A merger combines two companies into one entity, aiming to enhance market share, reduce costs, and increase competitive advantage. Understanding the different types of mergers, such as horizontal, vertical, and conglomerate, is essential for evaluating potential business impacts. Explore the rest of this article to discover how mergers can transform your company's future and the key factors to consider throughout the process.

Table of Comparison

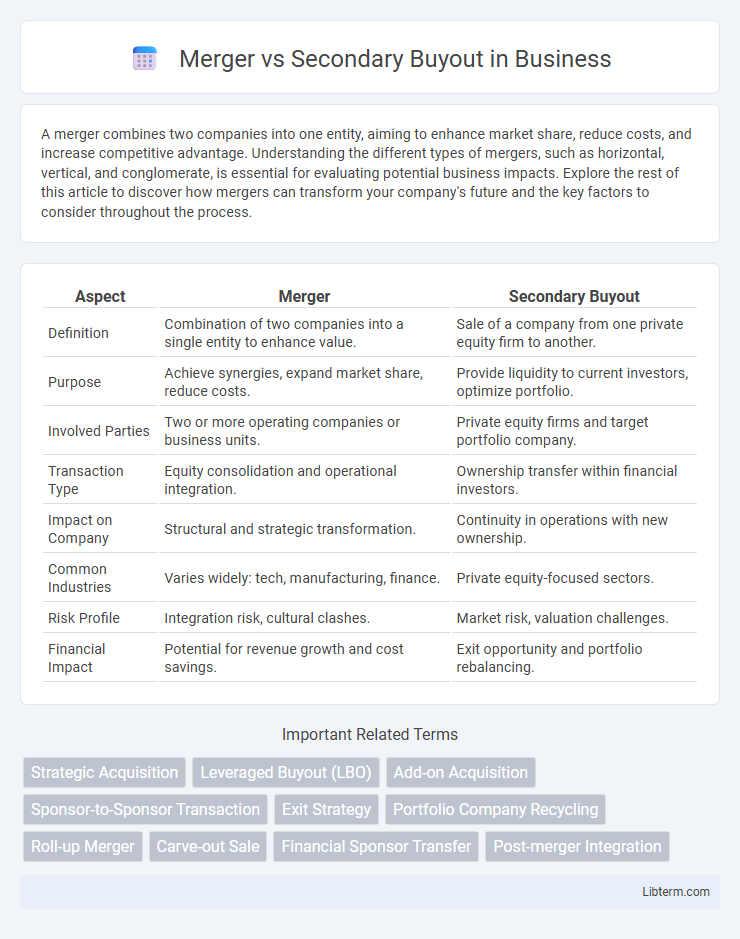

| Aspect | Merger | Secondary Buyout |

|---|---|---|

| Definition | Combination of two companies into a single entity to enhance value. | Sale of a company from one private equity firm to another. |

| Purpose | Achieve synergies, expand market share, reduce costs. | Provide liquidity to current investors, optimize portfolio. |

| Involved Parties | Two or more operating companies or business units. | Private equity firms and target portfolio company. |

| Transaction Type | Equity consolidation and operational integration. | Ownership transfer within financial investors. |

| Impact on Company | Structural and strategic transformation. | Continuity in operations with new ownership. |

| Common Industries | Varies widely: tech, manufacturing, finance. | Private equity-focused sectors. |

| Risk Profile | Integration risk, cultural clashes. | Market risk, valuation challenges. |

| Financial Impact | Potential for revenue growth and cost savings. | Exit opportunity and portfolio rebalancing. |

Introduction to Mergers and Secondary Buyouts

Mergers involve the consolidation of two companies to form a single entity, aiming to create synergies and enhance market share, while secondary buyouts occur when one private equity firm sells a portfolio company to another private equity firm. Mergers typically focus on strategic growth and operational integration, whereas secondary buyouts emphasize financial restructuring and value creation through expertise transfer. Understanding these distinctions is crucial for investors assessing deal structures, risk profiles, and long-term value potential in private equity transactions.

Defining Mergers: Key Characteristics

Mergers involve the consolidation of two companies into a single entity, combining assets, liabilities, and operations to achieve synergies and enhance market share. Key characteristics include mutual agreement between firms, integration of organizational structures, and often the creation of a new corporate identity. The process aims to maximize shareholder value by leveraging complementary strengths and eliminating redundancies.

Understanding Secondary Buyouts

Secondary buyouts involve the sale of a company from one private equity firm to another, differing from mergers where two companies combine to form a single entity. This transaction allows the selling firm to realize returns while enabling the buying firm to invest in an established asset with potential for further growth. Secondary buyouts provide liquidity and strategic repositioning opportunities without the complexities of merging operations or cultures.

Motivations Behind Mergers

Mergers are primarily motivated by the desire to achieve synergies, such as cost reductions, increased market share, and enhanced competitive positioning. Companies seek mergers to diversify their product lines, enter new markets, and leverage combined resources for innovation and operational efficiency. In contrast, secondary buyouts focus more on portfolio management and exiting private equity investments rather than long-term strategic growth.

Drivers of Secondary Buyouts

Secondary buyouts are primarily driven by private equity firms seeking liquidity and portfolio optimization, enabling sellers to exit investments while buyers acquire established assets with potential for value creation. Market conditions such as low interest rates and favorable debt financing options fuel these transactions by enhancing deal feasibility and returns. Operational improvements and growth prospects identified by purchasing firms further motivate secondary buyouts as a strategic alternative to mergers.

Comparative Analysis: Merger vs Secondary Buyout

A merger combines two companies into a single entity, often aimed at achieving synergies, market expansion, and operational efficiency, while a secondary buyout involves one private equity firm selling its stake in a portfolio company to another private equity firm, focusing on value realization and continuity of growth strategies. Mergers typically result in structural integration and share consolidation, impacting stakeholders through combined resources and market presence, whereas secondary buyouts mainly affect ownership structure with minimal operational disruption. Evaluating both options depends on strategic goals, with mergers favoring long-term market positioning and secondary buyouts emphasizing capital recycling and portfolio management.

Financial Implications and Outcomes

A merger combines two companies into a single entity, often resulting in synergies that enhance revenue growth and cost efficiencies, impacting the consolidated financial statements through asset revaluation and goodwill adjustments. In contrast, a secondary buyout involves one private equity firm selling a portfolio company to another, commonly affecting financial leverage and debt structures without generating operational synergies. Financial outcomes of mergers typically include increased market share and improved profitability metrics, whereas secondary buyouts focus on optimizing capital structure and achieving exit returns for investors.

Risks and Challenges Involved

Mergers carry integration risks such as cultural clashes, operational redundancies, and regulatory hurdles that can delay value realization and increase costs. Secondary buyouts pose challenges including valuation discrepancies, potential over-leverage, and difficulties in achieving desired exit timelines due to limited market liquidity. Both transactions require meticulous due diligence to mitigate financial, legal, and strategic risks impacting long-term performance.

Strategic Considerations for Investors

Investors evaluating mergers versus secondary buyouts prioritize strategic fit, growth potential, and risk management. Mergers often provide opportunities for synergy realization and market expansion, enhancing long-term value creation. Secondary buyouts focus on liquidity events and portfolio reshaping, offering investors a chance to reposition assets in line with evolving investment horizons and return expectations.

Choosing the Right Path: Merger or Secondary Buyout

Choosing between a merger and a secondary buyout involves analyzing strategic goals, company valuation, and long-term growth potential. Mergers often create synergies and expand market share by combining complementary businesses, while secondary buyouts provide existing investors liquidity and a path to value realization through new private equity ownership. Evaluating deal structure, stakeholder interests, and operational integration challenges is essential for determining the optimal path to maximize returns and sustain competitive advantage.

Merger Infographic

libterm.com

libterm.com