Earnings management involves the strategic manipulation of financial reports to influence stakeholders' perceptions of a company's profitability and financial health. Techniques used can range from aggressive revenue recognition to altering expense timing, potentially impacting investor decisions and regulatory scrutiny. Explore the rest of this article to understand how earnings management can affect your investment strategies and company transparency.

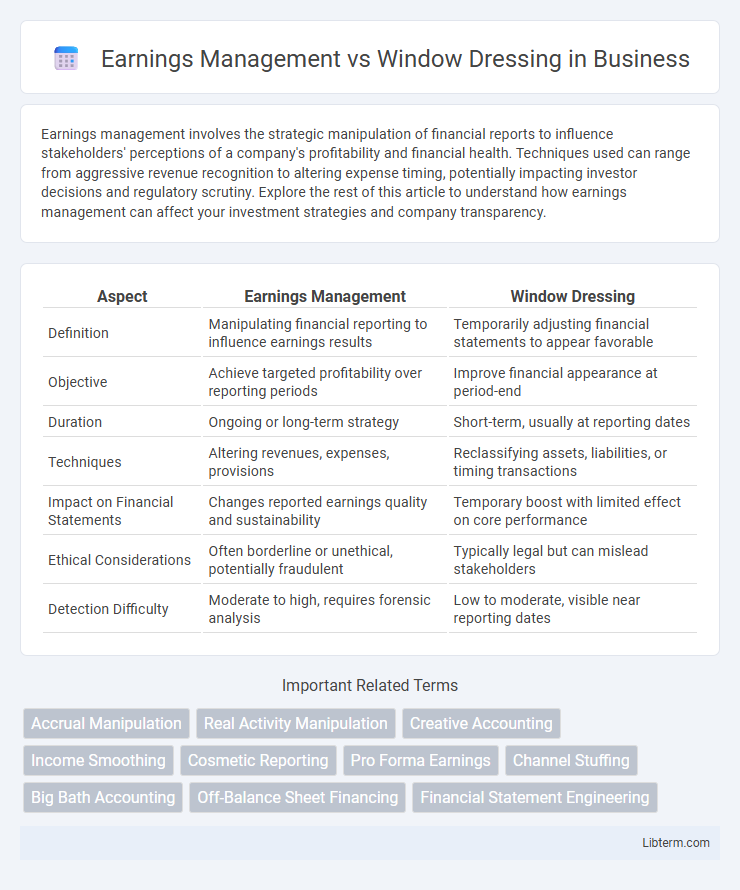

Table of Comparison

| Aspect | Earnings Management | Window Dressing |

|---|---|---|

| Definition | Manipulating financial reporting to influence earnings results | Temporarily adjusting financial statements to appear favorable |

| Objective | Achieve targeted profitability over reporting periods | Improve financial appearance at period-end |

| Duration | Ongoing or long-term strategy | Short-term, usually at reporting dates |

| Techniques | Altering revenues, expenses, provisions | Reclassifying assets, liabilities, or timing transactions |

| Impact on Financial Statements | Changes reported earnings quality and sustainability | Temporary boost with limited effect on core performance |

| Ethical Considerations | Often borderline or unethical, potentially fraudulent | Typically legal but can mislead stakeholders |

| Detection Difficulty | Moderate to high, requires forensic analysis | Low to moderate, visible near reporting dates |

Introduction to Earnings Management and Window Dressing

Earnings management involves the strategic manipulation of financial reports by company executives to meet specific targets or expectations, often using accounting techniques within regulatory boundaries. Window dressing refers to short-term actions taken by management near the end of a reporting period to improve the appearance of financial statements, without altering underlying economic reality. Both practices aim to influence stakeholder perceptions but differ in scope and duration of impact on financial disclosures.

Defining Earnings Management: Concepts and Techniques

Earnings management involves the strategic manipulation of financial reports by company management to influence stakeholders' perceptions of the firm's economic performance through legitimate accounting methods or questionable practices. Techniques include adjusting accruals, changing depreciation methods, deferring expenses, or accelerating revenues to meet targets or expectations. Unlike window dressing, which primarily focuses on improving financial appearance at specific reporting dates, earnings management impacts the comprehensive representation of profitability and financial health across periods.

Understanding Window Dressing: Meaning and Methods

Window dressing refers to the practice where companies manipulate financial statements at the end of a reporting period to present a more favorable picture of their financial health. Common methods include temporarily inflating revenues, delaying expenses, or adjusting asset valuations to boost key financial ratios. This technique differs from earnings management by its short-term focus on improving appearances rather than long-term income manipulation.

Key Differences Between Earnings Management and Window Dressing

Earnings management involves manipulating financial reports through accounting choices to influence perceptions of company performance over a period, often affecting reported earnings and cash flows. Window dressing refers specifically to actions taken at the end of a reporting period to improve the appearance of financial statements temporarily, such as adjusting asset valuations or liabilities. The key difference lies in earnings management's broader, ongoing impact on financial results, while window dressing focuses on short-term cosmetic enhancements without altering underlying economic realities.

Motivations Behind Earnings Management

Earnings management is primarily motivated by the desire to influence stakeholders' perceptions of a company's financial health through strategic accrual adjustments or real activities, aiming to meet targets or trigger bonuses. Companies engage in earnings management to manipulate reported earnings to satisfy investor expectations, avoid debt covenant violations, or enhance stock prices. Unlike earnings management, window dressing often focuses on short-term cosmetic improvements to financial statements at reporting dates, but both practices share the underlying motivation of improving perceived financial performance.

Common Window Dressing Practices in Financial Reporting

Common window dressing practices in financial reporting include manipulating year-end transactions to inflate earnings or improve financial ratios temporarily. Companies may accelerate revenue recognition, delay expense recording, or engage in off-balance-sheet financing to present a healthier financial position. These tactics differ from earnings management by their short-term focus on appearances rather than sustained financial manipulation.

Ethical Implications and Legal Considerations

Earnings management involves manipulating financial reports within legal boundaries to meet targets, often blurring ethical lines by misleading stakeholders about a company's true performance. Window dressing, a subset of earnings management, focuses on short-term cosmetic improvements to financial statements, potentially deceiving investors and violating accounting standards. Both practices raise significant ethical concerns and legal risks, including regulatory sanctions and loss of investor trust.

Impact on Investors and Stakeholders

Earnings management involves manipulating financial reports to meet targets, often obscuring true business performance and misleading investors about a company's profitability and risk profile. Window dressing, a short-term tactic to improve financial statements at period-end, can create overly optimistic impressions that misguide stakeholders' investment decisions and undermine trust. Both practices distort transparency, increasing uncertainty and potentially leading to suboptimal capital allocation and damaged reputations for firms among investors and stakeholders.

Detection and Prevention Strategies

Earnings management detection relies on forensic accounting techniques such as ratio analysis, variance analysis, and identifying unusual accruals or transaction patterns that deviate from industry norms. Window dressing is often detected through comparative financial statement analysis across reporting periods and scrutiny of end-of-period transactions, revealing manipulative timing of revenues or expenses to enhance reported performance. Prevention strategies include strengthening internal controls, enforcing strict corporate governance policies, implementing independent audits, and promoting transparent financial reporting standards to deter manipulation.

Conclusion: Navigating Financial Reporting Integrity

Earnings management manipulates financial results within accounting rules, while window dressing enhances appearance at specific reporting periods without altering economic reality. Both practices challenge financial reporting integrity, necessitating robust regulatory oversight and transparent disclosure. Investors and stakeholders must critically assess financial statements, emphasizing consistency and contextual analysis to navigate potential distortions effectively.

Earnings Management Infographic

libterm.com

libterm.com