A passive investor focuses on long-term growth by minimizing trading activity and aiming to match market returns through diversified portfolios, often using index funds or ETFs. This strategy reduces fees and lowers the risk associated with market timing, making it ideal for investors seeking steady growth without constant market monitoring. Discover how adopting a passive investment approach can enhance your financial future in the rest of this article.

Table of Comparison

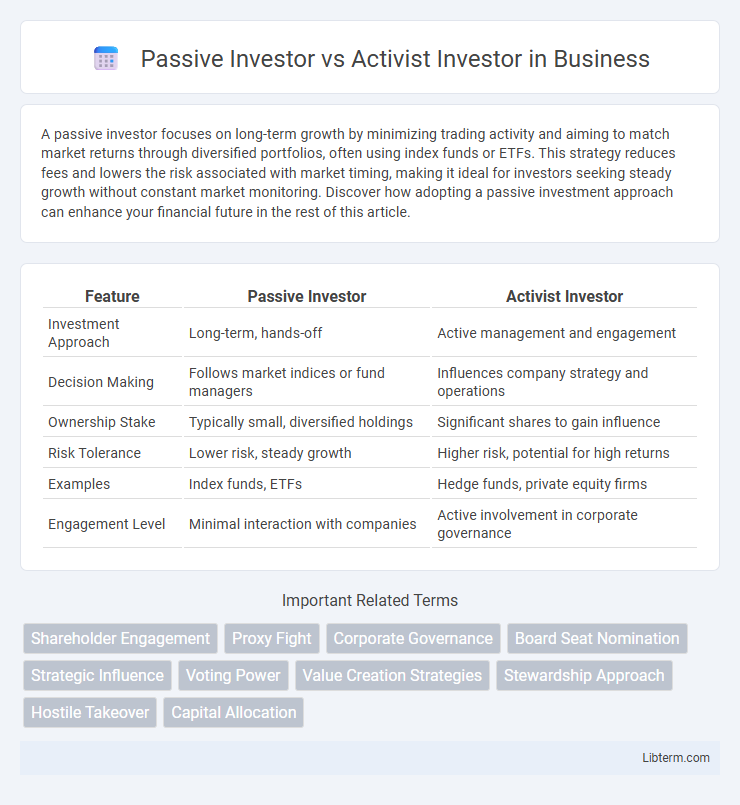

| Feature | Passive Investor | Activist Investor |

|---|---|---|

| Investment Approach | Long-term, hands-off | Active management and engagement |

| Decision Making | Follows market indices or fund managers | Influences company strategy and operations |

| Ownership Stake | Typically small, diversified holdings | Significant shares to gain influence |

| Risk Tolerance | Lower risk, steady growth | Higher risk, potential for high returns |

| Examples | Index funds, ETFs | Hedge funds, private equity firms |

| Engagement Level | Minimal interaction with companies | Active involvement in corporate governance |

Overview: Passive vs Activist Investing

Passive investors prioritize long-term growth by buying and holding a diversified portfolio with minimal trading to track market indices. Activist investors seek to influence a company's management and strategic direction through active engagement, often pushing for changes to unlock shareholder value. The fundamental difference lies in the passive approach of tracking market performance versus the proactive involvement aimed at driving corporate changes.

Defining Passive Investors

Passive investors primarily seek long-term capital appreciation by holding diversified portfolios, often through index funds or exchange-traded funds (ETFs), without actively influencing company management. They prioritize minimizing costs and maintaining market exposure rather than engaging in voting or corporate governance activities. Unlike activist investors who pursue strategic changes, passive investors focus on steady growth aligned with broader market performance.

Understanding Activist Investors

Activist investors strategically acquire significant stakes in companies to influence management decisions and drive changes that enhance shareholder value. They often push for restructuring, cost reductions, or shifts in corporate strategy, aiming to unlock hidden value and improve financial performance. Unlike passive investors who focus on long-term holding without intervention, activist investors actively engage with company leadership to implement transformational initiatives.

Investment Strategies: Passive vs Activist

Passive investors employ buy-and-hold strategies, typically investing in index funds or exchange-traded funds (ETFs) to mirror market performance with minimal trading activity or intervention. Activist investors take significant equity positions to influence company management and strategic decisions, often pushing for operational changes, governance reforms, or asset reallocations to enhance shareholder value. The passive approach prioritizes long-term market trends and broad diversification, whereas activist strategies focus on targeted, active engagement to unlock specific company value.

Risk Profiles and Tolerance

Passive investors generally exhibit lower risk tolerance, prioritizing stable, long-term growth through diversified portfolios and minimal trading activity, which reduces exposure to market volatility. Activist investors display higher risk tolerance by actively engaging in company management and strategic changes to unlock value, accepting potential fluctuations and short-term uncertainties. The distinct risk profiles reflect passive investors' preference for steady returns versus activists' willingness to pursue aggressive tactics for potentially higher rewards.

Influence on Corporate Governance

Passive investors typically exert limited influence on corporate governance, relying on long-term holding strategies and often delegating voting rights to fund managers or third parties. Activist investors actively engage with management and board members to drive strategic changes, improve accountability, and enhance shareholder value through proxy battles, public campaigns, or direct negotiations. The contrasting approaches significantly impact board composition, executive compensation, and corporate policies, shaping a company's governance framework and operational direction.

Impact on Company Performance

Passive investors typically prioritize long-term value and stability by holding diversified portfolios with minimal interference in company management, which often leads to steady but less aggressive growth in company performance. Activist investors actively engage with management to implement strategic, operational, or governance changes aimed at boosting short-term financial results and shareholder value, sometimes increasing volatility but potentially driving significant performance improvements. Empirical studies show that activist interventions can lead to higher abnormal returns and efficiency gains in targeted firms, whereas passive investment correlates with more stable but moderate performance outcomes.

Real-World Examples of Each Approach

Passive investors like Vanguard Group typically hold diversified portfolios and engage in minimal intervention, exemplified by their long-term investment in companies such as Apple without pushing for corporate changes. Activist investors, such as Elliott Management, actively pursue strategic shifts or governance reforms, as seen in their campaign to restructure AT&T's management and operations. These distinct approaches highlight contrasting philosophies in value creation and shareholder influence within financial markets.

Pros and Cons Compared

Passive investors benefit from lower fees and reduced transaction costs by following market indices, ensuring consistent long-term growth with minimal effort. Activist investors have the advantage of influencing corporate governance and strategic decisions, potentially driving higher returns through active engagement but face higher risks and costs associated with their interventions. However, passive investment limits control over company policies, while activist strategies may lead to conflicts and volatility due to aggressive tactics.

How to Choose the Right Investment Style

Choosing the right investment style depends on your risk tolerance, investment goals, and level of involvement desired. Passive investors seek long-term growth through diversified portfolios with minimal management, ideal for those preferring steady returns and lower fees. Activist investors actively influence company management to drive change and increase value, suited for experienced investors willing to engage in corporate governance and accept higher risk.

Passive Investor Infographic

libterm.com

libterm.com