Working capital is essential for managing your business's day-to-day operations by ensuring there are sufficient assets to cover short-term liabilities. Efficient working capital management improves liquidity, operational efficiency, and financial health. Discover more about optimizing your working capital to strengthen your business performance by reading the full article.

Table of Comparison

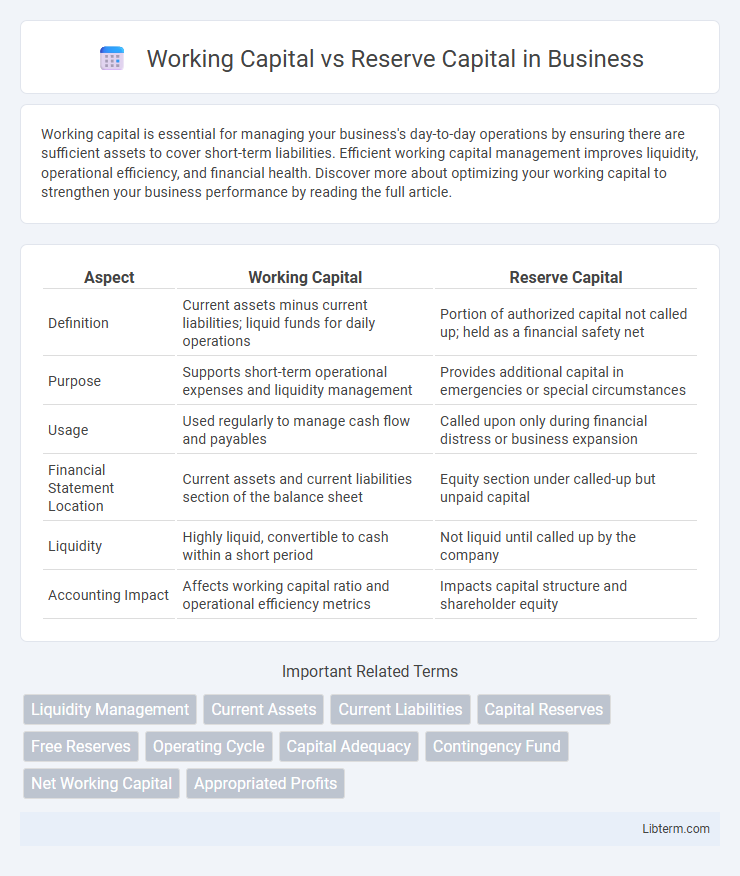

| Aspect | Working Capital | Reserve Capital |

|---|---|---|

| Definition | Current assets minus current liabilities; liquid funds for daily operations | Portion of authorized capital not called up; held as a financial safety net |

| Purpose | Supports short-term operational expenses and liquidity management | Provides additional capital in emergencies or special circumstances |

| Usage | Used regularly to manage cash flow and payables | Called upon only during financial distress or business expansion |

| Financial Statement Location | Current assets and current liabilities section of the balance sheet | Equity section under called-up but unpaid capital |

| Liquidity | Highly liquid, convertible to cash within a short period | Not liquid until called up by the company |

| Accounting Impact | Affects working capital ratio and operational efficiency metrics | Impacts capital structure and shareholder equity |

Introduction to Working Capital and Reserve Capital

Working capital represents the funds a company uses for its day-to-day operational expenses, including inventory, accounts receivable, and accounts payable, ensuring liquidity and smooth business operations. Reserve capital, on the other hand, refers to the portion of authorized capital that has been allotted but is not yet called up, serving as a financial safeguard for future investment or contingencies. Understanding the distinction between working capital and reserve capital is crucial for effective financial planning and maintaining business solvency.

Defining Working Capital

Working capital refers to the difference between a company's current assets and current liabilities, representing the funds available for day-to-day operations. It is crucial for maintaining liquidity, ensuring the business can meet short-term obligations and manage operational expenses efficiently. Reserve capital, in contrast, is a portion of capital set aside for future contingencies and long-term financial stability, not intended for routine use.

Defining Reserve Capital

Reserve capital refers to the portion of a company's authorized capital that is not called up or paid by shareholders and remains unissued, serving as a financial safeguard for future contingencies or expansion. Unlike working capital, which represents liquid assets readily available to cover daily operational expenses, reserve capital acts as a long-term financial buffer, enhancing a company's stability and creditworthiness. This reserved amount is critical for maintaining solvency during economic downturns or unforeseen financial demands.

Key Differences Between Working Capital and Reserve Capital

Working capital represents the funds utilized for day-to-day operational expenses, including inventory, salaries, and short-term liabilities, ensuring business liquidity. Reserve capital, on the other hand, is the portion of authorized capital not called up and held in reserve, providing financial strength for future contingencies or expansion. The key difference lies in working capital being actively employed for operational needs, while reserve capital remains unused, acting as a financial safeguard.

Importance of Working Capital in Business Operations

Working capital is crucial for maintaining smooth business operations by ensuring liquidity to cover day-to-day expenses such as payroll, inventory, and utilities. It directly impacts a company's operational efficiency and ability to meet short-term obligations, preventing disruptions in production and service delivery. Unlike reserve capital, which serves as a financial safety net for long-term stability, working capital is actively used to sustain ongoing business activities and drive growth.

Role of Reserve Capital in Financial Stability

Reserve Capital acts as a financial buffer that enhances a company's financial stability by covering unforeseen contingencies and obligations when working capital is insufficient. While Working Capital manages daily operational expenses by balancing current assets and liabilities, Reserve Capital strengthens long-term solvency and creditor confidence. Maintaining adequate Reserve Capital reduces liquidity risks, ensuring sustained business operations during economic downturns or emergencies.

Sources of Working Capital

Sources of working capital primarily include trade credit, bank loans, and inventory financing, which provide short-term liquidity for daily operations. Reserve capital, unlike working capital, represents a company's uncalled capital intended to cover future contingencies and is not utilized for immediate operational funding. Efficient management of diverse working capital sources ensures smooth cash flow and sustains business solvency.

Creation and Utilization of Reserve Capital

Reserve capital is created by setting aside a portion of a company's authorized capital, which remains uncalled until needed, providing a financial buffer without impacting working capital used for daily operations. It is utilized only in specific situations like covering liabilities or meeting unforeseen expenses, ensuring business stability. Unlike working capital, which is actively employed in managing short-term assets and liabilities, reserve capital serves as a passive financial safeguard.

Impact on Company Liquidity and Solvency

Working capital directly influences a company's liquidity by representing the difference between current assets and current liabilities, ensuring sufficient cash flow for day-to-day operations. Reserve capital, a portion of shareholder funds allocated for future contingencies, strengthens solvency by providing long-term financial stability and supporting debt obligations. Maintaining optimal levels of working capital enhances a company's ability to meet short-term liabilities, while adequate reserve capital safeguards against financial distress and reinforces overall creditworthiness.

Conclusion: Choosing the Right Capital Management Strategy

Choosing the right capital management strategy depends on a company's operational needs and financial stability. Working capital ensures smooth day-to-day operations by managing short-term assets and liabilities, while reserve capital acts as a financial safeguard for unforeseen expenses or investments. Prioritizing effective working capital management alongside maintaining adequate reserve capital strengthens overall financial resilience and supports sustainable business growth.

Working Capital Infographic

libterm.com

libterm.com