Equity capital represents the funds invested by shareholders in exchange for ownership stakes in a company, serving as a crucial resource for growth and operations. It strengthens the company's balance sheet by providing long-term financing without the obligation to repay like debt, thus supporting strategic initiatives and business expansion. Explore the following sections to understand how equity capital can impact your company's financial health and growth potential.

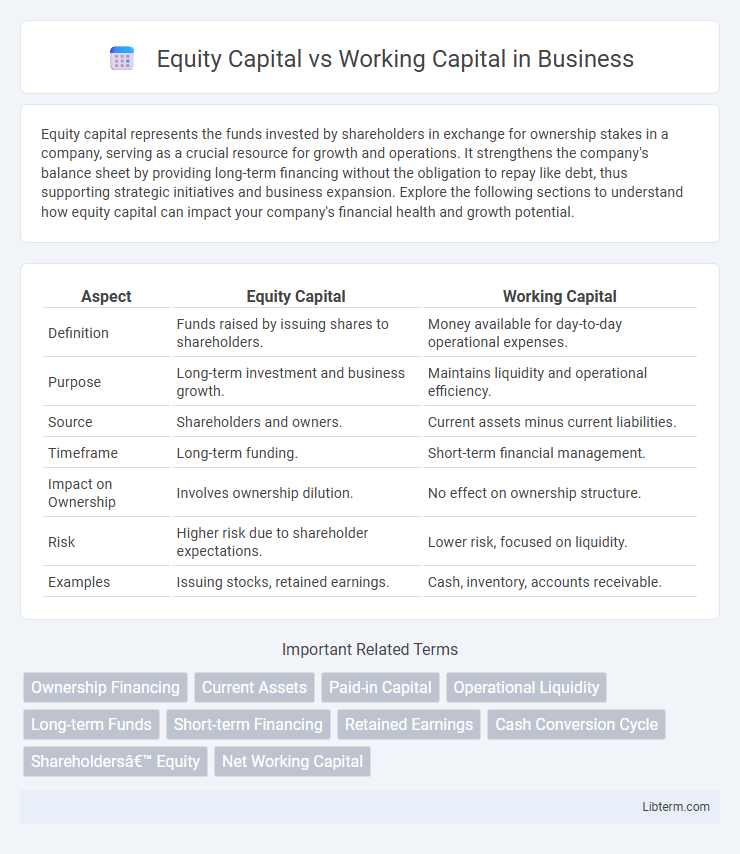

Table of Comparison

| Aspect | Equity Capital | Working Capital |

|---|---|---|

| Definition | Funds raised by issuing shares to shareholders. | Money available for day-to-day operational expenses. |

| Purpose | Long-term investment and business growth. | Maintains liquidity and operational efficiency. |

| Source | Shareholders and owners. | Current assets minus current liabilities. |

| Timeframe | Long-term funding. | Short-term financial management. |

| Impact on Ownership | Involves ownership dilution. | No effect on ownership structure. |

| Risk | Higher risk due to shareholder expectations. | Lower risk, focused on liquidity. |

| Examples | Issuing stocks, retained earnings. | Cash, inventory, accounts receivable. |

Defining Equity Capital

Equity capital represents the funds invested by shareholders or owners in a company, providing permanent financing without repayment obligations. It forms the foundation of a company's financial structure, enabling long-term growth and stability. Unlike working capital, which manages short-term operational liquidity, equity capital supports strategic investments and business expansion.

Understanding Working Capital

Working capital represents the difference between a company's current assets and current liabilities, serving as a key indicator of short-term financial health and operational efficiency. Unlike equity capital, which reflects long-term investment from shareholders, working capital is used to fund day-to-day business operations, such as payroll, inventory management, and supplier payments. Positive working capital ensures a company can meet its short-term obligations and continue smooth business functioning without liquidity issues.

Key Differences Between Equity Capital and Working Capital

Equity capital represents the funds invested by shareholders in a company, serving as long-term financing for business growth and asset acquisition, while working capital measures the company's short-term liquidity, reflecting the difference between current assets and current liabilities. Equity capital is permanent and doesn't require repayment, impacting the company's ownership structure, whereas working capital fluctuates regularly to support day-to-day operational expenses such as inventory and payroll. Understanding these distinctions is crucial for financial management, as equity capital influences long-term solvency and control, and working capital affects operational efficiency and cash flow stability.

Sources of Equity Capital

Equity capital primarily originates from shareholders through the issuance of common and preferred shares, representing ownership stakes in a company. Additional sources include retained earnings reinvested into the business and funds raised via private equity investments or venture capital. These funds provide long-term financing without the obligation of repayment, distinguishing equity capital from working capital, which is typically derived from short-term liabilities or current assets used to manage day-to-day operational expenses.

Components of Working Capital

Working capital consists of current assets such as cash, accounts receivable, and inventory, minus current liabilities including accounts payable and short-term debt. This metric reflects a company's ability to meet short-term obligations and manage operational efficiency. In contrast, equity capital represents shareholders' investment in the company, serving as a long-term source of financing rather than for daily operational needs.

Importance of Equity Capital in Business Growth

Equity capital forms the foundational investment in a business, fueling long-term growth by providing financial stability and enabling expansion without incurring debt. Unlike working capital, which manages short-term operational expenses, equity capital supports strategic initiatives such as research and development, market entry, and asset acquisition. The availability of strong equity capital attracts investors and improves creditworthiness, making it critical for sustainable business development.

Role of Working Capital in Daily Operations

Working capital plays a crucial role in managing a company's daily operations by ensuring sufficient liquidity to meet short-term obligations such as payroll, inventory purchases, and rent. Unlike equity capital, which provides long-term funding and financial stability, working capital directly impacts operational efficiency and cash flow management. Maintaining optimal working capital levels helps prevent disruptions in activities and supports smooth business continuity.

Impact on Financial Health and Performance

Equity capital strengthens a company's financial health by providing long-term funding without the obligation of repayment, enhancing creditworthiness and investor confidence. Working capital reflects the firm's operational efficiency and short-term liquidity, directly influencing its ability to meet immediate financial obligations and sustain smooth business operations. A balanced management of both equity capital and working capital is crucial for maintaining optimal financial performance and mitigating risks related to insolvency or undercapitalization.

Equity Capital vs Working Capital: Advantages and Disadvantages

Equity capital provides long-term funding without repayment obligations, enhancing business stability and creditworthiness, but it may dilute ownership and control for existing shareholders. Working capital ensures smooth daily operations by managing current assets and liabilities, improving liquidity and operational efficiency, yet it is limited to short-term financial needs and can fluctuate with business cycles. The choice between equity capital and working capital depends on balancing long-term growth versus short-term operational demands, factoring in cost, control, and financial flexibility.

Choosing the Right Capital Mix for Your Business

Choosing the right capital mix involves balancing equity capital, which provides long-term funding through ownership stakes, with working capital, essential for daily operational liquidity. Businesses must assess their growth stage, risk tolerance, and cash flow requirements to optimize this balance, ensuring sustainable expansion and operational efficiency. Strategic allocation enhances financial stability by leveraging equity to reduce debt burden while maintaining sufficient working capital for ongoing expenses.

Equity Capital Infographic

libterm.com

libterm.com