Effective financial planning involves budgeting, saving, and investing to secure your financial future while managing risks and setting clear goals. Proper strategies help you maximize wealth, reduce debt, and prepare for unexpected expenses to achieve long-term stability. Explore the rest of this article to discover practical tips and tools for successful financial planning.

Table of Comparison

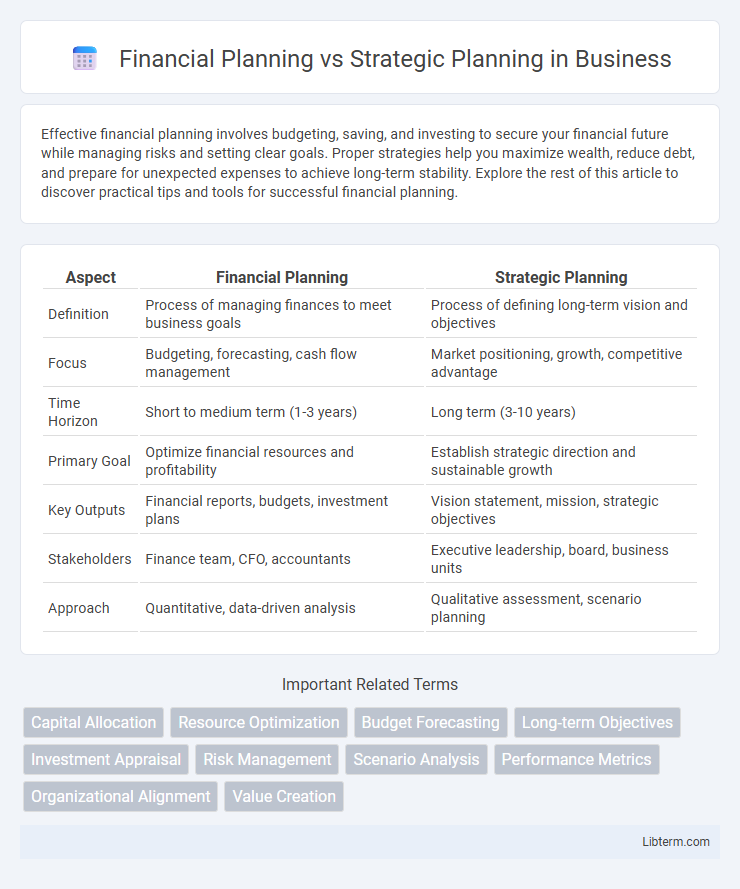

| Aspect | Financial Planning | Strategic Planning |

|---|---|---|

| Definition | Process of managing finances to meet business goals | Process of defining long-term vision and objectives |

| Focus | Budgeting, forecasting, cash flow management | Market positioning, growth, competitive advantage |

| Time Horizon | Short to medium term (1-3 years) | Long term (3-10 years) |

| Primary Goal | Optimize financial resources and profitability | Establish strategic direction and sustainable growth |

| Key Outputs | Financial reports, budgets, investment plans | Vision statement, mission, strategic objectives |

| Stakeholders | Finance team, CFO, accountants | Executive leadership, board, business units |

| Approach | Quantitative, data-driven analysis | Qualitative assessment, scenario planning |

Understanding Financial Planning

Financial planning involves creating detailed budgets, forecasting revenues and expenses, and managing cash flow to ensure an organization's financial health and sustainability. It focuses on aligning financial resources with short-term objectives, risk management, and compliance requirements. Understanding financial planning is essential for making informed decisions that support operational efficiency and long-term fiscal stability.

Defining Strategic Planning

Strategic planning involves setting long-term goals and determining the best approach to achieve a competitive advantage and sustainable growth within an organization. It focuses on analyzing internal capabilities, market trends, and external environments to formulate overarching strategies. Unlike financial planning, which concentrates on budget allocation and short-term financial goals, strategic planning integrates vision, mission, and core values to drive overall business direction.

Key Objectives of Financial Planning

Financial planning aims to ensure effective management of an organization's monetary resources by forecasting revenues, budgeting expenses, and optimizing cash flow to support operational stability. Key objectives include maintaining liquidity, controlling costs, maximizing return on investments, and mitigating financial risks to achieve long-term sustainability. This contrasts with strategic planning, which centers on setting overall business goals and competitive positioning rather than detailed financial management.

Core Goals of Strategic Planning

Strategic planning centers on setting long-term objectives to guide overall organizational growth, emphasizing mission alignment, competitive positioning, and resource allocation. Core goals include defining clear vision statements, establishing measurable performance targets, and fostering sustainable advantage in dynamic markets. Unlike financial planning, which focuses primarily on budgeting and fiscal management, strategic planning drives holistic decision-making to achieve enduring business success.

Major Differences: Financial vs Strategic Planning

Financial planning centers on managing an organization's budget, forecasting revenues and expenses, and ensuring cash flow aligns with short-term operational needs. Strategic planning focuses on setting long-term goals, defining competitive positioning, and identifying growth opportunities to guide overall business direction. The major difference lies in financial planning's emphasis on quantitative analysis and resource allocation, while strategic planning prioritizes vision development and market strategy.

How Financial Planning Supports Strategy

Financial planning provides the essential financial framework that enables strategic planning by allocating resources, forecasting revenues, and managing risks to support long-term goals. It translates strategic objectives into actionable budgets and financial targets, ensuring the organization maintains liquidity and capital efficiency for sustained growth. Effective financial planning aligns investments and operational expenditures with strategic priorities, facilitating informed decision-making and performance measurement.

Integrating Financial and Strategic Planning

Integrating financial and strategic planning ensures that resource allocation aligns with long-term business objectives, promoting sustainable growth and profitability. Financial planning provides quantifiable data for budgeting and forecasting, while strategic planning outlines the vision and goals to guide financial decisions. Effective integration fosters informed decision-making, optimizes capital investment, and enhances organizational agility in dynamic markets.

Challenges in Aligning Both Plans

Financial planning and strategic planning often face challenges in alignment due to differing time horizons and priorities; financial planning typically emphasizes short-term budgeting and cash flow management, whereas strategic planning focuses on long-term goals and organizational vision. Discrepancies arise when financial constraints limit the resources available for strategic initiatives, causing conflicts in resource allocation and performance metrics. Ensuring continuous communication between finance teams and strategic leaders is essential to synchronize forecasts, investment decisions, and risk management strategies for cohesive organizational growth.

Measuring Success: Metrics and KPIs

Financial planning measures success through metrics such as cash flow forecasts, budget variance analysis, and return on investment (ROI), providing a quantitative assessment of resource allocation and profitability. Strategic planning evaluates success with key performance indicators (KPIs) like market share growth, customer satisfaction scores, and achievement of long-term business objectives, aligning operational activities with vision and mission. Combining financial and strategic metrics offers a comprehensive framework for tracking organizational performance and guiding decision-making.

Choosing the Right Approach for Your Organization

Choosing between financial planning and strategic planning depends on your organization's priorities: financial planning centers on budgeting, cash flow management, and forecasting to ensure fiscal stability, while strategic planning focuses on long-term goals, competitive positioning, and resource allocation to drive growth. Organizations seeking immediate operational control benefit from detailed financial plans, whereas those aiming for market expansion or innovation require comprehensive strategic plans. Combining both approaches often yields the most effective results by aligning financial resources with overarching business objectives.

Financial Planning Infographic

libterm.com

libterm.com