Shareholders are individuals or entities that own shares in a corporation, granting them partial ownership and a claim on the company's assets and earnings. Their rights typically include voting on major corporate decisions and receiving dividends based on company performance. Discover how understanding shareholder roles can empower your financial decisions in the full article.

Table of Comparison

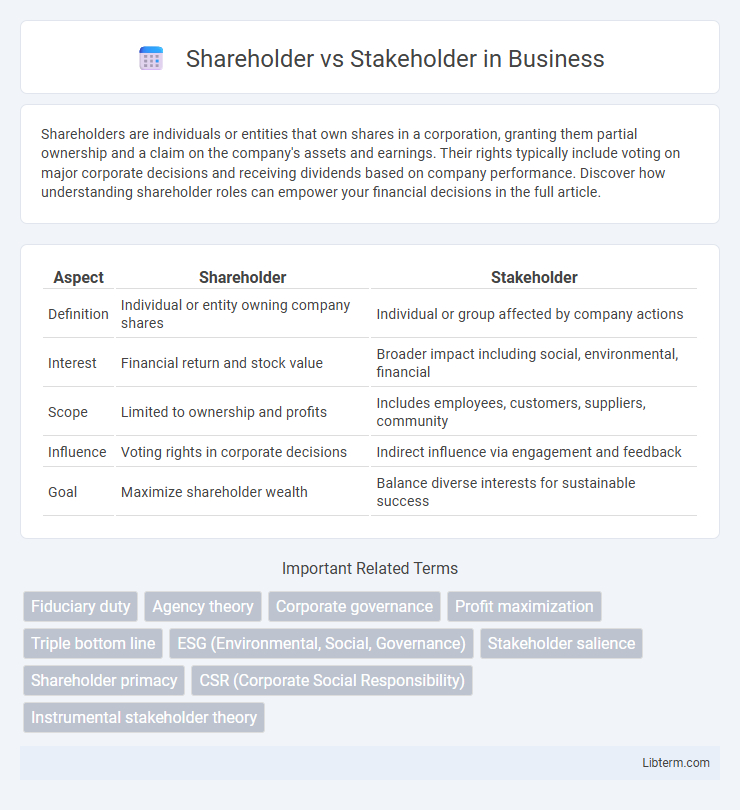

| Aspect | Shareholder | Stakeholder |

|---|---|---|

| Definition | Individual or entity owning company shares | Individual or group affected by company actions |

| Interest | Financial return and stock value | Broader impact including social, environmental, financial |

| Scope | Limited to ownership and profits | Includes employees, customers, suppliers, community |

| Influence | Voting rights in corporate decisions | Indirect influence via engagement and feedback |

| Goal | Maximize shareholder wealth | Balance diverse interests for sustainable success |

Introduction: Defining Shareholders and Stakeholders

Shareholders are individuals or entities that legally own shares in a corporation, granting them ownership stakes and voting rights in company decisions. Stakeholders encompass a broader group including shareholders, employees, customers, suppliers, and the community, all of whom are affected by the company's operations and performance. Understanding the distinction between shareholders and stakeholders is crucial for assessing corporate governance and accountability.

Historical Context: Evolution of Business Perspectives

The historical context of shareholder versus stakeholder perspectives reveals a significant evolution in business philosophy. Initially, business practices centered on maximizing shareholder value, driven by early 20th-century economic theories emphasizing profit as the primary goal. Over time, growing societal awareness and ethical considerations shifted focus towards stakeholder theory, recognizing the importance of employees, customers, communities, and the environment in sustainable business success.

Key Differences Between Shareholders and Stakeholders

Shareholders are individuals or entities that own shares in a company, directly benefiting from its profits and losses through dividends and stock value changes. Stakeholders encompass a broader group including shareholders, employees, customers, suppliers, and the community, each affected by the company's operations and decisions. The primary difference lies in the scope of interest: shareholders focus on financial returns, while stakeholders consider both financial and non-financial impacts of the company's activities.

The Shareholder Theory Explained

The Shareholder Theory posits that a corporation's primary responsibility is to maximize shareholder wealth by increasing stock value and dividends. This theory emphasizes profit generation as the main objective, prioritizing shareholders' financial interests over broader social or environmental concerns. Critics argue it overlooks the impact on other stakeholders such as employees, customers, and communities.

The Stakeholder Theory Explained

The Stakeholder Theory emphasizes that companies should create value for all parties involved, including employees, customers, suppliers, communities, and shareholders, rather than focusing solely on shareholder profits. This approach advocates for corporate accountability and sustainable business practices by balancing diverse interests to ensure long-term success and social responsibility. Firms adopting this theory often implement strategies that consider environmental, social, and governance (ESG) criteria to meet the demands of a broad range of stakeholders.

Benefits and Drawbacks of Prioritizing Shareholders

Prioritizing shareholders often leads to increased short-term profits and higher dividend payouts, attracting investor confidence and boosting stock prices. However, this focus can neglect stakeholder interests such as employee welfare, customer satisfaction, and environmental sustainability, potentially harming long-term business viability. Balancing shareholder demands with stakeholder needs is crucial for sustainable growth and corporate social responsibility.

Benefits and Drawbacks of Prioritizing Stakeholders

Prioritizing stakeholders in business decisions expands value creation beyond shareholders, fostering long-term sustainability, improved community relations, and employee satisfaction. However, balancing diverse stakeholder interests can dilute focus, lead to conflicting objectives, and complicate governance structures. While stakeholder prioritization enhances corporate social responsibility and mitigates risks, it may reduce short-term profitability and shareholder returns.

Real-World Examples: Case Studies in Business Approaches

Shareholder-focused companies like Apple prioritize maximizing shareholder returns through stock performance and dividends, reflecting a profit-driven approach. In contrast, stakeholder-oriented businesses such as Patagonia integrate environmental sustainability and employee welfare into their core strategies, balancing profit with social responsibility. These real-world examples highlight how different business models shape corporate decisions by emphasizing either investor value or broader community impact.

Impact on Corporate Governance and Decision-Making

Shareholders primarily influence corporate governance through voting rights and the pursuit of financial returns, shaping decisions that affect company profitability and stock value. Stakeholders encompass a broader group, including employees, customers, suppliers, and communities, whose interests impact governance by emphasizing sustainability, ethical practices, and long-term value creation. Balancing shareholder demands with stakeholder concerns leads to more comprehensive decision-making processes, promoting accountability and resilience in corporate strategy.

Future Trends: Balancing Shareholder and Stakeholder Interests

Future trends indicate a growing emphasis on balancing shareholder profits with stakeholder interests, reflecting a shift toward sustainable and ethical business practices. Companies increasingly adopt Environmental, Social, and Governance (ESG) criteria to align long-term growth with broader societal impact. Integrating stakeholder concerns fosters innovation, risk management, and corporate resilience in evolving global markets.

Shareholder Infographic

libterm.com

libterm.com