A stock split increases the number of shares outstanding by dividing existing shares into multiple new shares, lowering the price per share without changing the company's overall market value. This strategy makes shares more affordable and attractive to a broader range of investors, potentially improving liquidity and marketability. Discover how a stock split can impact your investment strategy by exploring the rest of this article.

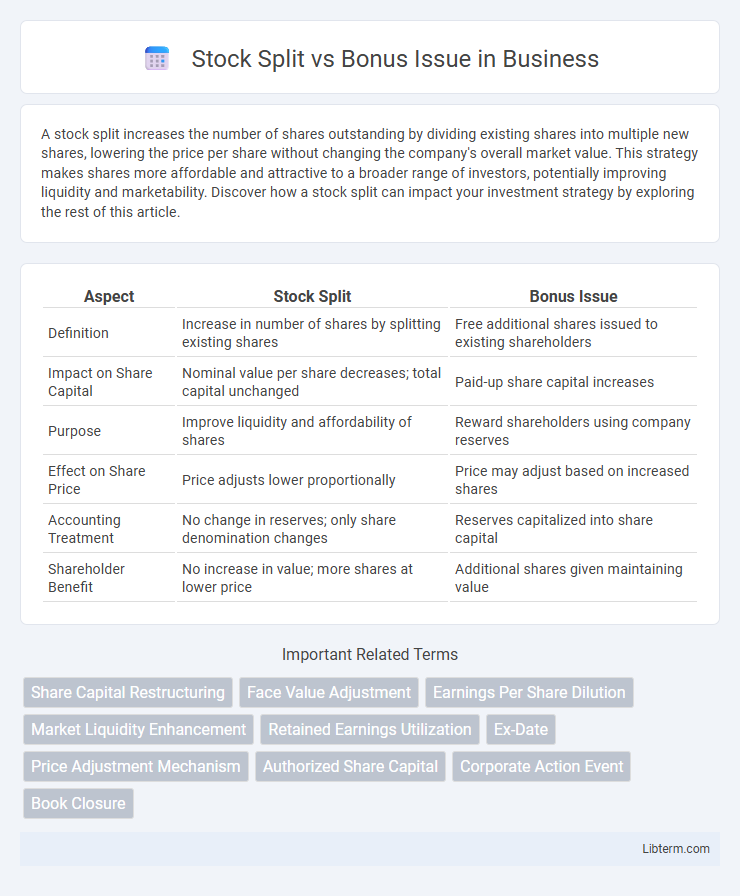

Table of Comparison

| Aspect | Stock Split | Bonus Issue |

|---|---|---|

| Definition | Increase in number of shares by splitting existing shares | Free additional shares issued to existing shareholders |

| Impact on Share Capital | Nominal value per share decreases; total capital unchanged | Paid-up share capital increases |

| Purpose | Improve liquidity and affordability of shares | Reward shareholders using company reserves |

| Effect on Share Price | Price adjusts lower proportionally | Price may adjust based on increased shares |

| Accounting Treatment | No change in reserves; only share denomination changes | Reserves capitalized into share capital |

| Shareholder Benefit | No increase in value; more shares at lower price | Additional shares given maintaining value |

Introduction to Stock Split and Bonus Issue

Stock split increases the number of outstanding shares by dividing existing shares into multiple new shares, reducing the share price without changing the company's market capitalization. Bonus issue involves issuing additional shares to existing shareholders based on their current holdings, distributing accumulated reserves without altering the total equity value. Both methods enhance stock liquidity and attract investors by making shares more affordable and rewarding shareholders.

Definition of Stock Split

A stock split is a corporate action where a company divides its existing shares into multiple new shares to increase the number of outstanding shares without changing the overall market capitalization. This process lowers the share price proportionally, making the stock more affordable and accessible to investors. Unlike bonus issues, which distribute additional shares as a dividend, stock splits primarily adjust the share quantity and price ratio without altering shareholder equity.

Definition of Bonus Issue

A bonus issue, also known as a scrip issue or capitalization issue, is a corporate action where a company distributes additional shares to existing shareholders without any extra cost, based on the number of shares they already own. Unlike a stock split, which increases the number of shares by dividing existing shares without affecting the company's reserves, a bonus issue involves converting accumulated profits or reserves into free shares. This process does not raise new capital but rewards shareholders by increasing their stake, often enhancing liquidity and marketability of the shares.

Key Differences Between Stock Split and Bonus Issue

Stock splits increase the number of shares by dividing existing shares, reducing the share price without changing the company's market capitalization, whereas bonus issues distribute additional shares to shareholders from the company's reserves, increasing the total shares but not the stock's market value. Stock splits improve liquidity and make shares more affordable, while bonus issues reward shareholders by capitalizing retained earnings. The key difference lies in the source of issuance: stock splits adjust share structure, and bonus issues convert reserves into equity shares.

Reasons Companies Opt for a Stock Split

Companies opt for a stock split primarily to enhance stock liquidity by increasing the number of shares available and making the share price more affordable for retail investors. This strategy helps broaden the investor base and can improve marketability without changing the company's market capitalization. Stock splits also signal confidence in future growth, often attracting more trading activity and potentially stabilizing stock price volatility.

Advantages and Disadvantages of Stock Split

Stock splits increase the number of shares outstanding, enhancing liquidity and making shares more affordable to retail investors, which can attract a broader investor base and potentially improve marketability. However, stock splits do not alter the company's intrinsic value or market capitalization, leading to no real gain in shareholder wealth, and can sometimes cause market confusion or misinterpretation of a company's financial health. While stock splits offer psychological benefits and increased trading activity, they may also incur additional administrative costs and dilute earnings per share, impacting perceived profitability.

Why Companies Issue Bonus Shares

Companies issue bonus shares to reward existing shareholders by capitalizing reserves into additional shares, increasing share liquidity without diluting ownership. Bonus issues signal strong financial health and profit retention, attracting investor confidence and enhancing market perception. This strategy also helps in adjusting the share price to a more affordable level, making shares accessible to a broader investor base.

Advantages and Disadvantages of Bonus Issue

Bonus issues increase the number of shares held by existing investors without altering the company's market capitalization, enhancing liquidity and making shares more affordable to small investors. However, bonus shares may dilute earnings per share (EPS) and do not provide immediate cash benefits to shareholders. This strategy rewards shareholders and signals company confidence but might also indicate limited opportunities for deploying retained earnings towards growth.

Impact on Shareholders and Stock Price

Stock splits increase the number of shares held by shareholders without altering the overall value of their investment, resulting in a lower stock price per share that enhances liquidity and makes shares more accessible. Bonus issues distribute additional shares to existing shareholders based on their current holdings, diluting the stock price but not affecting the company's market capitalization or individual shareholder wealth. Both actions typically do not impact the intrinsic value of the shares, but they can influence market perception and trading volume.

Which Is Better: Stock Split or Bonus Issue?

A stock split increases the number of shares by dividing existing shares, improving liquidity without changing the company's market capitalization, while a bonus issue distributes additional shares to shareholders, boosting their holdings without impacting share price immediately. Investors seeking improved marketability and affordability might prefer stock splits, whereas those aiming for enhanced shareholder value and retention may favor bonus issues. The better option depends on investor goals and company strategy, as stock splits focus on price adjustment and bonus issues emphasize rewarding shareholders.

Stock Split Infographic

libterm.com

libterm.com