A Limited Partner invests capital in a business while having limited liability, meaning their financial risk is confined to their investment amount. They typically do not partake in daily management or decision-making, safeguarding them from personal liability beyond their contribution. Explore the article to understand how being a Limited Partner can impact your investment strategy and legal responsibilities.

Table of Comparison

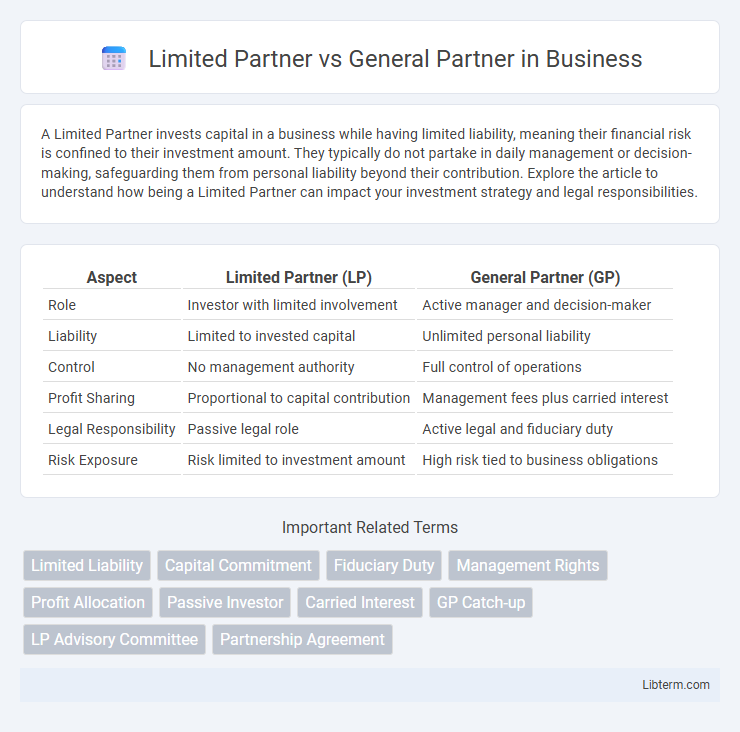

| Aspect | Limited Partner (LP) | General Partner (GP) |

|---|---|---|

| Role | Investor with limited involvement | Active manager and decision-maker |

| Liability | Limited to invested capital | Unlimited personal liability |

| Control | No management authority | Full control of operations |

| Profit Sharing | Proportional to capital contribution | Management fees plus carried interest |

| Legal Responsibility | Passive legal role | Active legal and fiduciary duty |

| Risk Exposure | Risk limited to investment amount | High risk tied to business obligations |

Introduction to Limited Partners and General Partners

Limited Partners (LPs) provide capital to a partnership but have limited liability and typically do not engage in daily management, protecting their personal assets beyond their investment. General Partners (GPs) manage the partnership's operations, assume unlimited liability, and make key decisions to drive the business forward. Understanding the distinct roles and responsibilities of LPs and GPs is crucial for structuring investment funds and defining legal liability.

Definition of Limited Partner (LP)

A Limited Partner (LP) is an investor in a partnership who contributes capital but has limited liability, meaning they are only financially responsible up to the amount they invested. LPs do not participate in the day-to-day management or decision-making of the business, leaving those responsibilities to the General Partners (GPs). This structure allows LPs to benefit from potential profits while minimizing their risk exposure.

Definition of General Partner (GP)

A General Partner (GP) is an individual or entity responsible for managing the day-to-day operations and decision-making in a partnership, typically bearing unlimited liability for the partnership's debts and obligations. In contrast to Limited Partners (LPs), who invest capital but have limited liability and no active management role, GPs oversee business activities, contractual agreements, and financial management. The GP's fiduciary duty includes acting in the best interest of the partnership and its investors, often holding a controlling interest in the venture.

Key Responsibilities of Limited Partners

Limited Partners primarily contribute capital and hold liability limited to their investment, without active management responsibilities in the partnership. They are typically passive investors who rely on General Partners to make operational decisions and manage daily business activities. Limited Partners also review financial reports and performance metrics to monitor their investment and ensure compliance with partnership agreements.

Key Responsibilities of General Partners

General Partners hold full management control and bear unlimited liability for the partnership's obligations, making critical decisions on day-to-day operations and strategic planning. They are responsible for fundraising, investment allocation, and overseeing the partnership's compliance with regulatory requirements. General Partners also manage relationships with Limited Partners, providing regular performance reports and ensuring the partnership meets fiduciary duties.

Liability Differences: LP vs GP

In a Limited Partnership (LP), the General Partner (GP) holds unlimited liability for the partnership's debts and obligations, exposing their personal assets to risk, while Limited Partners (LPs) enjoy liability limited to their investment amount. General Partners actively manage the business and bear full legal responsibility, whereas Limited Partners have no managerial control and therefore maintain protection from personal liability beyond their capital contributions. This fundamental liability distinction shapes the risk exposure and involvement level of LPs versus GPs in partnership structures.

Control and Decision-Making Power

In a business partnership, a General Partner holds significant control and decision-making authority, managing daily operations and making binding legal commitments on behalf of the partnership. Conversely, a Limited Partner has restricted control, primarily acting as an investor with no involvement in daily management or major business decisions. This distinction ensures that General Partners assume operational risks while Limited Partners benefit from limited liability and passive income.

Profit Sharing Structure

Limited Partners typically receive profits based on their capital contributions and have fixed return distributions, while General Partners share in profits alongside assuming full management control and unlimited liability. Profit sharing structures often allocate a preferred return to Limited Partners before General Partners receive carried interest or performance fees. This arrangement aligns incentives by rewarding General Partners for achieving higher investment returns beyond the agreed hurdle rate.

Legal Implications and Regulatory Requirements

Limited Partners (LPs) have limited liability confined to their investment amount and typically lack management control, whereas General Partners (GPs) bear unlimited personal liability for the partnership's obligations and actively manage its operations. GPs must comply with extensive regulatory requirements, including fiduciary duties and potential registration with regulatory bodies, while LPs face fewer compliance burdens and reduced exposure to lawsuits. The legal distinction impacts tax treatment, reporting obligations, and risk exposure, making the partnership structure crucial for aligning investor roles with liability and regulatory frameworks.

Choosing Between Limited Partner and General Partner

Choosing between a limited partner and a general partner hinges on liability, management control, and financial commitment. Limited partners enjoy liability protection up to their investment amount but lack active management authority, making them suitable for passive investors. General partners have unlimited personal liability and full management control, ideal for those seeking hands-on involvement and decision-making power in the partnership.

Limited Partner Infographic

libterm.com

libterm.com