitability analysis. Platforms like QuickBooks, Microsoft Power BI, and Tableau integrate cost data with sales metrics to visualize margins effectively. Automated dashboards and alerts help identify cost overruns and margin erosion, driving informed financial decisions.

Best Practices for Balancing Cost and Margin

Optimizing cost and margin requires precise tracking of production expenses and strategic pricing models that reflect market demand and value perception. Implementing lean manufacturing techniques and leveraging technology for supply chain efficiency reduce costs while maintaining product quality. Regular financial analysis and dynamic margin adjustments enable businesses to respond swiftly to market fluctuations, maximizing profitability without sacrificing competitiveness.

Cost Infographic

libterm.com

libterm.com