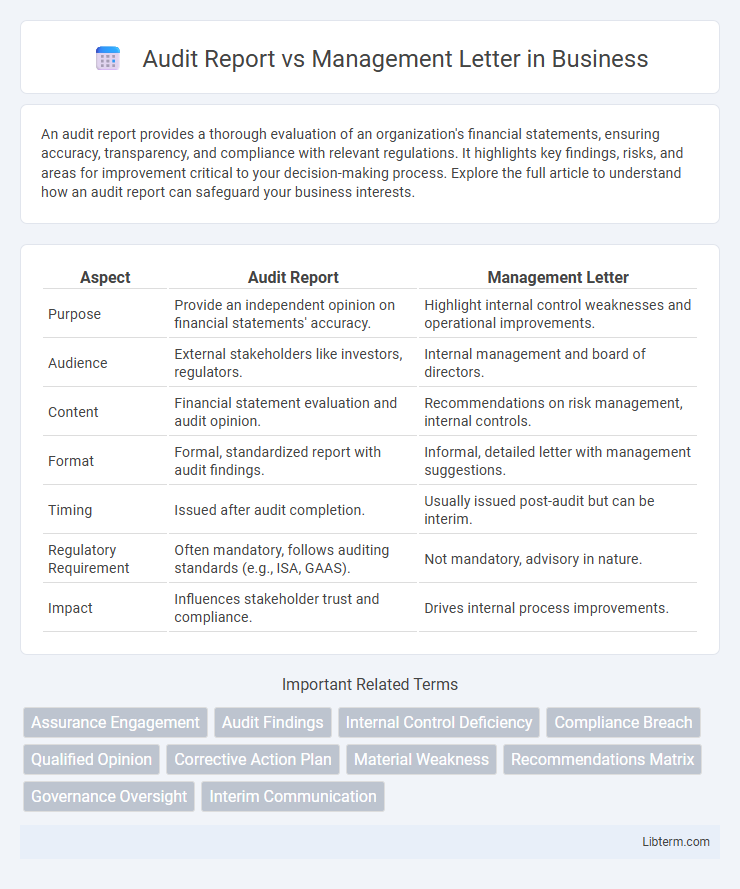

An audit report provides a thorough evaluation of an organization's financial statements, ensuring accuracy, transparency, and compliance with relevant regulations. It highlights key findings, risks, and areas for improvement critical to your decision-making process. Explore the full article to understand how an audit report can safeguard your business interests.

Table of Comparison

| Aspect | Audit Report | Management Letter |

|---|---|---|

| Purpose | Provide an independent opinion on financial statements' accuracy. | Highlight internal control weaknesses and operational improvements. |

| Audience | External stakeholders like investors, regulators. | Internal management and board of directors. |

| Content | Financial statement evaluation and audit opinion. | Recommendations on risk management, internal controls. |

| Format | Formal, standardized report with audit findings. | Informal, detailed letter with management suggestions. |

| Timing | Issued after audit completion. | Usually issued post-audit but can be interim. |

| Regulatory Requirement | Often mandatory, follows auditing standards (e.g., ISA, GAAS). | Not mandatory, advisory in nature. |

| Impact | Influences stakeholder trust and compliance. | Drives internal process improvements. |

Introduction to Audit Reports and Management Letters

Audit reports provide a formal, structured evaluation of an organization's financial statements, ensuring compliance with accounting standards and regulatory requirements. Management letters focus on internal controls, operational improvements, and recommendations identified during the audit process. Both documents serve distinct roles in communicating findings, with audit reports offering an opinion on financial accuracy, while management letters highlight areas for management's attention and corrective action.

Definition and Purpose of Audit Reports

Audit reports provide a formal evaluation of a company's financial statements, offering assurance to stakeholders regarding accuracy, compliance, and transparency. Their primary purpose is to communicate the auditor's opinion on whether the financial statements present a true and fair view in accordance with relevant accounting standards. In contrast, management letters highlight internal control weaknesses and offer recommendations to improve operational efficiency, aiming to assist management in strengthening governance and risk management practices.

Definition and Purpose of Management Letters

Management letters are formal communications issued by auditors to an organization's management, highlighting internal control weaknesses, operational inefficiencies, and recommendations for improvement. Unlike audit reports, which provide an opinion on the financial statements' fairness and compliance with accounting standards, management letters focus on enhancing business processes and risk management. The purpose of management letters is to assist management in strengthening internal controls and improving overall governance, ensuring more effective and efficient operations.

Key Differences Between Audit Reports and Management Letters

Audit reports provide an objective evaluation of a company's financial statements to ensure accuracy and compliance with accounting standards, while management letters focus on internal control weaknesses and operational improvements identified during the audit. Audit reports are formal documents intended for external stakeholders, emphasizing the fairness of financial representation, whereas management letters are directed at company management, offering recommendations to enhance business practices. The key difference lies in their purpose and audience: audit reports validate financial integrity externally, whereas management letters serve as internal tools for organizational betterment.

Structure and Components of an Audit Report

An audit report typically includes a title, addressee, introduction, scope, auditor's opinion, and signature, providing a formal conclusion on the financial statements' fairness and compliance with accounting standards. The management letter, in contrast, contains observations on internal controls, operational issues, and recommendations for improvement without expressing an overall opinion on the financial statements. The structured nature of the audit report ensures clarity and legal significance, while the management letter serves as a complementary document aimed at enhancing organizational processes.

Structure and Contents of a Management Letter

A management letter typically comprises observations on internal controls, operational inefficiencies, and recommendations for improvements, structured into distinct sections such as an executive summary, detailed findings, and actionable suggestions. Unlike the audit report, which focuses on expressing an opinion on financial statements' fairness, the management letter emphasizes practical insights to enhance entity governance and risk management. The document's content often includes identified weaknesses, potential risks, and proposed corrective measures tailored to the management's operational responsibilities.

Users and Recipients: Who Reads What?

Audit reports are primarily read by external stakeholders such as investors, regulators, and creditors who rely on the verified financial statements to make informed decisions. Management letters are directed at an organization's internal management team and provide detailed insights, recommendations, and observations to improve internal controls and operational efficiency. While audit reports ensure compliance and accountability, management letters focus on enhancing management practices and risk mitigation strategies.

Significance in Corporate Governance and Compliance

An audit report provides an independent assessment of a company's financial statements, ensuring transparency and accountability critical for corporate governance and regulatory compliance. The management letter highlights internal control weaknesses and operational improvements, enabling boards and executives to strengthen risk management and regulatory adherence. Together, these documents enhance stakeholder confidence by promoting effective oversight and continuous improvement in governance frameworks.

Common Misconceptions About Audit Reports and Management Letters

Audit reports and management letters serve distinct purposes: audit reports provide an opinion on financial statement accuracy, while management letters highlight internal control weaknesses and operational improvements. A common misconception is that management letters replace audit reports, when in fact they complement each other by addressing separate aspects of an audit engagement. Misunderstandings also arise around the implication of findings; audit reports focus on material misstatements, whereas management letters often contain recommendations not directly related to financial statement accuracy.

Conclusion: Choosing the Right Document for Effective Communication

The audit report provides a formal opinion on the financial statements' accuracy and compliance, essential for external stakeholders' assurance, while the management letter offers detailed recommendations and observations aimed at improving internal controls and operational efficiency for management. Selecting the appropriate document depends on the target audience and communication goals: use the audit report to confirm financial integrity and the management letter to address specific risks and improvement areas. Effective communication in auditing hinges on leveraging both documents strategically to enhance transparency and facilitate informed decision-making.

Audit Report Infographic

libterm.com

libterm.com