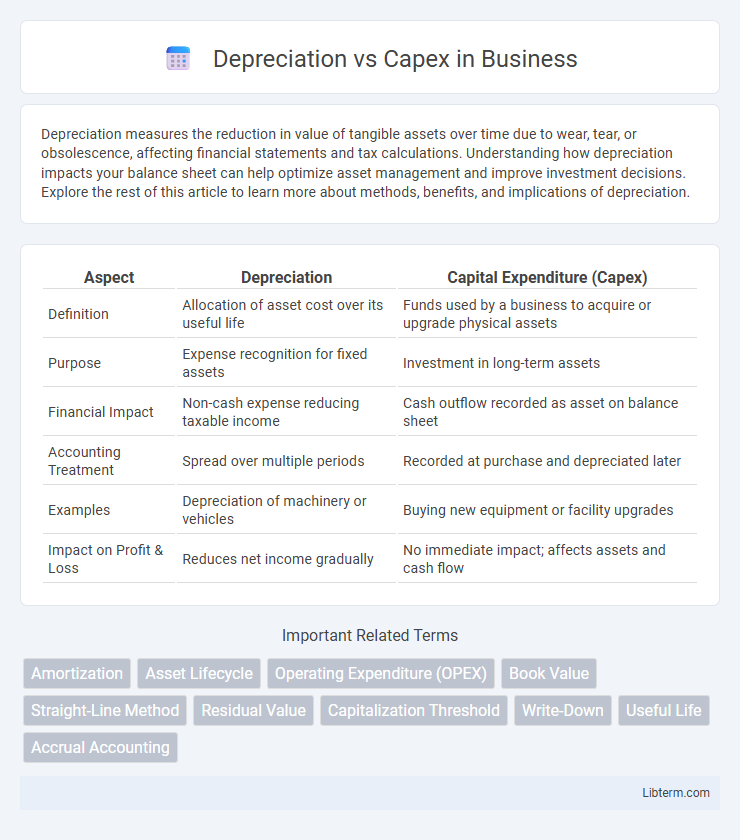

Depreciation measures the reduction in value of tangible assets over time due to wear, tear, or obsolescence, affecting financial statements and tax calculations. Understanding how depreciation impacts your balance sheet can help optimize asset management and improve investment decisions. Explore the rest of this article to learn more about methods, benefits, and implications of depreciation.

Table of Comparison

| Aspect | Depreciation | Capital Expenditure (Capex) |

|---|---|---|

| Definition | Allocation of asset cost over its useful life | Funds used by a business to acquire or upgrade physical assets |

| Purpose | Expense recognition for fixed assets | Investment in long-term assets |

| Financial Impact | Non-cash expense reducing taxable income | Cash outflow recorded as asset on balance sheet |

| Accounting Treatment | Spread over multiple periods | Recorded at purchase and depreciated later |

| Examples | Depreciation of machinery or vehicles | Buying new equipment or facility upgrades |

| Impact on Profit & Loss | Reduces net income gradually | No immediate impact; affects assets and cash flow |

Understanding Depreciation and Capex

Depreciation represents the systematic allocation of the cost of tangible assets over their useful lives, reflecting wear and tear or obsolescence in financial statements. Capex, or capital expenditures, are funds used by a company to acquire, upgrade, and maintain physical assets such as property, industrial buildings, or equipment, directly impacting the company's long-term operational capacity. Understanding the distinction between depreciation and Capex is crucial for accurate financial analysis, as Capex increases asset value while depreciation spreads cost over time, affecting profitability and tax calculations.

Key Differences Between Depreciation and Capex

Depreciation represents the systematic allocation of the cost of a tangible asset over its useful life, reflecting the asset's consumption and aging in financial statements. Capex (capital expenditures) refers to the actual funds used by a company to acquire, upgrade, or maintain physical assets like property, equipment, or machinery. The key difference lies in timing and accounting treatment: Capex is recorded as an asset on the balance sheet when incurred, while depreciation is the non-cash expense recognized periodically to allocate the cost of that asset over time.

The Purpose of Capital Expenditures (Capex)

Capital Expenditures (Capex) represent investments in acquiring or upgrading physical assets such as buildings, machinery, and equipment, designed to enhance operational capacity and extend productive life. These expenditures are crucial for business growth, enabling companies to maintain competitiveness and support long-term strategic goals. Depreciation, in contrast, systematically allocates the cost of these capital assets over their useful life, reflecting asset wear and aging in financial statements.

How Depreciation Works in Accounting

Depreciation in accounting systematically allocates the cost of a tangible asset over its useful life, reflecting wear and tear or obsolescence. This non-cash expense reduces taxable income while preserving cash flow, making it a critical factor in financial reporting and tax planning. Unlike Capex, which represents the initial outlay for acquiring or upgrading assets, depreciation spreads that cost over time, aligning expenses with revenue generation.

Impact on Financial Statements: Depreciation vs Capex

Depreciation reduces net income on the income statement by allocating the cost of fixed assets over their useful life, while it simultaneously decreases the asset's book value on the balance sheet. Capital expenditures (Capex) increase the asset base on the balance sheet without immediately impacting net income, as these costs are capitalized and expensed over time through depreciation. The cash flow statement reflects Capex as an outflow under investing activities, whereas depreciation is added back in operating activities since it is a non-cash expense.

Tax Implications: Capex vs Depreciation

Capital expenditures (Capex) represent significant upfront investments in assets, which are not immediately deductible for tax purposes but are capitalized and depreciated over the asset's useful life, spreading tax benefits over multiple years. Depreciation allows businesses to allocate the cost of tangible assets as an expense on their income statement, reducing taxable income annually and providing a tax shield over time. Understanding the timing and impact of Capex versus depreciation is crucial for effective tax planning, as it affects cash flow, taxable income, and overall tax liability.

Effect on Cash Flow and Budgeting

Depreciation is a non-cash expense that reduces taxable income without impacting immediate cash flow, while Capex (capital expenditures) requires actual cash outlay affecting cash flow directly. In budgeting, Capex demands careful planning due to its significant upfront costs and long-term asset implications, whereas depreciation spreads expense recognition evenly, aiding in smoother profit analysis over time. Understanding the difference between depreciation and Capex is crucial for effective cash flow management and accurate financial forecasting.

Depreciation Methods and Their Significance

Depreciation methods such as straight-line, declining balance, and units of production determine how asset costs are allocated over time, impacting financial statements and tax liabilities. Straight-line depreciation evenly spreads costs, while declining balance accelerates expense recognition, benefiting businesses with quickly aging assets. Choosing the appropriate method is crucial for accurate asset valuation, budgeting, and compliance with accounting standards like GAAP or IFRS.

Strategic Decision-Making: When to Spend Capex

Strategic decision-making on Capex spending involves evaluating long-term asset value against immediate operational needs, with depreciation accounting providing insight into asset cost allocation over time. Investing in capital expenditures demands assessing potential returns, impact on cash flow, and alignment with growth objectives to ensure sustainable financial health. Understanding the interplay between Capex outlays and depreciation expenses enables businesses to optimize capital deployment while maintaining accurate financial reporting.

Best Practices for Managing Capex and Depreciation

Effective management of Capex and depreciation requires detailed tracking of asset life cycles and aligning capital expenditures with strategic business goals to optimize tax benefits and cash flow. Organizations should implement robust asset management systems to monitor depreciation schedules accurately, ensuring financial statements reflect true asset values and support budget forecasting. Regularly reviewing and adjusting Capex plans and depreciation methods helps maintain compliance with accounting standards and maximizes resource allocation efficiency.

Depreciation Infographic

libterm.com

libterm.com