Auction markets facilitate the buying and selling of goods or services through competitive bidding, ensuring fair market prices driven by supply and demand dynamics. Participants actively engage by placing bids, allowing the market to discover equilibrium prices efficiently. Explore the rest of the article to understand how auction markets operate and how you can benefit from them.

Table of Comparison

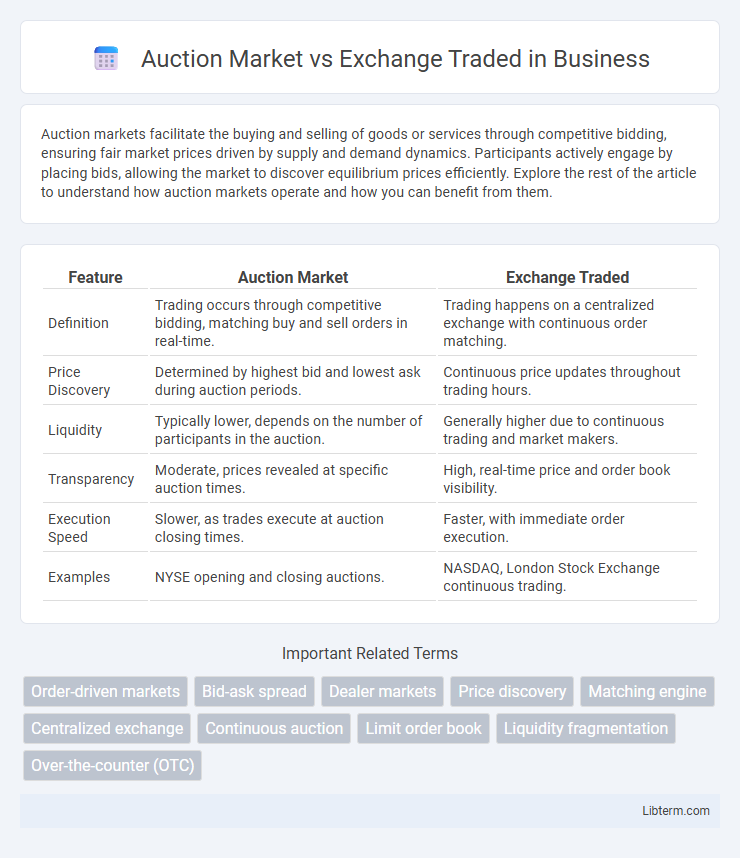

| Feature | Auction Market | Exchange Traded |

|---|---|---|

| Definition | Trading occurs through competitive bidding, matching buy and sell orders in real-time. | Trading happens on a centralized exchange with continuous order matching. |

| Price Discovery | Determined by highest bid and lowest ask during auction periods. | Continuous price updates throughout trading hours. |

| Liquidity | Typically lower, depends on the number of participants in the auction. | Generally higher due to continuous trading and market makers. |

| Transparency | Moderate, prices revealed at specific auction times. | High, real-time price and order book visibility. |

| Execution Speed | Slower, as trades execute at auction closing times. | Faster, with immediate order execution. |

| Examples | NYSE opening and closing auctions. | NASDAQ, London Stock Exchange continuous trading. |

Introduction to Auction Markets and Exchange-Traded Markets

Auction markets facilitate price discovery by matching buy and sell orders through a centralized bidding process, often seen in stock exchanges like the New York Stock Exchange (NYSE). Exchange-traded markets enable transparent trading of standardized securities or derivatives, allowing participants to execute orders instantly at prevailing market prices. Both market types rely on order books but differ in execution mechanisms, with auction markets emphasizing competitive bidding and exchange-traded markets prioritizing continuous trading.

Defining Auction Markets: Key Features

Auction markets operate by matching buyers and sellers through a competitive bidding process where participants submit bids and offers simultaneously to determine the market price. Key features include transparency in price discovery, order-driven trading, and the presence of a centralized auctioneer or electronic system facilitating transactions at a single price point. This structure contrasts with exchange-traded markets that often use dealer-based systems or continuous trading mechanisms.

Understanding Exchange-Traded Markets

Exchange-traded markets involve standardized contracts, such as stocks, bonds, or derivatives, traded on regulated exchanges like the NYSE or NASDAQ, which provide transparency, liquidity, and price discovery. These markets operate with continuous auction mechanisms where buyers and sellers interact in real-time, ensuring efficient matching of orders and market equilibrium. Unlike auction markets that may include periodic or irregular bidding, exchange-traded markets offer consistent regulatory oversight and automated clearing, reducing counterparty risk.

Comparison: Auction Market vs Exchange-Traded Market

Auction markets operate through a centralized process where buyers and sellers submit competing bids and offers, enabling price discovery through direct interaction. Exchange-traded markets facilitate trading of standardized financial instruments on regulated platforms, offering transparency, liquidity, and strict regulatory oversight. While auction markets emphasize price matching via competitive bids, exchange-traded markets ensure standardized contract terms and faster transaction execution through automated systems.

Trading Mechanisms in Auction Markets

Auction markets utilize a centralized bidding process where buyers and sellers submit competitive bids and offers, allowing prices to be determined transparently through supply and demand interaction. This mechanism promotes price discovery and liquidity by aggregating all orders in a single location, often facilitated by a designated market maker or specialist. Unlike exchange-traded markets with continuous trading, auction markets execute transactions at specific intervals, such as opening or closing auctions, enhancing market efficiency during volatile periods.

Order Matching Process in Exchange-Traded Markets

The order matching process in exchange-traded markets operates through electronic order books that pair buy and sell orders based on price-time priority, ensuring transparency and fairness. Unlike auction markets where orders accumulate and are matched at specific intervals, exchange-traded systems execute trades continuously, allowing real-time price discovery and liquidity. This mechanism reduces bid-ask spreads and enhances market efficiency by promptly matching market participants' orders.

Liquidity Differences: Auction vs Exchange-Traded

Auction markets, such as the New York Stock Exchange, determine prices through a centralized bidding process where buyers and sellers interact directly, often resulting in higher liquidity for less frequently traded securities. Exchange-traded markets, like NASDAQ, rely on a network of dealers providing continuous bid-ask quotes, enhancing liquidity especially for highly liquid, high-volume stocks. The auction market's transparent price discovery contrasts with the dealer-based exchange model, influencing liquidity by balancing supply and demand in real-time.

Price Discovery and Transparency

Auction markets facilitate price discovery through direct interaction of buyers and sellers, enabling competitive bidding that reveals the true market value of assets. Exchange-traded markets offer higher transparency by providing standardized pricing, centralized order books, and real-time trade data accessible to all participants. This combination enhances market efficiency, reduces information asymmetry, and supports fairer valuation processes.

Risks and Advantages of Each Market Type

Auction markets offer transparency through continuous price discovery and open bidding, reducing the risk of price manipulation but may face liquidity risks during low participation periods. Exchange-traded markets provide standardized contracts and regulated environments, enhancing risk management and reducing counterparty risk, though they may incur higher fees and limit flexibility in trade negotiation. Understanding these distinctions helps traders balance market efficiency with risk exposure in their investment strategies.

Choosing the Right Market for Traders and Investors

Choosing the right market involves understanding the auction market's price discovery mechanism, where buyers and sellers submit bids and offers to establish equilibrium prices, versus the exchange-traded market's continuous trading model with real-time price updates and liquidity. Traders seeking transparency and price accuracy may prefer auction markets like the New York Stock Exchange, while those prioritizing speed and ease of access might lean towards electronically exchange-traded platforms such as NASDAQ. Evaluating factors like trading volume, volatility, order types, and transaction costs is crucial for aligning market choice with investment goals and risk tolerance.

Auction Market Infographic

libterm.com

libterm.com