Venture capital fuels the growth of innovative startups by providing essential funding and strategic support during early development stages. This investment method involves higher risks but offers substantial returns when startups succeed. Discover how venture capital can impact your business journey as you explore the rest of this article.

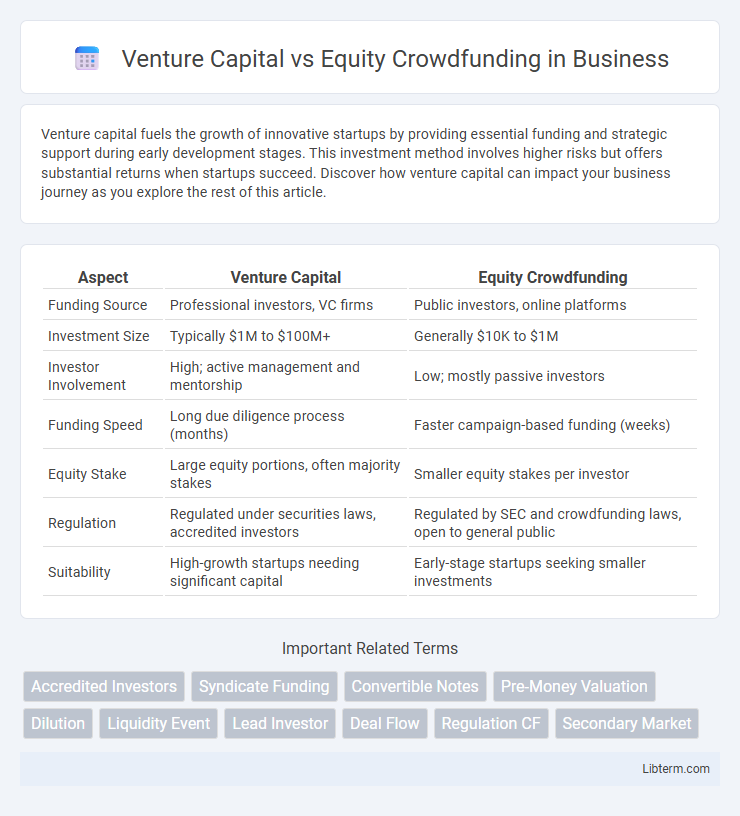

Table of Comparison

| Aspect | Venture Capital | Equity Crowdfunding |

|---|---|---|

| Funding Source | Professional investors, VC firms | Public investors, online platforms |

| Investment Size | Typically $1M to $100M+ | Generally $10K to $1M |

| Investor Involvement | High; active management and mentorship | Low; mostly passive investors |

| Funding Speed | Long due diligence process (months) | Faster campaign-based funding (weeks) |

| Equity Stake | Large equity portions, often majority stakes | Smaller equity stakes per investor |

| Regulation | Regulated under securities laws, accredited investors | Regulated by SEC and crowdfunding laws, open to general public |

| Suitability | High-growth startups needing significant capital | Early-stage startups seeking smaller investments |

Introduction to Venture Capital and Equity Crowdfunding

Venture capital involves institutional investors providing substantial funding to startups with high growth potential in exchange for equity, often accompanied by strategic support and governance influence. Equity crowdfunding enables numerous individual investors to collectively invest smaller amounts into early-stage companies via online platforms, democratizing access to startup equity. Both methods offer capital infusion but differ significantly in investor type, funding scale, and regulatory frameworks.

How Venture Capital Works

Venture capital operates by investing funds from limited partners into high-growth startups in exchange for equity, aiming for substantial returns upon exit events like IPOs or acquisitions. Venture capitalists conduct rigorous due diligence and provide strategic guidance, leveraging their expertise and networks to accelerate business growth. Unlike equity crowdfunding, which gathers small investments from the public, venture capital involves larger, concentrated investments managed by professional firms focused on scalable innovation sectors.

Understanding Equity Crowdfunding

Equity crowdfunding allows startups to raise capital by offering shares to a large pool of small investors through online platforms, democratizing investment opportunities beyond traditional venture capital firms. This method provides access to diverse funding sources while enabling investors to participate in early-stage growth potential with lower individual risk. Unlike venture capital, which involves significant due diligence and large investments from professional entities, equity crowdfunding emphasizes broad participation and streamlined regulatory compliance.

Key Differences Between Venture Capital and Equity Crowdfunding

Venture capital involves institutional investors providing large funding rounds to high-growth startups in exchange for significant equity and board influence, often requiring rigorous due diligence and long-term commitments. Equity crowdfunding allows multiple individual investors to collectively invest smaller amounts in early-stage companies through online platforms, offering broader accessibility but typically less control and smaller investment sizes. The key differences lie in investment scale, investor type, control over company decisions, and the regulatory frameworks governing each funding method.

Pros and Cons of Venture Capital

Venture capital provides substantial funding along with strategic guidance and industry connections, accelerating startup growth but often demands significant equity and control, potentially diluting founders' ownership. The rigorous vetting process ensures that only high-potential startups receive investment, although it can be time-consuming and competitive, limiting access for early or niche-stage ventures. High stakes and pressure to scale quickly may lead to misaligned goals between entrepreneurs and investors, affecting long-term company vision.

Pros and Cons of Equity Crowdfunding

Equity crowdfunding enables startups to raise capital from a large pool of individual investors, offering increased access to funding without relinquishing significant control or facing stringent requirements typical of venture capital. It democratizes investment opportunities but often involves challenges such as managing a large number of shareholders and potential dilution of ownership. While the funding process is generally faster and more flexible, equity crowdfunding may attract smaller amounts of capital compared to venture capital and requires substantial marketing efforts to reach prospective investors.

Funding Stages and Suitability

Venture capital typically targets later funding stages such as Series A and beyond, making it suitable for startups with proven traction and high growth potential seeking substantial capital injections. Equity crowdfunding is more appropriate for early-stage ventures or startups in seed rounds, providing access to a broad investor base with smaller individual investments. The choice between venture capital and equity crowdfunding depends on the startup's development stage, capital requirements, and need for strategic support versus community engagement.

Investor Involvement and Influence

Venture capital investors typically secure significant equity stakes, granting them substantial influence over strategic decisions and active involvement in company governance through board seats or voting rights. Equity crowdfunding participants generally hold smaller shares with limited control, often without direct input on management or operational strategies. The level of investor influence in venture capital aligns with higher capital commitments and a focus on long-term growth, whereas equity crowdfunding emphasizes broad investor participation with minimal individual impact.

Legal and Regulatory Considerations

Venture capital is subject to stringent regulatory frameworks, including extensive due diligence, investor accreditation requirements under SEC Regulation D, and compliance with securities laws to protect accredited investors. Equity crowdfunding operates under specific exemptions such as the JOBS Act Regulation Crowdfunding, allowing non-accredited investors to participate but with capped investment limits and mandatory disclosure obligations to the SEC. Both models require ongoing compliance with financial reporting, anti-fraud provisions, and investor protection measures to ensure legal adherence throughout the funding lifecycle.

Choosing the Right Funding Option for Your Startup

Venture capital offers startups substantial funding and strategic guidance but often requires giving up significant equity and control, making it ideal for high-growth companies with scalable business models. Equity crowdfunding allows businesses to raise smaller amounts of capital from a broad base of investors, providing access to funds without sacrificing excessive ownership but may involve more complex regulatory compliance and marketing efforts. Assessing your startup's growth stage, capital needs, and willingness to dilute ownership is crucial for selecting the right funding option.

Venture Capital Infographic

libterm.com

libterm.com