Equity recapitalization restructures a company's capital by replacing debt with equity or vice versa to improve financial stability and reduce risk. This strategy can enhance your company's creditworthiness, free up cash flow, and attract new investors. Discover how equity recapitalization can transform your business by exploring the detailed insights in the rest of this article.

Table of Comparison

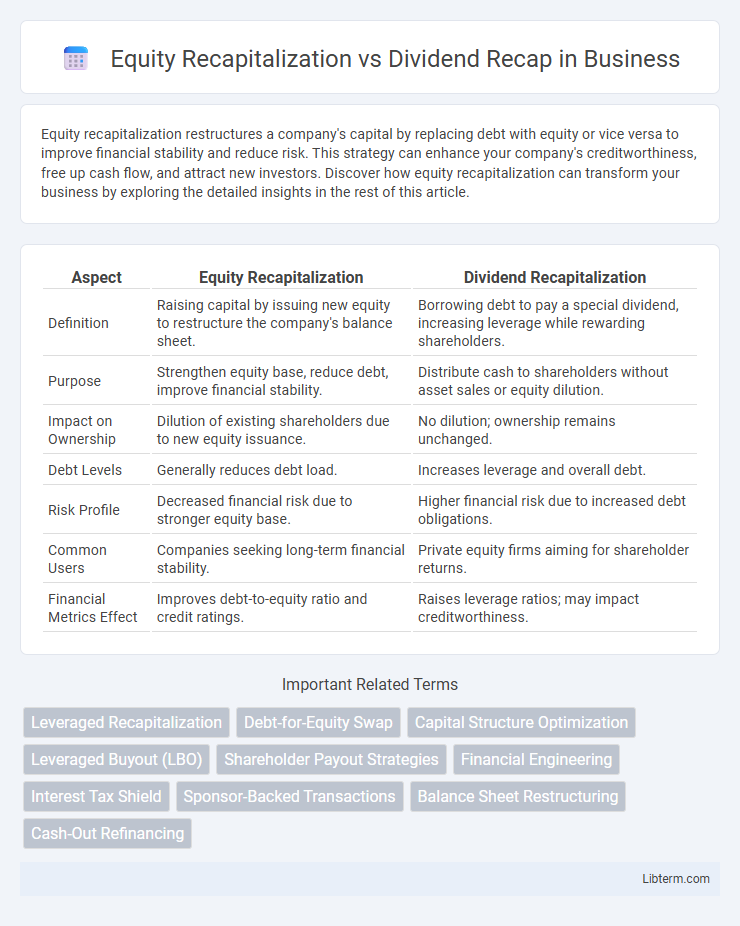

| Aspect | Equity Recapitalization | Dividend Recapitalization |

|---|---|---|

| Definition | Raising capital by issuing new equity to restructure the company's balance sheet. | Borrowing debt to pay a special dividend, increasing leverage while rewarding shareholders. |

| Purpose | Strengthen equity base, reduce debt, improve financial stability. | Distribute cash to shareholders without asset sales or equity dilution. |

| Impact on Ownership | Dilution of existing shareholders due to new equity issuance. | No dilution; ownership remains unchanged. |

| Debt Levels | Generally reduces debt load. | Increases leverage and overall debt. |

| Risk Profile | Decreased financial risk due to stronger equity base. | Higher financial risk due to increased debt obligations. |

| Common Users | Companies seeking long-term financial stability. | Private equity firms aiming for shareholder returns. |

| Financial Metrics Effect | Improves debt-to-equity ratio and credit ratings. | Raises leverage ratios; may impact creditworthiness. |

Understanding Equity Recapitalization

Equity recapitalization involves restructuring a company's capital by issuing new equity shares to reduce debt or improve the balance sheet, enhancing financial stability and flexibility. This strategy differs from dividend recap, which typically increases debt to pay dividends to shareholders without altering ownership structure. Understanding equity recapitalization helps businesses strengthen their equity base, reduce leverage ratios, and attract long-term investors.

What Is a Dividend Recapitalization?

A dividend recapitalization is a financial strategy where a company incurs new debt to pay a special dividend to shareholders, often used by private equity firms to extract value without selling equity. Unlike equity recapitalization, which involves issuing new equity or exchanging debt for equity to strengthen the balance sheet, dividend recaps increase leverage but provide immediate cash returns to investors. This approach leverages the company's balance sheet to optimize shareholder returns while maintaining ownership control.

Key Differences Between Equity Recap and Dividend Recap

Equity recapitalization involves issuing new equity shares to raise capital or restructure the company's balance sheet, diluting existing ownership but improving financial stability. Dividend recapitalization entails taking on additional debt to pay dividends to shareholders, increasing leverage without diluting ownership but raising financial risk. The key differences center on capital structure impact, ownership dilution, and risk profile, with equity recap prioritizing long-term solvency and dividend recap focusing on immediate shareholder returns.

Strategic Objectives of Each Recapitalization Method

Equity recapitalization primarily aims to strengthen a company's balance sheet by diluting existing ownership to raise new capital, facilitating growth initiatives, debt reduction, or enhancing financial flexibility. Dividend recapitalization focuses on leveraging debt to distribute cash payments to shareholders without significantly altering ownership structures, often targeting immediate shareholder returns and optimizing capital structure. Each method aligns with distinct strategic objectives: equity recaps prioritize long-term financial stability and expansion, while dividend recaps emphasize rewarding investors and managing leverage.

Impact on Ownership Structure

Equity recapitalization involves issuing new shares or restructuring existing equity, leading to potential dilution of current shareholders' ownership percentages. Dividend recapitalization typically uses debt to pay dividends without changing the number of shares, preserving existing ownership stakes but increasing financial leverage. As a result, equity recapitalization impacts ownership structure by altering control dynamics, while dividend recap increases financial risk without modifying shareholder distribution.

Effects on Company Financial Health

Equity recapitalization improves a company's financial health by injecting new capital, reducing debt levels, and strengthening the balance sheet, which enhances creditworthiness and supports long-term growth. Dividend recapitalization increases leverage by adding debt to pay shareholders, potentially weakening financial stability and elevating default risk due to higher interest obligations. Companies pursuing equity recapitalization prioritize sustainable capital structure, while those opting for dividend recaps may face higher financial strain despite short-term shareholder payouts.

Risks and Considerations for Stakeholders

Equity recapitalization involves issuing new shares to raise capital, which can dilute existing shareholders' ownership but strengthens the company's balance sheet by reducing debt risk. Dividend recapitalization entails taking on additional debt to pay dividends, increasing financial leverage and heightening default risk for creditors and stakeholders. Stakeholders must consider the trade-off between dilution risk in equity recapitalization and increased solvency risk in dividend recapitalization when evaluating long-term company value and financial stability.

Tax Implications of Equity and Dividend Recaps

Equity recapitalization typically involves issuing new shares to raise capital, which does not trigger immediate tax liabilities as it is considered a capital transaction rather than income. Dividend recaps, on the other hand, involve taking on new debt to pay dividends to shareholders, resulting in taxable income at the individual level and potential double taxation for C-corporations. Understanding these tax implications is crucial for companies evaluating capital structure changes to optimize after-tax returns and shareholder value.

When to Choose Equity Recapitalization versus Dividend Recap

Equity recapitalization is ideal when a company seeks to strengthen its balance sheet and fund growth without increasing debt, often chosen in early-stage or turnaround scenarios. Dividend recapitalization suits mature businesses with stable cash flows aiming to return capital to shareholders while leveraging debt capacity. Opt for equity recapitalization to improve financial flexibility and opt for dividend recap when prioritizing shareholder distributions without diluting ownership.

Real-World Examples and Case Studies

Equity recapitalization involves restructuring a company's capital by issuing new equity to reduce debt or fund growth, as demonstrated by Dell's 2013 buyout where founder Michael Dell partnered with Silver Lake to recapitalize the firm and reduce liabilities. Dividend recapitalization, on the other hand, allows leveraged companies to distribute cash to shareholders by borrowing more debt, exemplified by the 2014 case of Caesars Entertainment, which used dividend recaps to pay owners despite increasing financial leverage. These real-world cases highlight how equity recapitalizations enhance balance sheet stability, while dividend recaps prioritize immediate shareholder returns at the expense of higher debt risk.

Equity Recapitalization Infographic

libterm.com

libterm.com