A payment receipt serves as an official record confirming that a transaction has been completed. It details the amount paid, date, payment method, and contact information for both parties to ensure transparency and accountability. Explore the rest of the article to understand how to effectively manage and secure your payment receipts.

Table of Comparison

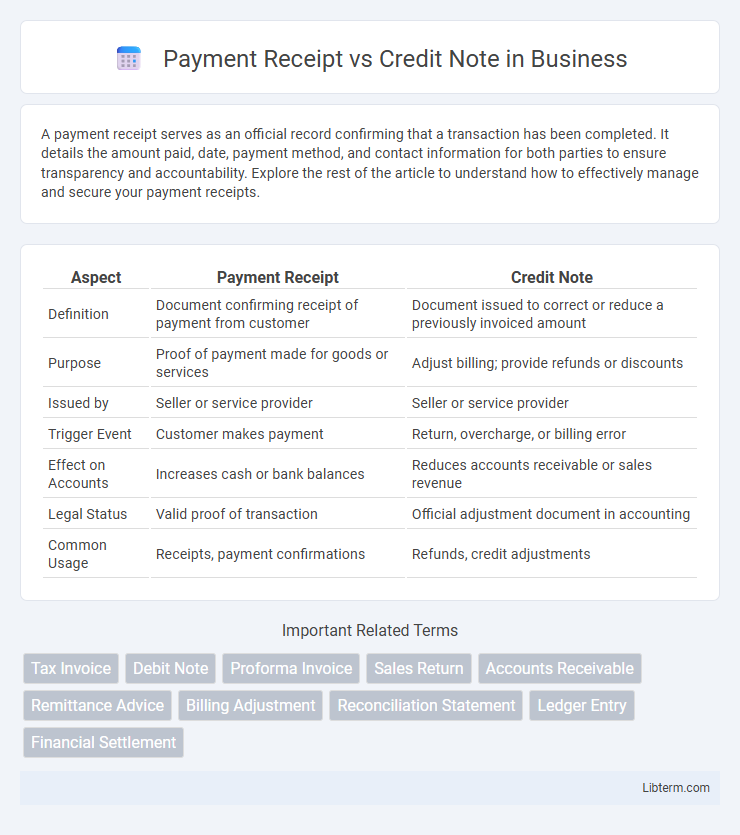

| Aspect | Payment Receipt | Credit Note |

|---|---|---|

| Definition | Document confirming receipt of payment from customer | Document issued to correct or reduce a previously invoiced amount |

| Purpose | Proof of payment made for goods or services | Adjust billing; provide refunds or discounts |

| Issued by | Seller or service provider | Seller or service provider |

| Trigger Event | Customer makes payment | Return, overcharge, or billing error |

| Effect on Accounts | Increases cash or bank balances | Reduces accounts receivable or sales revenue |

| Legal Status | Valid proof of transaction | Official adjustment document in accounting |

| Common Usage | Receipts, payment confirmations | Refunds, credit adjustments |

Introduction to Payment Receipts and Credit Notes

Payment receipts serve as official confirmations of payment made by a customer, detailing the transaction amount, date, and payment method to verify completion. Credit notes are documents issued by sellers to buyers, indicating a reduction in the invoice amount due to returns, overpayments, or discounts. Both play critical roles in financial record-keeping and auditing by ensuring transparent documentation of monetary exchanges and adjustments.

Definition of Payment Receipt

A payment receipt is a formal document issued by a seller or service provider confirming the receipt of payment from a buyer or client for goods or services rendered. It serves as proof of transaction, detailing payment amount, date, method, and invoice reference for accurate record-keeping and financial reconciliation. Unlike a credit note, which adjusts or reduces the amount owed, a payment receipt verifies that payment has been successfully completed and acknowledged.

Definition of Credit Note

A credit note is a document issued by a seller to a buyer, reducing the amount that the buyer owes due to returned goods, errors in billing, or agreed discounts. It serves as an official adjustment to a previously issued invoice, reflecting a credit balance that the buyer can use against future purchases or request as a refund. Unlike a payment receipt, which confirms payment received, a credit note corrects or cancels part of a transaction, ensuring accurate financial records for both parties.

Key Differences Between Payment Receipt and Credit Note

A payment receipt serves as proof of a completed transaction, confirming that the buyer has paid the agreed amount for goods or services. A credit note, however, is issued by the seller to the buyer to acknowledge a reduction in the invoice amount, often due to returns, allowances, or billing errors. While a payment receipt validates payment received, a credit note modifies the original invoice by adjusting the amount owed.

Importance of Payment Receipts in Business Transactions

Payment receipts serve as crucial proof of transaction, confirming that payment has been successfully received and protecting both buyer and seller from future disputes. They help maintain accurate financial records for auditing, tax reporting, and cash flow management, ensuring transparency in business operations. Unlike credit notes, which adjust or cancel previous invoices, payment receipts validate completed payments, supporting smoother business relationships and trust.

Role of Credit Notes in Financial Management

Credit notes play a crucial role in financial management by correcting invoice errors and adjusting customer account balances without affecting cash flow, unlike payment receipts which only acknowledge received payments. They help maintain accurate revenue records and facilitate easier reconciliation of accounts by documenting returned goods, discounts, or billing discrepancies. Effective use of credit notes ensures transparency and compliance in financial reporting, enhancing overall accounting accuracy.

When to Issue a Payment Receipt

A payment receipt is issued immediately after a customer makes a payment, serving as proof of the transaction and confirming funds have been received. It is crucial to provide the receipt at the time of payment to ensure transparent record-keeping and customer trust. Credit notes, on the other hand, are issued only when correcting a previously invoiced amount or processing returns, not at the point of payment.

When to Use a Credit Note

A credit note should be used when a customer returns goods, receives a partial refund, or when an invoice is issued with errors such as overcharging or incorrect quantities. It serves as an official document to adjust the amount owed, effectively reducing the outstanding balance without processing a direct cash refund. Using a credit note ensures accurate accounting records and maintains clear communication with customers regarding transaction adjustments.

Legal and Accounting Implications

A payment receipt serves as legal proof of payment received by a seller and must comply with accounting standards to validate revenue recognition and cash flow records. A credit note, issued to correct billing errors or return goods, legally adjusts the original invoice amount and impacts accounts receivable and sales revenue, ensuring accurate financial reporting. Both documents are critical for audit trails, tax compliance, and maintaining transparent financial statements in accordance with statutory regulations.

Best Practices for Managing Receipts and Credit Notes

Effective management of payment receipts and credit notes involves accurate record-keeping and timely reconciliation to ensure financial transparency and compliance. Businesses should implement standardized procedures for issuing receipts and credit notes, including clear documentation of transaction details, reasons for credit issuance, and maintaining audit trails. Utilizing accounting software with automated tracking features enhances efficiency, minimizes errors, and supports seamless integration with accounts payable and receivable processes.

Payment Receipt Infographic

libterm.com

libterm.com