Overriding royalty interest (ORRI) represents a non-operating interest in oil and gas production, allowing holders to earn revenue without bearing production costs. This interest is carved out from the working interest and is paid before any profits are distributed, giving you a percentage of the gross production revenues. Explore the rest of the article to understand how overriding royalty interests impact your investments and lease agreements.

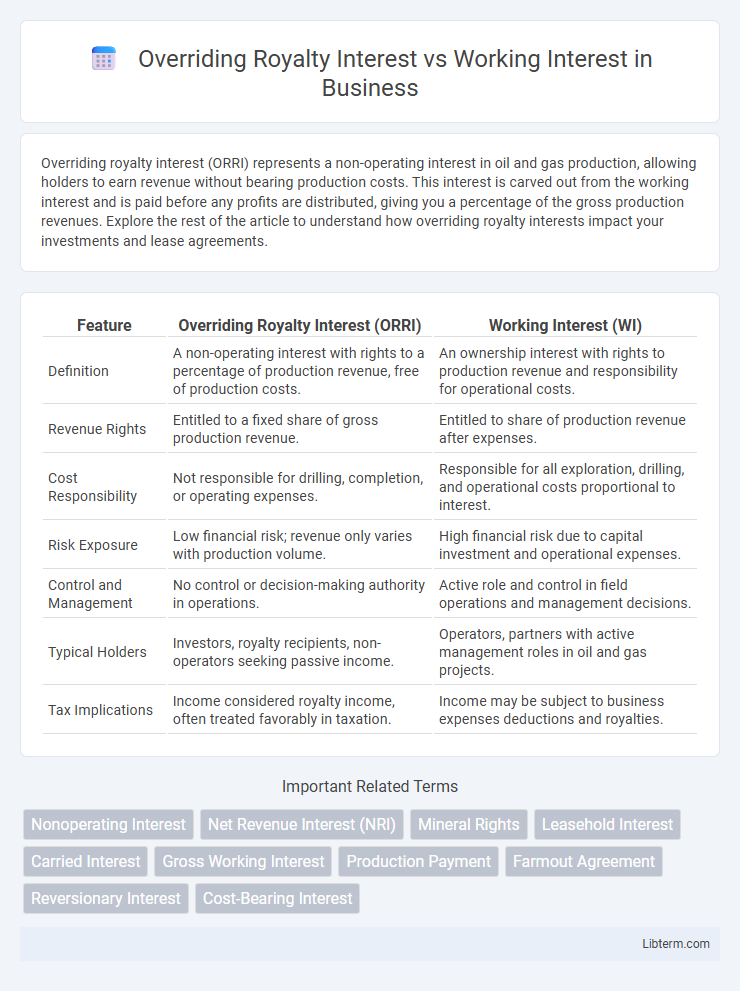

Table of Comparison

| Feature | Overriding Royalty Interest (ORRI) | Working Interest (WI) |

|---|---|---|

| Definition | A non-operating interest with rights to a percentage of production revenue, free of production costs. | An ownership interest with rights to production revenue and responsibility for operational costs. |

| Revenue Rights | Entitled to a fixed share of gross production revenue. | Entitled to share of production revenue after expenses. |

| Cost Responsibility | Not responsible for drilling, completion, or operating expenses. | Responsible for all exploration, drilling, and operational costs proportional to interest. |

| Risk Exposure | Low financial risk; revenue only varies with production volume. | High financial risk due to capital investment and operational expenses. |

| Control and Management | No control or decision-making authority in operations. | Active role and control in field operations and management decisions. |

| Typical Holders | Investors, royalty recipients, non-operators seeking passive income. | Operators, partners with active management roles in oil and gas projects. |

| Tax Implications | Income considered royalty income, often treated favorably in taxation. | Income may be subject to business expenses deductions and royalties. |

Introduction to Oil and Gas Interests

Overriding Royalty Interest (ORRI) and Working Interest (WI) are critical concepts in oil and gas property ownership and revenue distribution. ORRI grants the owner a percentage of production revenue without responsibility for operational costs, while WI holders manage drilling and production expenses but receive a full share of profits. Understanding the distinction between these interests is essential for stakeholders to accurately assess financial rights and obligations in oil and gas agreements.

Defining Overriding Royalty Interest (ORRI)

Overriding Royalty Interest (ORRI) is a non-operating interest carved out of the working interest in an oil and gas lease, providing its holder a percentage of production revenue without bearing any extraction or operating costs. Unlike working interest owners who manage and pay for drilling, ORRI holders receive payments solely from the production revenue as a burden on the lease. This interest does not extend beyond the lease term and is often used to compensate landowners or investors without involving them in day-to-day operations.

Understanding Working Interest (WI)

Working Interest (WI) represents the ownership stake in an oil and gas lease that entitles the holder to a proportionate share of production revenues and also obligates them to bear a corresponding share of exploration, development, and operating costs. WI holders actively participate in decision-making and operations on the lease, including drilling, completion, and production activities. This interest contrasts with Overriding Royalty Interest (ORRI), which provides revenue entitlements without cost responsibilities or operational control.

Key Differences Between ORRI and WI

Overriding Royalty Interest (ORRI) grants a non-operating party a percentage of production revenue without bearing drilling or operating costs, while Working Interest (WI) involves ownership in exploration and production, including responsibility for all operational expenses. ORRI holders receive royalty payments net of costs, contrasted with WI holders who earn profits or losses after deducting expenses such as drilling, completion, and facility costs. Key differences include ORRI's passive income nature versus WI's active risk exposure and operational control.

Advantages of Overriding Royalty Interest

Overriding Royalty Interest (ORRI) provides passive income to the interest holder without any operational or development costs, unlike Working Interest which requires capital investment and exposes the owner to production risks. ORRI holders benefit from a consistent percentage of production revenues, ensuring steady cash flow without liabilities related to drilling, leasing, or maintenance. This financial advantage makes ORRI a favored option for investors seeking royalty-based earnings with minimal management responsibilities.

Benefits and Risks of Working Interest

Working interest owners bear the costs of exploration, drilling, and production but gain a proportionate share of the produced hydrocarbons and revenues, providing direct control over operations and potential for higher returns. Risks include significant financial exposure to operational expenses and liabilities, as well as fluctuating production volumes impacting revenue stability. Unlike overriding royalty interests, working interest holders have decision-making authority but face greater risk due to active involvement and capital investment obligations.

Revenue Generation: ORRI vs WI

Overriding Royalty Interest (ORRI) generates revenue by entitling holders to a percentage of production revenue without bearing any operational costs, making it a passive income source. In contrast, Working Interest (WI) owners share both the production revenues and the expenses of exploration, drilling, and operations, resulting in higher potential profits but increased financial risk. ORRI provides consistent revenue streams unaffected by operational decisions, while WI revenue fluctuates with operational performance and capital investments.

Tax Implications for ORRI and WI Holders

Overriding Royalty Interest (ORRI) holders receive revenue free of production and operating expenses, leading to tax treatment primarily as ordinary income subject to income tax without depletion deductions. Working Interest (WI) holders are responsible for all exploration, development, and operating costs, allowing them to deduct expenses and claim percentage depletion or cost depletion against taxable income. Tax implications differ significantly; ORRI owners face simpler tax reporting but limited deductions, whereas WI owners gain tax benefits from expense deductions but also bear higher financial risk and complexity in tax filings.

Legal Considerations and Ownership Transfer

Overriding royalty interest (ORRI) represents a non-operating interest held by a party entitled to a percentage of production revenue without bearing production costs, contrasting with working interest (WI), which includes operational responsibilities and liabilities. Legal considerations for ORRI involve clear definitions in lease agreements to prevent disputes over revenue entitlements, while transfers of ownership must comply with regulatory requirements and often require formal assignment documentation. Working interest ownership transfers necessitate thorough due diligence on operational obligations and regulatory compliance, as well as consent from all parties involved to ensure proper conveyance of both rights and liabilities.

Which is Best: Choosing ORRI or WI?

Overriding Royalty Interest (ORRI) offers a fixed percentage of production revenue without bearing operational costs, making it attractive for investors seeking passive income. Working Interest (WI) holders share in both production revenues and operational expenses, allowing for greater control and potentially higher returns but with increased financial risk. Choosing between ORRI and WI depends on factors like risk tolerance, desired involvement level, and long-term financial goals within oil and gas investments.

Overriding Royalty Interest Infographic

libterm.com

libterm.com