A broker acts as an intermediary between buyers and sellers, facilitating transactions in various markets such as real estate, finance, and insurance. Understanding the role of a broker can help you make informed decisions and secure better deals. Explore the rest of this article to learn how a broker can benefit your investments and transactions.

Table of Comparison

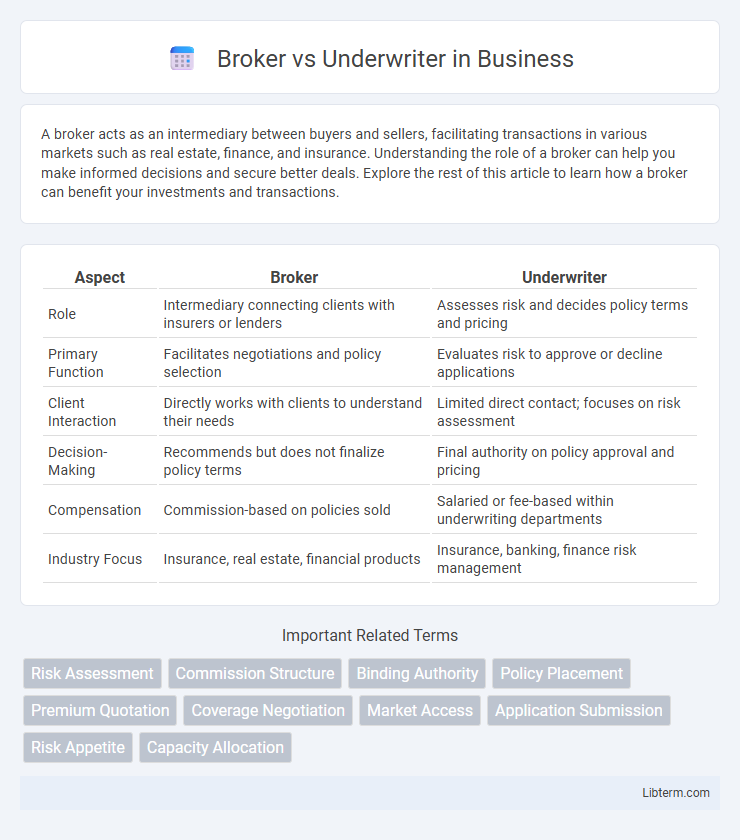

| Aspect | Broker | Underwriter |

|---|---|---|

| Role | Intermediary connecting clients with insurers or lenders | Assesses risk and decides policy terms and pricing |

| Primary Function | Facilitates negotiations and policy selection | Evaluates risk to approve or decline applications |

| Client Interaction | Directly works with clients to understand their needs | Limited direct contact; focuses on risk assessment |

| Decision-Making | Recommends but does not finalize policy terms | Final authority on policy approval and pricing |

| Compensation | Commission-based on policies sold | Salaried or fee-based within underwriting departments |

| Industry Focus | Insurance, real estate, financial products | Insurance, banking, finance risk management |

Introduction to Brokers and Underwriters

Brokers act as intermediaries, connecting buyers and sellers in financial markets to facilitate transactions, while underwriters assess risks and determine the terms for insurance policies or securities offerings. Brokers typically work on commissions and provide market access and advice, whereas underwriters analyze financial information to set pricing and policy conditions. Understanding their distinct roles is crucial for effective financial and insurance decision-making.

Defining the Role of a Broker

A broker acts as an intermediary who connects buyers and sellers, facilitating transactions without assuming the risk of the assets involved. They provide clients with market information, negotiate terms, and earn commissions or fees based on completed deals. By understanding client needs and market conditions, brokers optimize matching parties in insurance, real estate, or securities markets.

Understanding the Function of an Underwriter

An underwriter evaluates the risk and determines the terms and pricing of insurance policies, loans, or securities offerings to protect the financial interests of the issuer. Unlike brokers who act as intermediaries between clients and providers, underwriters use detailed data analysis and risk assessment models to decide whether to approve or reject applications. Their function ensures appropriate risk management and compliance with regulatory standards within financial and insurance industries.

Key Differences Between Brokers and Underwriters

Brokers act as intermediaries who connect buyers and sellers, facilitating transactions without assuming financial risk, while underwriters evaluate and assume risks by guaranteeing the purchase of securities or insurance policies. Brokers earn commissions based on sales, relying on market knowledge and client relationships, whereas underwriters make profits from the spread between the price they pay and the price at which they sell securities or policies. The primary key difference lies in risk assumption: underwriters bear financial risk, whereas brokers provide advisory and transactional services without direct exposure to financial loss.

Responsibilities and Decision-Making

Brokers act as intermediaries between buyers and sellers, focusing on negotiating terms, securing clients, and facilitating transactions without assuming risk. Underwriters evaluate financial and risk information to determine the eligibility, terms, and pricing of insurance policies or loans, ultimately making binding decisions on coverage or credit approval. Brokers prioritize client acquisition and market matching, while underwriters are responsible for risk assessment and regulatory compliance in decision-making processes.

Impact on Clients and Policyholders

Brokers act as intermediaries who represent clients' interests by seeking the best insurance policies tailored to individual needs, ensuring transparency and personalized options. Underwriters assess risk and determine policy terms, directly influencing the premiums and coverage available to policyholders based on their risk profiles. The interplay between brokers' client advocacy and underwriters' risk evaluation shapes the accessibility, affordability, and suitability of insurance solutions.

Required Skills and Qualifications

Brokers require strong negotiation skills, excellent communication abilities, and an in-depth understanding of market trends to effectively connect buyers and sellers. Underwriters need analytical expertise, attention to detail, and proficiency in risk assessment tools to evaluate loan or insurance applications accurately. Both roles demand industry-specific certifications, such as FINRA licenses for brokers and Chartered Property Casualty Underwriter (CPCU) designation for underwriters.

Regulatory and Compliance Considerations

Brokers must adhere to regulatory frameworks such as the SEC and FINRA rules, ensuring transparent client disclosures and fair dealing practices. Underwriters operate under strict compliance with securities laws, including due diligence requirements mandated by the Securities Act of 1933 to prevent misrepresentation in securities offerings. Both entities must maintain rigorous record-keeping and reporting protocols to meet regulatory audits and protect investor interests.

Pros and Cons: Broker vs Underwriter

Brokers offer clients access to multiple insurance options, enhancing market competition and personalized coverage, but may face conflicts of interest due to commission-based earnings. Underwriters provide risk assessment expertise, ensuring appropriate policy pricing and risk management, though they often have limited product options and focus on company profitability over client choice. Choosing between a broker and an underwriter depends on whether priority is given to variety and tailored advice or to precise risk evaluation and underwriting control.

Choosing the Right Professional for Your Needs

Selecting the right professional depends on your specific financial goals: brokers act as intermediaries connecting buyers and sellers in insurance or securities markets, while underwriters assess risk and set terms for loans or insurance policies. Brokers offer personalized advice and a broad market overview, making them ideal for clients seeking multiple options and tailored strategies. Underwriters provide essential risk evaluation to ensure favorable terms, which benefits those requiring specialized assessments to secure funding or coverage.

Broker Infographic

libterm.com

libterm.com