A Special Purpose Acquisition Company (SPAC) is a publicly traded company created solely to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing private company. SPACs provide a faster and often less complex alternative to traditional IPOs, allowing private companies to access public markets more efficiently. Discover how SPACs work and whether this investment vehicle might be the right move for your business by reading the rest of the article.

Table of Comparison

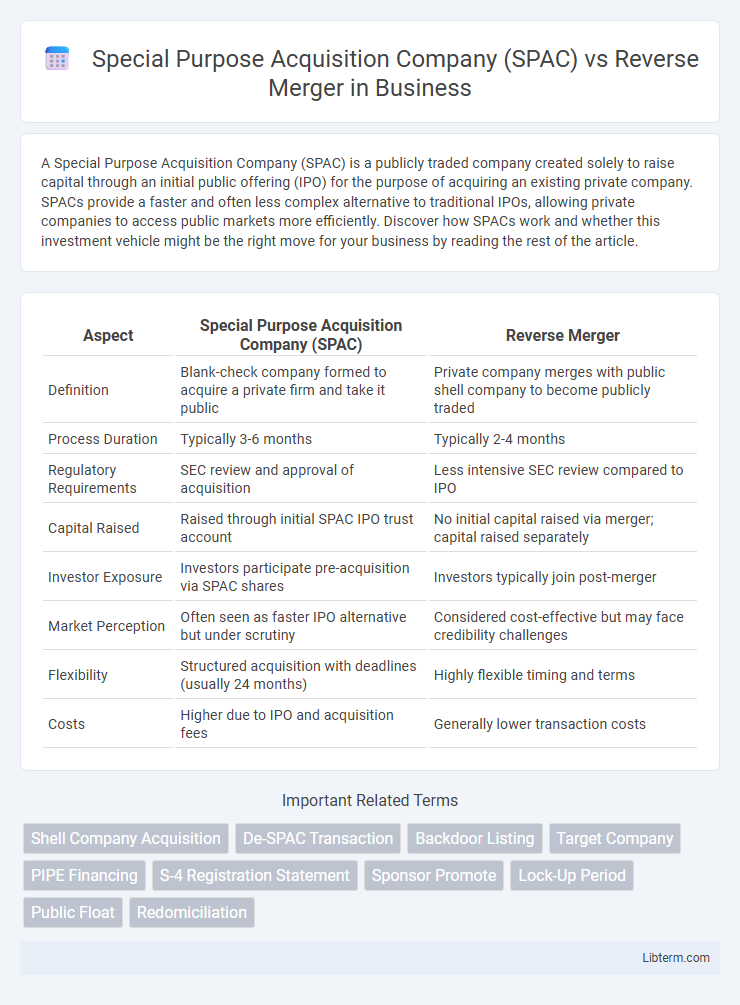

| Aspect | Special Purpose Acquisition Company (SPAC) | Reverse Merger |

|---|---|---|

| Definition | Blank-check company formed to acquire a private firm and take it public | Private company merges with public shell company to become publicly traded |

| Process Duration | Typically 3-6 months | Typically 2-4 months |

| Regulatory Requirements | SEC review and approval of acquisition | Less intensive SEC review compared to IPO |

| Capital Raised | Raised through initial SPAC IPO trust account | No initial capital raised via merger; capital raised separately |

| Investor Exposure | Investors participate pre-acquisition via SPAC shares | Investors typically join post-merger |

| Market Perception | Often seen as faster IPO alternative but under scrutiny | Considered cost-effective but may face credibility challenges |

| Flexibility | Structured acquisition with deadlines (usually 24 months) | Highly flexible timing and terms |

| Costs | Higher due to IPO and acquisition fees | Generally lower transaction costs |

Introduction to Alternative Public Listing Methods

Special Purpose Acquisition Companies (SPACs) and Reverse Mergers are alternative public listing methods that enable private companies to go public without a traditional initial public offering (IPO). SPACs involve a publicly traded shell company created to acquire a private firm, providing a faster and potentially less regulatory-intensive path to public markets. Reverse Mergers allow private companies to merge with an existing public company to achieve immediate public status, often reducing time and costs associated with conventional IPO procedures.

What is a Special Purpose Acquisition Company (SPAC)?

A Special Purpose Acquisition Company (SPAC) is a publicly traded blank-check firm created solely to raise capital through an initial public offering (IPO) for the purpose of acquiring or merging with an existing private company. SPACs offer private companies a faster and potentially less complex route to public markets compared to traditional IPOs. By merging with a SPAC, private firms can access public capital while benefiting from the SPAC's experienced management team and predetermined valuation framework.

Understanding Reverse Mergers

Reverse mergers provide a faster alternative to traditional initial public offerings (IPOs) by enabling private companies to become publicly traded through merging with an existing public shell company. This process circumvents the lengthy regulatory scrutiny associated with IPOs and grants immediate access to public capital markets. Understanding reverse mergers reveals their advantages in cost efficiency and speed, though they require thorough due diligence to mitigate risks linked to shell company liabilities.

Key Steps in the SPAC Process

The SPAC process begins with the formation of a blank-check company that raises capital through an initial public offering (IPO) to acquire or merge with a target private company. Following the IPO, the SPAC conducts extensive due diligence and negotiates terms with the target before shareholders approve the business combination. The final step involves the de-SPAC transaction, where the target company merges with the SPAC, gaining public listing status without a traditional IPO, streamlining capital access compared to the reverse merger method.

How Reverse Mergers Work

Reverse mergers involve a private company acquiring a publicly traded shell company to quickly become publicly listed without undergoing a traditional initial public offering (IPO) process. This strategy allows the private entity to bypass extensive regulatory scrutiny and lengthy approval timelines, facilitating faster market access. SPACs differ as they raise capital through an IPO first, then search for a private company to merge with, whereas reverse mergers start directly with merging into an existing public shell.

Comparative Timeline: SPACs vs Reverse Mergers

SPACs typically complete the acquisition process within 3 to 6 months after the initial IPO, offering a faster route to public markets compared to traditional IPOs. Reverse mergers often take longer, averaging 6 to 12 months, due to regulatory scrutiny and the complexities of merging with an existing public shell company. The expedited timeline of SPACs attracts companies seeking speed and certainty, whereas reverse mergers appeal to those prioritizing cost-efficiency despite longer integration periods.

Pros and Cons of SPACs

Special Purpose Acquisition Companies (SPACs) offer a faster and more streamlined path to public markets compared to traditional reverse mergers, with the advantage of upfront capital raised through an initial public offering (IPO). However, SPACs can present risks such as potential misalignment of sponsor incentives, dilution of shares, and less regulatory scrutiny, which may lead to overvaluation or poor post-merger performance. While reverse mergers provide a quicker way to become publicly traded without extensive SEC review, SPACs typically offer greater transparency, investor protections, and access to institutional capital.

Pros and Cons of Reverse Mergers

Reverse mergers offer a faster and less expensive route for private companies to become publicly traded compared to traditional IPOs, providing immediate access to capital markets and enhanced liquidity. However, reverse mergers often carry risks such as potential undisclosed liabilities from the acquired shell company and lower market credibility, which can impact investor confidence and stock performance. The lack of extensive regulatory scrutiny prior to the merger can lead to less transparent financial reporting and increased volatility post-merger.

Regulatory and Compliance Considerations

Special Purpose Acquisition Companies (SPACs) navigate a rigorous regulatory framework governed primarily by the SEC, requiring extensive disclosures, investor protections, and adherence to timelines for acquisition completion. In contrast, reverse mergers involve private companies merging with public shell companies, often subject to less stringent initial regulatory scrutiny but face heightened risks of later SEC enforcement actions and market skepticism. Both methods demand strict compliance with securities laws, but SPACs typically undergo more transparent and structured regulatory compliance processes compared to the relatively expedited and potentially riskier regulatory environment of reverse mergers.

Which is Better: SPAC or Reverse Merger?

Special Purpose Acquisition Companies (SPACs) provide faster access to public markets with clearer regulatory oversight compared to reverse mergers, which can be more cost-effective but carry higher risks of regulatory scrutiny and market skepticism. SPACs offer benefits like experienced management teams and capital certainty, while reverse mergers allow private companies to avoid the extensive disclosure requirements of traditional IPOs. Ultimately, SPACs tend to be better suited for companies seeking transparent valuation and investor confidence, whereas reverse mergers may appeal to firms prioritizing speed and lower upfront costs.

Special Purpose Acquisition Company (SPAC) Infographic

libterm.com

libterm.com