EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, serves as a key financial metric that measures a company's operating performance by focusing on profitability from core operations. It excludes non-operational expenses and provides insight into cash flow potential and overall financial health. Explore the rest of the article to better understand how EBITDA impacts your investment decisions and business analysis.

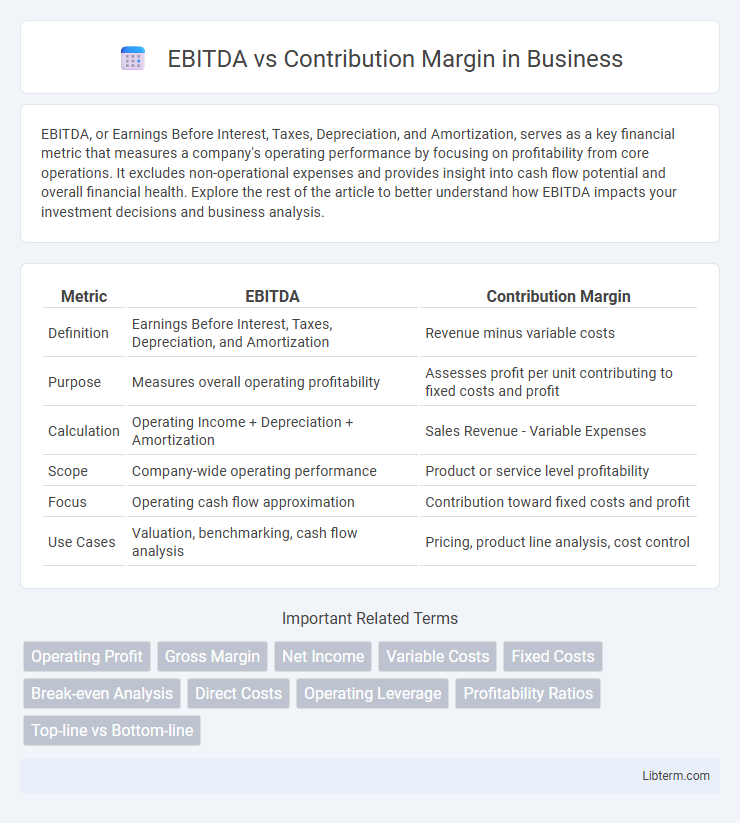

Table of Comparison

| Metric | EBITDA | Contribution Margin |

|---|---|---|

| Definition | Earnings Before Interest, Taxes, Depreciation, and Amortization | Revenue minus variable costs |

| Purpose | Measures overall operating profitability | Assesses profit per unit contributing to fixed costs and profit |

| Calculation | Operating Income + Depreciation + Amortization | Sales Revenue - Variable Expenses |

| Scope | Company-wide operating performance | Product or service level profitability |

| Focus | Operating cash flow approximation | Contribution toward fixed costs and profit |

| Use Cases | Valuation, benchmarking, cash flow analysis | Pricing, product line analysis, cost control |

Understanding EBITDA: Definition and Importance

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) represents a company's operational profitability by excluding non-operating expenses and non-cash charges, providing a clearer picture of core business performance. It is crucial for comparing companies within the same industry as it removes the effects of financing and accounting decisions, facilitating better investment and management decisions. Understanding EBITDA helps stakeholders assess cash flow generation potential and operational efficiency, unlike Contribution Margin, which focuses solely on variable costs and profitability per unit sold.

What is Contribution Margin? Key Concepts

Contribution Margin represents the revenue remaining after deducting variable costs directly associated with producing goods or services, serving as a crucial indicator of operational efficiency and profitability. It helps businesses understand how much money is available to cover fixed costs and generate profit, calculated as Sales Revenue minus Variable Costs. Unlike EBITDA, which includes fixed costs, depreciation, and amortization, Contribution Margin focuses strictly on variable cost coverage and is essential for break-even analysis and pricing decisions.

EBITDA vs Contribution Margin: Core Differences

EBITDA measures a company's overall profitability by excluding interest, taxes, depreciation, and amortization, providing a clear view of operational performance. Contribution Margin calculates the revenue remaining after variable costs are deducted, highlighting the profitability of individual products or services. The core difference lies in EBITDA assessing total business efficiency, while Contribution Margin focuses on the direct impact of sales on profit generation.

Calculating EBITDA: Step-by-Step Guide

Calculating EBITDA involves starting with net income and adding back interest, taxes, depreciation, and amortization to measure a company's operational profitability. This metric excludes non-operating expenses and non-cash charges, providing a clearer view of core business performance compared to the Contribution Margin, which focuses solely on variable costs versus sales revenue. Understanding EBITDA helps investors and analysts evaluate cash flow generation potential, while Contribution Margin aids in assessing product-level profitability and cost structure.

How to Compute Contribution Margin

Contribution Margin is calculated by subtracting variable costs from total sales revenue, highlighting the portion of sales that contributes to covering fixed costs and generating profit. Unlike EBITDA, which includes earnings before interest, taxes, depreciation, and amortization, Contribution Margin focuses purely on variable cost control and pricing efficiency. Understanding this metric helps businesses optimize pricing strategies and assess product profitability more accurately.

EBITDA in Financial Analysis: Use Cases

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) serves as a key metric in financial analysis to assess a company's operational profitability by excluding non-operating expenses and non-cash charges. This measure is crucial for comparing performance across companies and industries, enabling investors to evaluate cash flow generation without the distortion of capital structure or tax environments. Unlike Contribution Margin, which focuses on unit-variable costs and pricing strategy, EBITDA provides a broader view of overall business efficiency and profitability.

Role of Contribution Margin in Business Decision-Making

Contribution Margin plays a crucial role in business decision-making by highlighting the profitability of individual products or services before fixed costs are considered, enabling managers to identify which items contribute most to covering overhead and generating profit. Unlike EBITDA, which reflects overall operational profitability by including fixed costs and expenses, Contribution Margin focuses on variable costs, helping businesses optimize pricing, production levels, and product mix decisions. This granular insight supports strategic choices such as discontinuing unprofitable products, scaling profitable lines, and improving cost efficiency to enhance overall financial health.

Advantages and Limitations of EBITDA

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, highlights a company's operational profitability by excluding non-operational expenses, making it advantageous for comparing performance across firms and industries. Its limitation lies in ignoring capital expenditures and working capital changes, which are crucial for understanding long-term cash flow and financial health. Contribution margin focuses on variable costs and directly ties profitability to sales volume, but it does not account for fixed costs or broader financial obligations, unlike EBITDA.

Pros and Cons of Using Contribution Margin

Contribution margin highlights the profitability of individual products by subtracting variable costs from sales, enabling precise cost control and pricing decisions essential for short-term financial analysis. It excludes fixed costs, which can lead to an incomplete understanding of overall profitability and may overlook long-term financial obligations. While contribution margin aids operational decisions and break-even analysis, EBITDA provides a broader measure by including fixed costs and depreciation, offering a more comprehensive view of company performance.

Which Metric to Choose: EBITDA or Contribution Margin?

Choosing between EBITDA and Contribution Margin depends on the financial insight required; EBITDA measures overall profitability by accounting for operating expenses, depreciation, and amortization, offering a holistic view of earnings before interest and taxes. Contribution Margin focuses on the profitability of individual products or services by calculating revenue minus variable costs, which aids in pricing decisions and operational efficiency analysis. Companies prioritize EBITDA for assessing long-term financial health and investment potential, while Contribution Margin is preferred for internal cost control and short-term decision-making processes.

EBITDA Infographic

libterm.com

libterm.com